US President Donald Trump has threatened to impose up to 100 percent tariffs on Taiwan’s semiconductor exports to the US to encourage chip manufacturers to move their production facilities to the US, but experts are questioning his strategy, warning it could harm industries on both sides.

“I’m very confused and surprised that the Trump administration would try and do this,” Bob O’Donnell, chief analyst and founder of TECHnalysis Research in California, said in an interview with the Central News Agency on Wednesday.

“It seems to reflect the fact that they don’t understand how the semiconductor industry really works,” O’Donnell said.

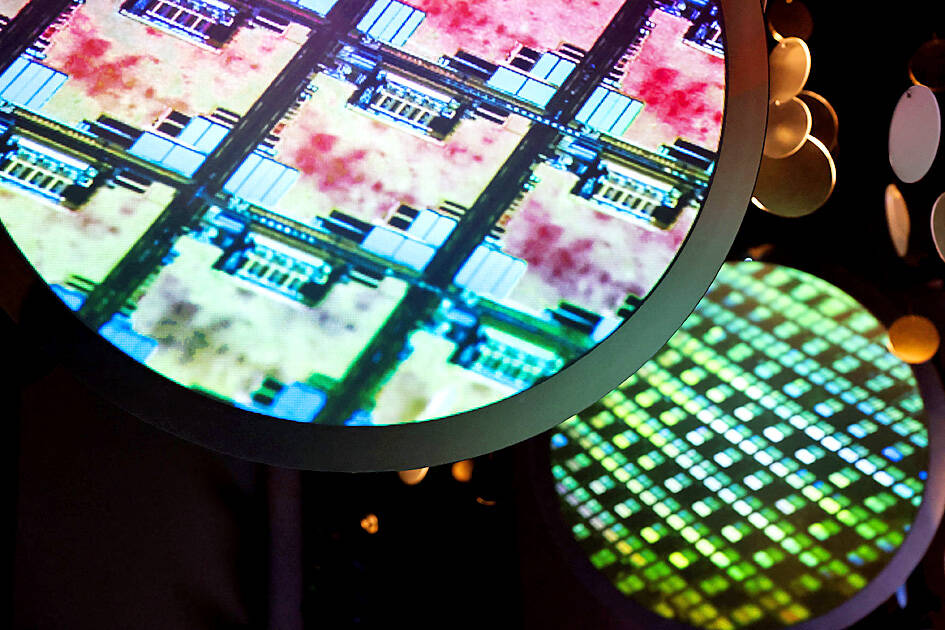

Photo: Cheng I-hwa, AFP

Economic sanctions would not boost chip manufacturing in the US overnight, because building a chip fab requires billions of dollars and many years of construction, he said.

He described Trump’s economic policies as “shortsighted,” adding that they would not diminish Taiwan’s leading position in advanced chip manufacturing, but rather would drive up the cost of chips made in Taiwan.

“It will have a huge negative impact on every tech-related industry,” O’Donnell said.

The proposed tariffs would harm Taiwanese chipmakers, as well as US tech companies that depend heavily on their chip supplies, including Apple Inc, Nvidia Corp, Qualcomm Inc, Intel Corp and Advanced Micro Devices Inc, he said.

Brian Peck, a former official at the Office of the US Trade Representative, told CNA in a separate interview that the US tech industry, which relies on Taiwanese chips, would face higher prices in the short term.

Those increased costs ultimately would be passed on to American consumers, said Peck, who is an assistant professor at the University of Southern California Gould School of Law.

In the long term, tariffs would put pressure on Taiwan’s semiconductor producers, he said in an interview.

Suppliers of semiconductors based in Taiwan would probably face a decline in sales, because US companies “would be forced either to move manufacturing to the US or find other suppliers that are not subject to the same level of tariffs,” Peck said.

Trump is likely to follow through on the tariff threats, if his goal is to bring chipmaking back to the US, but the US president’s actions have been “somewhat unpredictable,” he said.

Trump might be using the tariff issue as leverage to push Taipei to increase defense spending or make other concessions, as seen in his dealings with Mexico and Canada, Peck said.

In that case, “I think, those would be some of the issues that need to be discussed and worked out” between Taiwan and the US, he said.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth