When Powerchip Technology Corp (力晶科技) entered a deal with the eastern Chinese city of Hefei in 2015 to set up a new chip foundry, it hoped the move would help provide better access to the promising Chinese market.

However, nine years later, that Chinese foundry, Nexchip Semiconductor Corp (合晶集成), has become one of its biggest rivals in the legacy chip space, leveraging steep discounts after Beijing’s localization call forced Powerchip to give up the once-lucrative business making integrated circuits for Chinese flat panels.

Nexchip is among Chinese foundries quickly winning market share in the crucial US$56.3 billion industry of so-called legacy or mature node chips made on 28-nanometer process technology and larger, a trend that prompted former US president Joe Biden’s administration to initiate an investigation and is alarming Taiwanese industry.

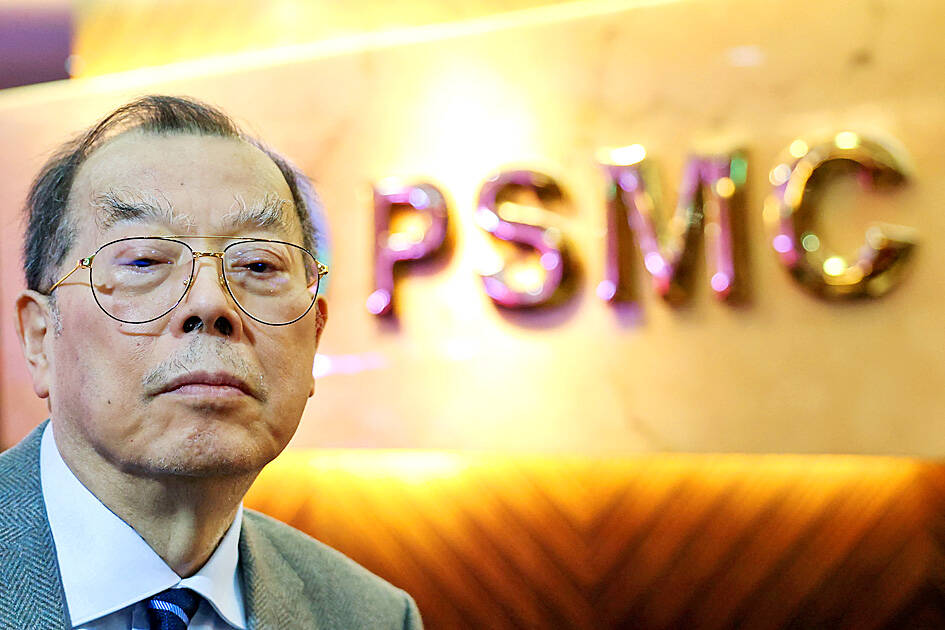

Photo: Ann Wang, Reuters

These Chinese foundries, which include Hua Hong Semiconductor Ltd (華虹半導體) and Semiconductor Manufacturing International Corp (SMIC, 中芯國際), are threatening the long-held dominance of Powerchip, United Microelectronics Corp (UMC, 聯電) and Vanguard International Semiconductor Corp (世界先進) in the market for chips used in cars and display panels by slashing prices and embarking on aggressive capacity expansion plans.

Taiwanese foundries are then forced to retreat or pursue more advanced and specialty processes, executives in Taiwan said.

“Mature-node foundries like us must transform; otherwise, Chinese price cuts will mess us up even further,” said Frank Huang (黃崇仁), chairman of Powerchip Investment Holding Corp (力晶創新投資控股) and its listed unit Powerchip Manufacturing Semiconductor Corp (力積電), which the company was reorganized into in 2019.

UMC said that the expansion of capacity globally had created “severe challenges” for the industry and that it was working with Intel to develop more advanced, smaller chips and diversify beyond legacy chipmaking.

US-China trade tensions might ease the pain a bit, executives in Taiwan said, as companies hoping to secure supply chains seek chips made outside China. However, US President Donald Trump has said he plans to impose tariffs as high as 100 percent on semiconductors made outside the US.

Blocked by the US in recent years from pursuing high-end chip technology, Chinese foundries doubled down on legacy chips and have undercut Taiwanese rivals on price, because of strong funding support from Beijing and their embrace of lower margins, executives in Taiwan said.

Chinese companies have dramatically increased legacy chip production capacity in the past few years.

China’s share of global mature node manufacturing capacity was 34 percent last year, while Taiwan’s was 43 percent, Taipei-based TrendForce Corp (集邦科技) said.

By 2027, China’s share is projected to surpass Taiwan’s, while South Korea and the US, with single-digit shares, are expected to decline.

Consultancy SEMI forecasts that out of 97 new fabrication plants starting production from 2023 to this year, 57 are in China.

Although Taiwanese foundries can still compete on factors such as process stability and better production yields, one executive working at a Taiwanese chip designer said Chinese foundries had since 2023 become more aggressive in pitching business.

That person, and a second one working at another Taiwanese chip designer, said Chinese customers — especially in consumer-focused sectors such as panels — were increasingly asking Taiwanese chip designers to hire Chinese fabs to make the chips, in line with a call from Beijing for Chinese companies to localize supply chains.

Some respite could come from efforts by Washington to curb China’s chip industry growth, alongside worsening relations between Beijing and other countries that force customers to split supply chains into China-for-China and non-China networks.

Huang said they were already seeing some orders that would have gone to China being directed to their sites in Taiwan and expect that to accelerate. An executive from a chip design company in Taiwan also said they had been receiving more orders from international customers asking to make chips outside China since 2023.

“Some customers will tell us that no matter what, they don’t want us to tape out chips in China; they don’t want ‘Made in China,’” the executive said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.