Chunghwa Precision Test Technology Co (CHPT, 中華精測), a chip testing and wafer probing services provider, yesterday said it expects improvements in revenue and gross margin in the second half of this year and next year, thanks to strong testing demand for artificial intelligence (AI) and high-performance computing (HPC) chips.

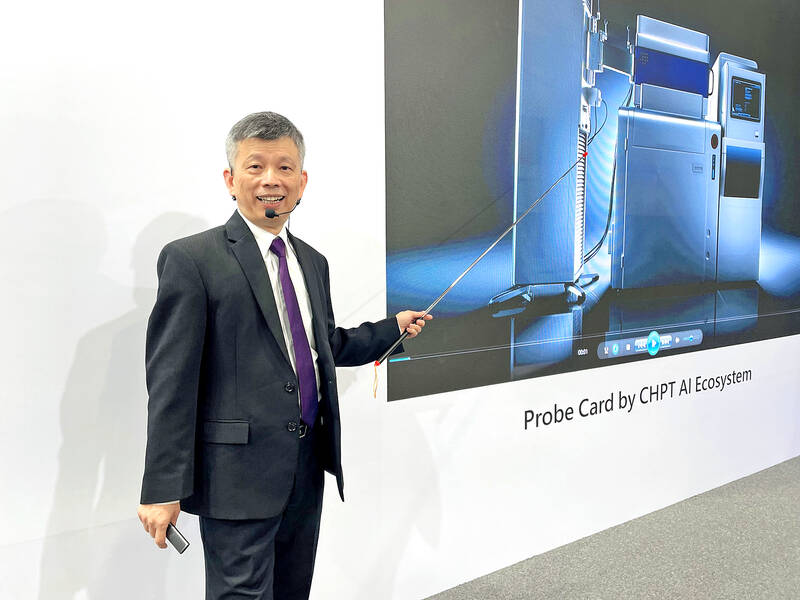

In addition, the company has the competitive edge in providing advanced testing services for AI graphics processing units (GPUs) and HPC chips, CHPT president Scott Huang (黃水可) said at the Semicon Taiwan trade show at the Taipei Nangang Exhibition Center.

“Artificial intelligence has created good business opportunities for us,” Huang said.

Photo: CNA

“The second half will be better than the first half and we anticipate a better year next year compared with this year,” he said.

The company in July said that its new probe card solutions, used in AI GPU testing, were under customers’ verification. It had started small volume shipments by testing high-bandwidth-memory chips and expected revenue contribution to emerge next year, the company said at the time.

Thanks to HPC and AI-related business, the company’s revenue last month surged 45.35 percent year-on-year to NT$302 million (US$9.38 million), the highest level in 20 months.

During the first eight months, revenue climbed 5.41 percent to NT$2 billion from a year earlier.

Gross margin last quarter rose to 52.4 percent as faster design flows and operational efficiency on the back of integrating AI technology in the company’s operations led to a reduction in costs, Huang said.

Gross margin is expected to rise to between 50 percent and 55 percent on average this year, a pickup from 48.26 percent last year, and the company’s goal is to keep its gross margin stable at 50 percent in the long term, he said.

CHPT recently received orders from a US customer, which was impressed by the Taoyuan-based company’s 3D imaging technology, Huang said.

The company uses the technology in the drilling process to improve precision, drilling depth and residual copper rate, achieving a 100 percent yield in back drilling, he said, adding that the company is a pioneer among the world’s wafer testing companies in adopting the technology.

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

‘IMMENSE SWAY’: The top 50 companies, based on market cap, shape everything from technology to consumer trends, advisory firm Visual Capitalist said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) was ranked the 10th-most valuable company globally this year, market information advisory firm Visual Capitalist said. TSMC sat on a market cap of about US$915 billion as of Monday last week, making it the 10th-most valuable company in the world and No. 1 in Asia, the publisher said in its “50 Most Valuable Companies in the World” list. Visual Capitalist described TSMC as the world’s largest dedicated semiconductor foundry operator that rolls out chips for major tech names such as US consumer electronics brand Apple Inc, and artificial intelligence (AI) chip designers Nvidia Corp and Advanced

Pegatron Corp (和碩), an iPhone assembler for Apple Inc, is to spend NT$5.64 billion (US$186.82 million) to acquire HTC Corp’s (宏達電) factories in Taoyuan and invest NT$578.57 million in its India subsidiary to expand manufacturing capacity, after its board approved the plans on Wednesday. The Taoyuan factories would expand production of consumer electronics, and communication and computing devices, while the India investment would boost production of communications devices and possibly automotive electronics later, a Pegatron official told the Taipei Times by telephone yesterday. Pegatron expects to complete the Taoyuan factory transaction in the third quarter, said the official, who declined to be