Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, yesterday raised its revenue forecast to annual growth of 30 percent this year, thanks to strong and sustainable demand for artificial intelligence (AI) processors for servers.

It was the second upward adjustment from 25 percent year-on-year growth estimated three months ago, despite recent concerns about whether the AI boom could be another technology bubble.

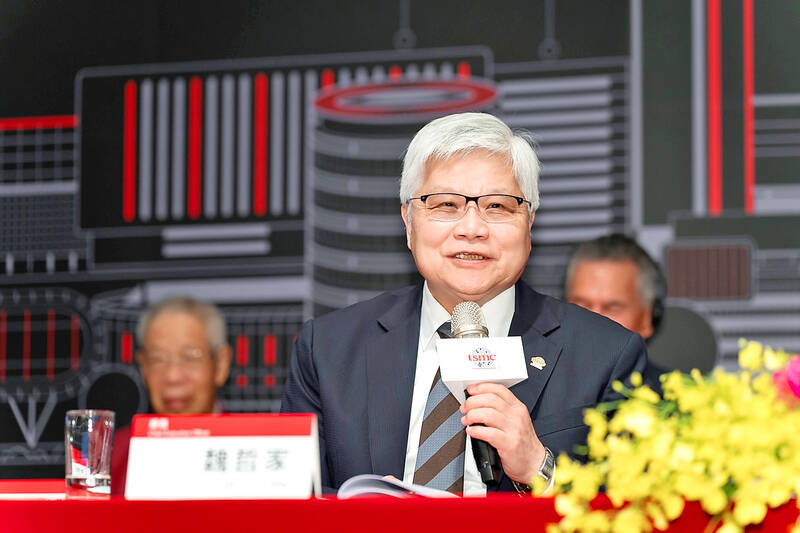

“The demand is real. It’s real. And I believe it is just the beginning of this demand. Alright, so one of my key customers said the demand right now is ‘insane,’” TSMC chairman and chief executive C.C. Wei (魏哲家) said in response to an investor’s question yesterday, citing Nvidia Corp chief executive Jensen Huang’s (黃仁勳) comments about demand for the company’s newest Blackwell AI chips.

Photo: Grace Hung, Taipei Times

“It’s just the beginning ... and it will continue for many years,” Wei said.

Building on such strong growth momentum, TSMC expects to enjoy healthy growth over the next five years due to AI-related applications, Wei said.

That has reflected robust demand for TSMC’s next-generation technologies.

“We have many, many customers interested in 2-nanometer technology,” Wei said.

“We are, actually, seeing more demand than we have ever dreamed about compared with 3-nanometer. So we have to prepare more capacity for 2-nanometer than 3-nanometer,” he said.

That would be followed by A16 technology, Wei said.

A16 is “very, very attractive for the AI server chips and so, actually, demand is also very high,” he said.

The volume production of 2-nanometer technology is to start next year and production of A16 technology is scheduled for the second half of 2026, according to TSMC’s technology road map.

When asked if TSMC would consider acquiring chip manufacturing facilities from Intel Corp after the US firm spun off its foundry business, Wei said his company was not interested.

The firm is seeing “extremely robust AI-related demand from our customers throughout the second half of 2024,” leading to higher capacity utilization of its 3-nanometer and 5-nanometer process technologies, Wei said.

As a result, revenue contribution from server AI processors is to more than triple this year and account for about 15 percent of TSMC’s revenue, Wei said.

Overall, wafer revenue is to grow about 30 percent year-on-year this year in US dollar terms, he said.

TSMC expects its capital spending to be slightly above US$30 billion this year and spending next year might go up from that record-high level, given the robust demand outlook, the chipmaker said.

Revenue this quarter is expected to be between US$26.1 billion and US$26.9 billion, representing quarterly growth of 13 percent or an annual expansion of 35 percent.

Gross margin is expected to range between 57 percent and 59 percent this quarter, compared with 57.8 percent last quarter and 53 percent in the fourth quarter of last year, the firm said.

TSMC yesterday posted the strongest quarterly net income in the company’s history.

Net income surged 31.2 percent quarter-on-quarter to NT$325.26 billion (US$10.11 billion) from NT$247.85 billion.

That represented annual growth of 54.2 percent from NT$211 billion.

Earnings per share rose to NT$12.54, from NT$9.56 in the second quarter and NT$8.14 in the third quarter last year.

Gross margin surpassed the company’s estimate of 55.5 percent.

Revenue last quarter rose to US$23.5 billion, better than its estimate of US$23.2 billion.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,