Samsung Electronics Co on Wednesday unveiled its newest Galaxy S25 smartphones, powered by Qualcomm’s chips and Google’s artificial intelligence (AI) model, hoping its upgraded AI features can reinvigorate sales and fend off Apple Inc and Chinese rivals.

Samsung also previewed a thinner version of the flagship models at the end of an event in California, aiming to launch the Galaxy S25 Edge in the first half of this year ahead of Apple’s anticipated rollout of its slimmer iPhone.

Samsung was faster than Apple in launching an AI-powered smartphone, but failed to regain its crown in the global smartphone market last year, squeezed by competition with the US rival in the premium market and with Chinese firms in the lower-end segment.

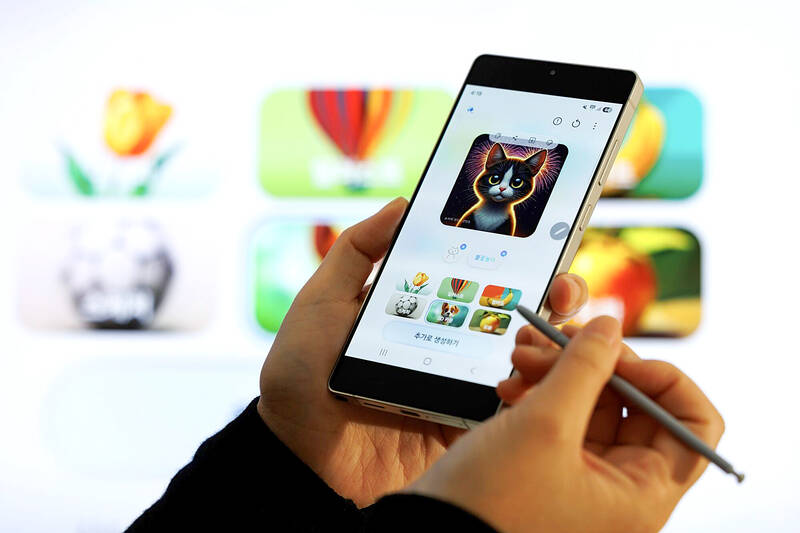

Photo: Bloomberg

“We are one step ahead of the industry in terms of offering AI features. I believe we are going in the right direction,” said Park Ji-sun, the executive vice president who leads Samsung’s Language AI team.

Samsung kept the prices of its Galaxy S25 series unchanged at between US$799 and US$1,299.

The new Galaxy S25 uses Gemini offered by Alphabet’s Google as its default AI engine and features Samsung’s upgraded in-house voice assistant, Bixby, Park said.

The two tools complement each other and Bixby plays a key role at Samsung, whose products span mobile phones to TVs and home appliances, he said.

Thomas Husson, an analyst at Forrester, said that differentiating Bixby would be a challenge for Samsung.

“I don’t think there is really a killer application today that you know would convince them [consumers]: ‘OK, I’m going to buy this one because it’s an AI smartphone,’” he said.

However, AI features could create a halo effect around the Samsung brand, Husson said.

The Galaxy S25 would offer a more personalized AI experience. For example, its “Now Brief” service — which makes recommendations to users based on personalized data that is stored and processed on the phone for privacy reasons — would display a suite of customized items such as calendars, news and bedroom air temperature and carbon dioxide levels, Park said.

The phone would be able to carry out multiple tasks with a single command, such as finding upcoming sporting events and then adding them to users’ calendars.

Samsung used Qualcomm’s Snapdragon 8 Elite Mobile Platform for the entire Galaxy S25 lineup, ditching its own mobile chip Exynos, a major change of strategy for a company that previously used both to have more bargaining power with suppliers.

Using a Qualcomm chip is a setback to the South Korean firm’s chip business, which counts its mobile division as one of its major customers.

A person familiar with the matter said that Samsung is looking to use the Exynos chip in its foldable phones to be launched later this year.

“The Galaxy S25 series’ sale is important at a time when Samsung’s foldable phone sales have been stagnating in the face of challenges from Chinese companies,” said Lim Su-jeong, associate director at research firm Counterpoint.

Samsung’s preliminary fourth-quarter profit, released earlier this month, missed estimates by a large margin due to chip development costs and rising competition in the smartphone market.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the