Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday.

“This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday.

“Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said.

Photo: Bloomberg

That meant local supply would be their preference, given growing macroeconomic uncertainty, he said.

North America has long been the biggest revenue source for TSMC, accounting for 75 percent of the chipmaker’s overall revenue last quarter, with Apple Inc, Nvidia Corp, Advanced Micro Devices Inc, Broadcom Inc and Qualcomm Inc among its major customers.

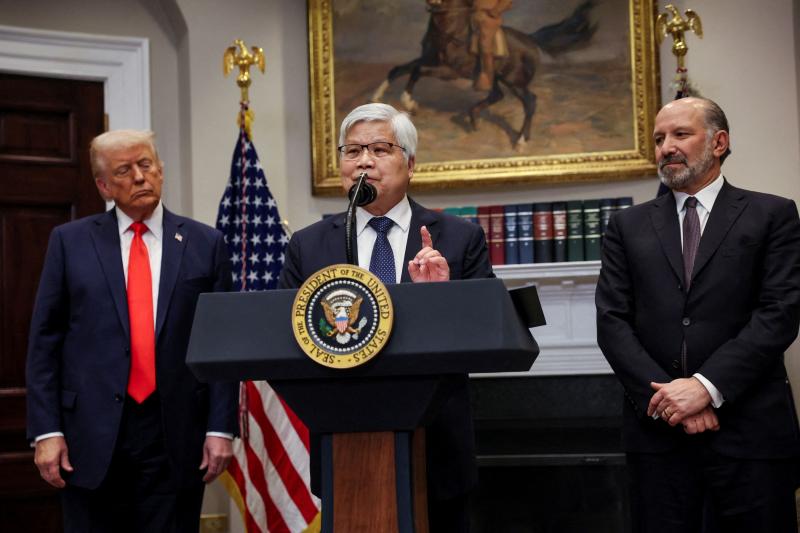

Zeng’s remarks came after US President Donald Trump and TSMC chairman C.C. Wei (魏哲家) jointly announced at the White House on Monday that the company would invest US$100 billion to build three semiconductor fabs, two advanced packaging plants, and a research and development center.

Photo: Leah Millis, Reuters

Together with the company’s previously announced investment of US$65 billion, TSMC would spend a total of US$165 billion in the US, the company said.

TSMC’s investment in Taiwan would remain unchanged, and the company would press ahead with projects in Japan and Germany, it added.

TSMC’s new US investment plan could help alleviate the immediate risk of tariffs on Taiwanese semiconductors, Taishin Securities Investment Advisory Co (台新投顧) analyst Tony Huang (黃文清) said.

However, it is not clear if the company can pass higher production costs on to US clients, Huang said.

On the other hand, Mega International Investment Services Corp (兆豐國際投顧) analyst Alex Huang (黃國偉) said that the US expansion could disrupt the supply-demand balance for TSMC’s Taiwan-based production.

The cost of building facilities in the US could be up to four times higher than in Taiwan, potentially impacting TSMC’s gross margin, he said.

However, Zeng said TSMC should be able to keep its gross margin target at 53 percent until 2028, before ramping up its second fab in Arizona and starting to book new depreciation costs.

Nevertheless, supply-chain firms might follow the step of TSMC.

A TSMC component supplier has said that it is seriously considering building its first production line in the US, as demand would increase significantly.

Wiwynn Corp (緯穎), a supplier of AI servers and components, last week said that it planned to invest US$300 million to build its first manufacturing facility in Texas to cope with the realignment of global supply chains amid escalating macroeconomic uncertainty.

Even so, analysts agreed that expanding in the US is a more viable option than helping rival Intel Corp, following reports that the Trump administration is pressuring TSMC to help boost Intel’s semiconductor manufacturing business.

TSMC’s new US investment plan would help expand its US presence and maintain shareholders’ interest while taming uncertainty linked to geopolitical tensions and punitive tariffs on semiconductors, other analysts said.

“This represents a win-win negotiation,” TF International Securities Group Co (天風國際證券) analyst Kuo Ming-chi (郭明錤) wrote in a post on X.

“The US government clearly knew what it wanted, while TSMC glanced government demands with commercial interests to maximize shareholders’ benefits,” Kuo wrote.

A lack of details provides the flexibility for spending, softening the impact on profitability, he said.

TSMC’s new US investment plan exceeded market expectations, and it was aligned with Trump’s attempt to revitalize manufacturing in the US, Taiwan Institute of Economic Research (TIER, 台經院) research fellow Arisa Liu (劉佩真) said.

However, expanded investment in the US will inevitably affect chip manufacturing in Taiwan, especially in advanced processes, Liu said.

TSMC's expansion plans in Japan may also be affected as resources are spread out, she said.

Liu said that the proportion of chips manufactured in Taiwan may decrease to 75-80 percent as the fabs in Arizona enter the mass production stage.

Looking ahead, Taiwan should focus on delivering cost-effective semiconductors to counterbalance the higher production costs in the US, Liu said, emphasizing that Taiwan will continue to benefit from a well-established ecosystem, a highly efficient supply chain, and a workforce that can operate around the clock — advantages that are difficult to replicate elsewhere.

Nevertheless, it would take a long time for TSMC to fulfill its new investment plans, and the US presidency could change before that, bringing a shift in trade policies that would impact TSMC’s strategy and development, TIER economist Gordon Sun (孫明德) said.

TSMC shares lost 1.96 percent to close at NT$1,000 in Taipei trading yesterday as investors were still digesting the news about TSMC’s new investment plan.

TSMC could issue bonds in the US to finance its new investment, rather than diluting shareholders’ interests through equity offerings, stock analyst Chang Chen-hao (張陳浩) said.

A US bond issuance would provide a hedge against foreign exchange fluctuations, Chang said.

The US investments would prove long-term gains, as it would allow TSMC to save costs in streamlining logistics and material procurement, but it would pose short-term pressure on profit margin, he said.

Additional reporting by CNA

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,