The downward trend of DRAM chip prices is expected to accelerate this quarter at a quarterly pace of 13 percent at the steepest amid weakness in demand for products such as PCs and server DRAM chips, TrendForce Corp (集邦科技) said on Monday.

The Taipei-based researcher attributed the industry-wide slump to a seasonal downcycle for consumer electronics, primarily smartphones, and sagging demand for PCs, as notebook computer vendors have prebuilt DRAM inventory to cope with the possibility that the US would impose new tariffs after US president-elect Donald Trump takes office on Jan. 20.

Prices of standard DRAM chips, mostly for PCs, are expected to slide 8 to 13 percent sequentially this quarter, deeper than last quarter’s drop, which would be 5 to 10 percent, TrendForce said.

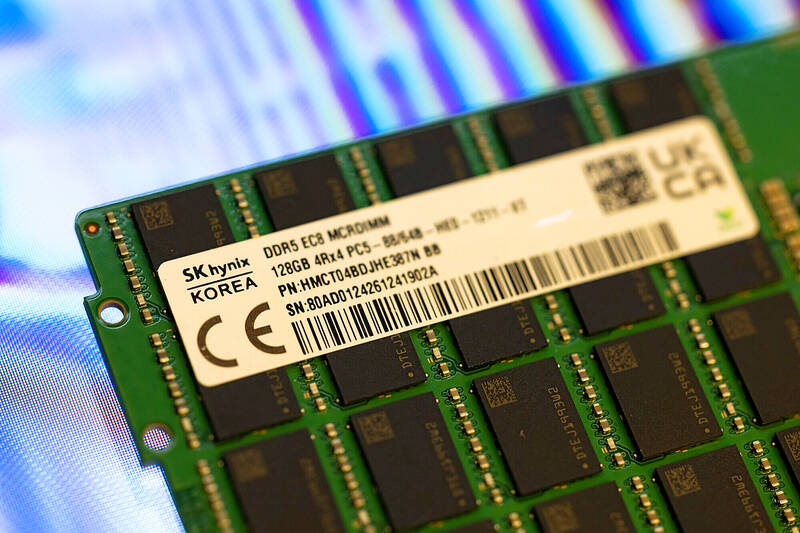

Photo: Bloomberg

Including high-bandwidth memory chips used for servers, standard DRAM prices would be flat or fall at a milder pace of 5 percent quarter-on-quarter this quarter, it said.

Among standard PC DRAM chips, DDR4 chips are to suffer the brunt of demand weakness amid overcapacity in China, with prices likely to plunge 10 to 15 percent this quarter, faster than a quarterly decline of 8 to 13 percent last quarter, TrendForce said.

Nanya Technology Corp (南亞科技), the nation’s biggest DRAM chipmaker, mainly produces DDR4 memory chips and a few older-generation DDR3 memory chips.

The company said it is in the process of migrating part of its DDR4 capacity to the production of DDR5 memory chips, which are used in a wider range of electronic devices than DDR4 chips.

The memorychip maker has reported losses for the past eight quarters.

Server DRAM chip prices would fall 5 to 10 percent this quarter from this quarter due to seasonal weakness, TrendForce said, adding that they are expected to have risen 5 percent at most last quarter.

Prices of DDR4 server DRAM chips are to tumble 10 to 15 percent this quarter, more drastic than last quarter’s decline of 8 to 13 percent amid high inventories on supply chains and increased supply from China, the researcher said.

The prices of DDR5 server DRAM chips are to fall 3 to 8 percent sequentially this quarter, the same as last quarter, it said.

Prices of mobile DRAM chip prices are to dip 3 to 13 percent quarter-on-quarter this quarter, as smartphone makers tend to take a conservative approach to chip sourcing after their inventory returns to healthy levels, TrendForce said.

Prices for DRAM chips used in consumer electronics plummeted 3 to 15 percent, a slide from a quarterly decrease of 5 to 10 percent last quarter, the researcher said.

Sagging demand for consumer electronics and scant room for growth in DRAM content per box are bad news for consumer electronics DRAM chips, TrendForce said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new