India’s Adani Group yesterday called US charges that their billionaire tycoon founder Gautam Adani had paid more than US$250 million in bribes “baseless,” as the opposition leader demanded his arrest.

The stiff denial came after shares in the industrialist’s conglomerate nosedived nearly 20 percent in Mumbai, the morning after a bombshell indictment in New York accused him of deliberately misleading international investors.

Adani is a close ally of Hindu nationalist Indian Prime Minister Narendra Modi and was at one point the world’s second-richest man, and critics have long accused him of improperly benefitting from their relationship.

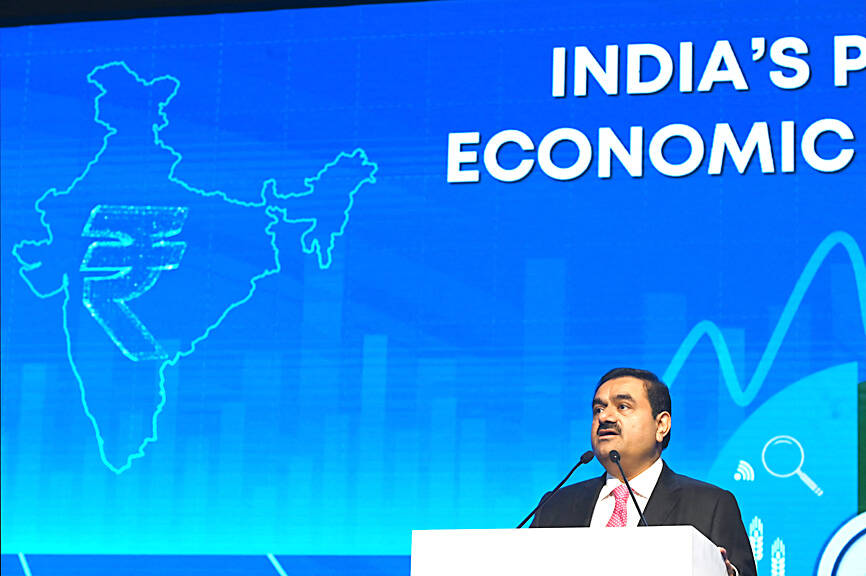

Photo: INDRANIL MUKHERJEE / AFP

“The allegations made by the US Department of Justice and the US Securities and Exchange Commission against directors of Adani Green are baseless and denied,” the conglomerate said in a statement, adding that “all possible legal recourse will be sought.”

Indian National Congress leader Rahul Gandhi said the businessmen should be taken into custody.

“We demand that Adani be immediately arrested. But we know that won’t happen as Modi is protecting him,” Gandhi told reporters in New Delhi. “Modi can’t act even if he wants to, because he is controlled by Adani.”

Wednesday’s indictment accuses Adani and multiple subordinates of paying huge sums of more than US$250 million in bribes to Indian officials for lucrative solar energy supply contracts.

The deals were projected to generate more than US$2 billion in profits after tax over roughly 20 years.

None of the multiple defendants named in the case are in custody.

Adani and two other board members of his Adani Group “lied about the bribery scheme as they sought to raise capital from US and international investors,” US attorney Breon Peace said in a statement.

The indictment drove steep losses in flagship listed unit Adani Enterprises Ltd and multiple other subsidiaries immediately after the Mumbai stock exchange reopened yesterday. The conglomerate’s renewable energy subsidiary, Adani Green Energy Ltd, said it had decided to halt a planned bond sale “in light of these developments.”

Modi’s government has yet to comment on the charges, but a spokesman for his ruling Bharatiya Janata Party, Amit Malviya, said the indictment appeared to implicate opposition parties rather than his own.

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to