US President Joe Biden’s administration has proposed a new framework for exports of advanced computer chips used to develop artificial intelligence (AI), an attempt to balance national security concerns about the technology with the economic interests of producers and other countries.

However, the framework proposed yesterday also raised concerns of chip industry executives who say the rules would limit access to existing chips used for video games and restrict in 120 countries the chips used for data centers and AI products. Mexico, Portugal, Israel and Switzerland are among the nations that could have limited access to chips needed for AI data centers and products, though much of the underlying focus is aimed at China.

US Secretary of Commerce Gina Raimondo said that it is “critical” to preserve the US’ leadership in AI and the development of AI-related computer chips.

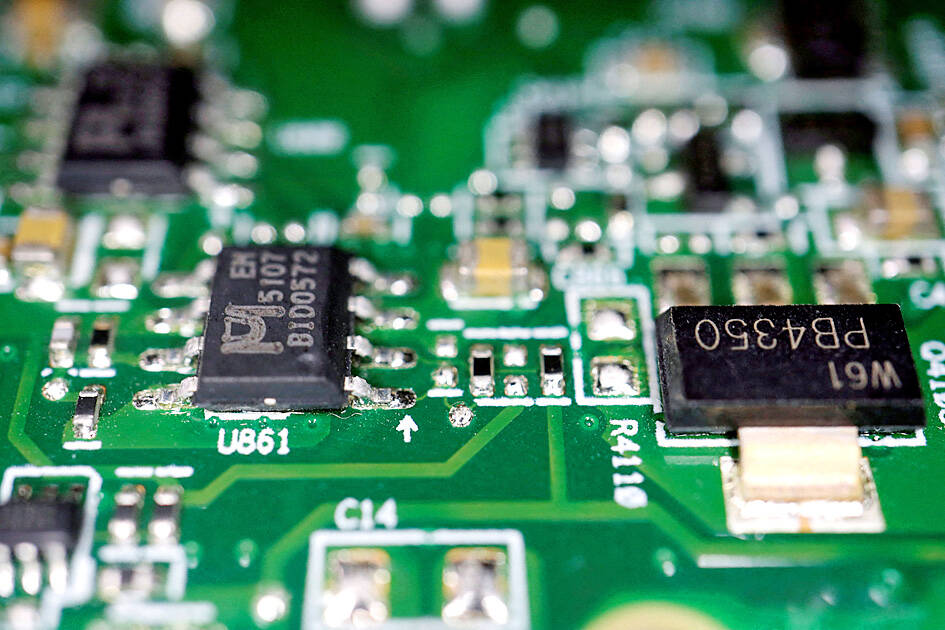

Photo: Reuters

The fast-evolving AI technology enables computers to produce novels, make scientific research breakthroughs, automate driving, and foster a range of other transformations that could reshape economies and warfare.

“As AI becomes more powerful, the risks to our national security become even more intense,” Raimondo said.

The framework “is designed to safeguard the most advanced AI technology and ensure that it stays out of the hands of our foreign adversaries, but also enabling the broad diffusion and sharing of the benefits with partner countries,” she said.

US National Security Adviser Jake Sullivan stressed that the framework would ensure that the most cutting-edge aspects of AI would be developed within the US and with its closest allies, instead of getting offshored, such as the battery and renewable energy sectors.

“If it’s China and not the United States determining the future of AI on the planet, I think that the stakes of that are just profound," Sullivan said.

Tech industry group the Information Technology Industry Council warned Raimondo in a letter last week that a hastily implemented new rule from the Democratic administration could fragment global supply chains and put US companies at a disadvantage.

“While we share the US government’s commitment to national and economic security, the rule’s potential risks to US global leadership in AI cannot be emphasized enough,” said a statement from Naomi Wilson, the group’s senior vice president for Asia and global trade policy.

She called for a more extensive consultation with the tech industry.

One industry executive, who is familiar with the framework and insisted on anonymity to discuss it, said the proposed restrictions would limit access to chips already used for video games, despite claims made otherwise by the US government.

The executive said it would also limit which companies could build data centers abroad.

Because the framework includes a 120-day comment period, the incoming Republican administration of US president-elect Donald Trump could ultimately determine the rules for the sales abroad of advanced computer chips. This sets up a scenario in which Trump would have to balance economic interests with the need to keep the US and its allies safe.

Government officials said they felt the need to act quickly in hopes of preserving what is perceived to be the US’ six-to-18-month advantage on AI over rivals such as China, a head start that could easily erode if competitors were able to stockpile the chips and make further gains.

Nvidia Corp vice president of external affairs Ned Finkle said in a statement that the prior Trump administration had helped create the foundation for AI’s development and that the proposed framework would hurt innovation without achieving the stated national security goals.

“While cloaked in the guise of an anti-China measure, these rules would do nothing to enhance US security,” he said. “The new rules would control technology worldwide, including technology that is already widely available in mainstream gaming PCs and consumer hardware.”

Under the framework, about 20 key allies and partners would face no restrictions on accessing chips, but other countries would face caps on the chips they could import, a fact sheet provided by the White House showed.

The allies without restrictions include Taiwan, Australia, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, South Korea, Spain, Sweden and the UK.

But the limits to other countries within the European Union raised objections from EU officials yesterday who said selling advanced AI chips to EU members represents an economic opportunity for the US and “not a security risk.”

Users outside of these close allies could purchase up to 50,000 graphics processing units (GPUs) per country. There would also be government-to-government deals which could bump up the cap to 100,000 if their renewable energy and technological security goals are aligned with the US.

Institutions in certain countries could also apply for a legal status that would let them purchase up to 320,000 advanced GPUs over two years. Still, there would be limits as to how much AI computational capacity could be placed abroad by companies and other institutions.

Also, computer chip orders equivalent to 1,700 advanced GPUs would not need a license to import or count against the national chip cap, among the other standards set by the framework. The exception for the 1,700 GPUs would likely help meet the orders for universities and medical institutions, as opposed to data centers.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the