The US on Wednesday unveiled a fresh round of regulations aimed at keeping advanced chips produced by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other companies from making their way to China, one last attempt by US President Joe Biden’s administration to fill holes in the tech blockade of its geopolitical rival.

The new measures call for chip producers like TSMC and Samsung Electronics Co to step up their scrutiny and due diligence of customers, especially Chinese firms. That is an acknowledgment that advanced semiconductors are still making their way to China and Russia, including one incident where TSMC-made chips were secretly diverted to the blacklisted Huawei Technologies Co (華為).

The curbs impose sanctions on 16 Chinese companies that are “acting at the behest of Beijing” to build their country’s chip industry, the US Department of Commerce said in a press release. The list includes Sophgo Technologies Ltd (算能科技), which was allegedly involved in Huawei getting access to TSMC chips last year.

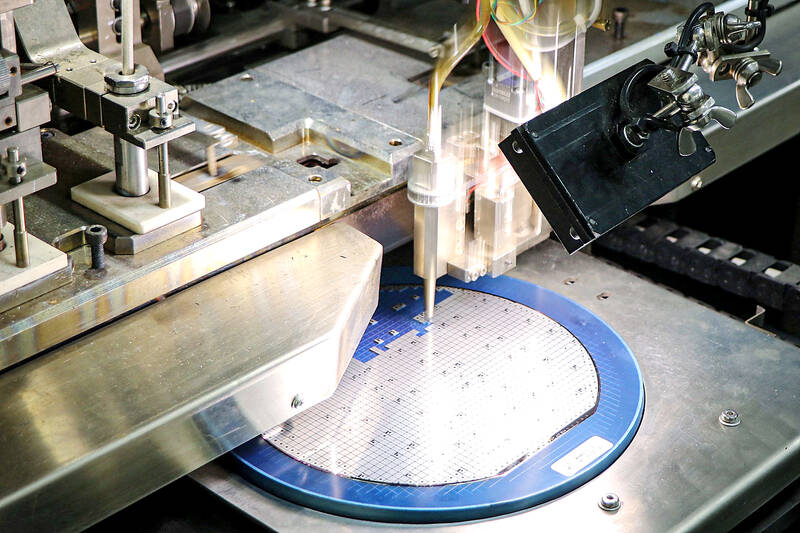

Photo: AFP

The US is also expanding licensing requirements on foundries — companies like TSMC that manufacture chips for external customers — and packaging companies seeking to export advanced semiconductors. The tougher rules apply unless the chips are for “trusted” customers that prove the processors fall below a defined performance threshold, or if the chips are packaged by approved assemblers that verify their technological capabilities.

“These rules will further target and strengthen our controls to help ensure that the PRC and others who seek to circumvent our laws and undermine US national security fail in their efforts,” US Secretary of Commerce Gina Raimondo said in a statement on Wednesday, referring to the People’s Republic of China (PRC).

“We will continue to safeguard our national security by restricting access to advanced semiconductors, aggressively enforcing our rules, and proactively addressing new and emerging threats,” she added.

The commerce department on Wednesday placed 25 China-based entities including Sophgo Technologies, alongside two Singapore ones, on a trade blacklist as well.

Companies added to the so-called Entity List are restricted from obtaining US items and technologies without a license.

Some of the Entity List additions were made because the businesses helped advance China’s military modernization through the development of artificial intelligence (AI) research, a government posting said.

Others were accused of aiding the development of advanced computing integrated circuits that further China’s progress in weapons systems, or posing a risk of diversion to Huawei — which has itself been blacklisted.

Such activities, according to the postings, were contrary to US national security and foreign policy interests.

The Biden administration is trying to cement its legacy in restricting the flow of advanced technologies to China in its final days in power. The Democratic team unveiled rounds of sweeping controls on the country’s access to chips and AI, and has poured out a series of last-minute rules before leaving office on Monday next week.

On Monday, the US published curbs that limit the sale of AI chips by the likes of Nvidia Corp and other advanced makers to data centers in most countries. The due diligence measures apply to semiconductor exports covered by those global restrictions.

The rules for AI chips follow controls announced last month that aim to cut off Beijing’s access to high-bandwidth memory chips, which are essential AI components. Wednesday’s regulations include some updates to those earlier measures.

The Chinese Ministry of Commerce said the country “firmly opposed” the spate of US measures, adding that the recent rules “will only strengthen China’s confidence and ability to be self-reliant and technologically innovative.”

Additional reporting by AFP

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan