An investor conference scheduled by chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) for Thursday would be watched closely for more clues about the outlook of the global semiconductor market, analysts said.

What TSMC says at the conference is expected to influence the movements of global tech stocks, analysts added.

Arisa Liu (劉佩真), a researcher at the Taiwan Industry Economics Database of the Taiwan Institute of Economic Research (TIER, 台灣經濟研究院), said she expects TSMC’s sales momentum to continue into the fourth quarter following an increase in orders from Apple Inc, which unveiled the newest iPhone 16 models using TSMC’s advanced chips, as well as from artificial intelligence (AI) chip designer Nvidia Corp and smartphone chip designers MediaTek Inc (聯發科) and Qualcomm Inc.

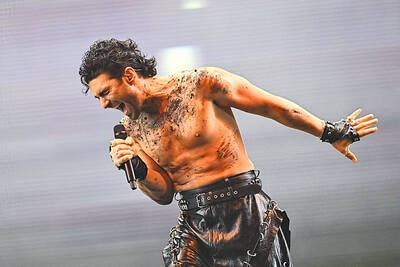

Photo:An Rong Xu/Bloomberg

The biggest focus of the upcoming conference would be on whether TSMC upgrades its sales forecast for this year, providing a better understanding of the demand for high-end process technologies, Liu said.

The chipmaker has forecast its sales this year would grow 24 percent to 26 percent from a year earlier in US dollar terms, topping the expected 10 percent growth in sales for the global semiconductor industry, excluding the memory chip segment.

TSMC posted NT$759.69 billion (US$23.1 billion) in consolidated sales in the July-to-September period, up 12.8 percent from a quarter earlier and up almost 39 percent from a year earlier.

The figure beat TSMC’s earlier estimate of NT$728 billion to NT$754 billion.

In the first nine months of the year, TSMC’s consolidated sales rose 31.9 percent from a year earlier to NT$2.03 trillion.

Investors are also expected to keep a close eye on TSMC’s global expansion and want to hear how the company has secured orders at its overseas bases from clients there, Liu said.

TSMC’s first fab in Kumamoto, Japan, is scheduled to start commercial production in the fourth quarter, and its first plant in Arizona would begin mass production in the first half of next year.

Last week, international news media reported that US chip designer Advanced Micro Devices Inc is set to become the second client of TSMC’s Arizona facility after Apple Inc.

In Taiwan, TSMC is developing the sophisticated 2-nanometer process technology, which is expected to start mass production next year, with investors looking for comments about the progress of this development, Liu said.

TSMC is also developing the A16 process technology, an upgraded version of the 2-nanometer technology. Those efforts are also expected to be a focus of Thursday’s conference. Mass production of the A16 technology is scheduled for the second half of 2026, Liu added.

Analysts said investors would also pay close attention to TSMC’s planned capital expenditures for next year, as the chipmaker’s spending plans would reflect market demand. In July, TSMC said its capital spending for this year is expected to be between US$30 billion and US$32 billion, up from an estimate of US$28 billion to US$32 billion made in April.

With demand for AI applications robust, TSMC’s advanced 3D chip-on-wafer-on-substrate (CoWoS) integrated circuit packaging services have been in high demand. How the chipmaker’s CoWoS expansion plan proceeds is also expected to be spotlighted at the conference, analysts said.

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary