The production value of Taiwan’s semiconductor equipment is likely to grow this year after falling 7.3 percent last year amid strong global demand for artificial intelligence (AI) and other emerging technologies, the Ministry of Economic Affairs said.

The ministry made the comment last week after reporting that the production value of Taiwan-made semiconductor equipment for the first five months of this year rose by 5.5 percent from a year earlier to NT$62.7 billion (US$1.93 billion).

If the forecast is correct, the production value of Taiwan’s semiconductor equipment would be higher than the NT$149.7 billion last year and stay above the NT$100 million level for the fifth consecutive year.

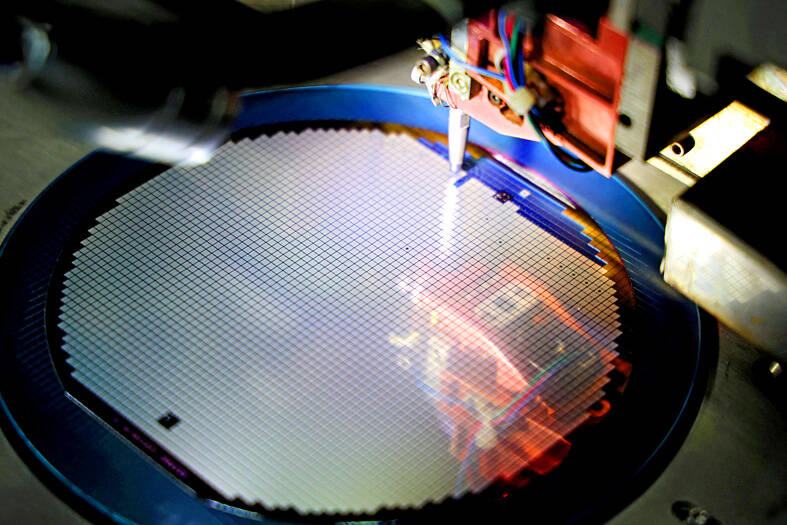

Photo: AFP

As companies accelerated digital transformation and pursued industrial automation following the impact of the COVID-19 pandemic, market demand for semiconductors has been booming in recent years, which has driven semiconductor companies to actively invest in capacity expansion, the ministry said in a statement.

The production value of Taiwan’s semiconductor equipment — composed mainly of manufacturing and inspection equipment, and its related components — surpassed NT$100 billion in 2020, reaching NT$103.1 billion, up 47.3 percent compared with 2019, ministry data showed.

After 2020, production value registered two consecutive years of double-digit percentage growth, but decreased by 7.3 percent annually last year after high inflation and interest rates worldwide, which seriously dented consumer consumption and business investment, the ministry said.

This year, the rise of AI opportunities and strong demand for high-performance computing applications have greatly pushed up the market’s demand for advanced semiconductor processes and boosted the semiconductor equipment sector’s growth momentum from January to May, it said.

Taiwan Semiconductor Manufacturing Co (台積電), the world’s largest contract chipmaker and a market leader in terms of advanced technologies, last month told investors that it would hike its capital expenditure budget for this year to between US$30 billion and US$32 billion, compared with its earlier estimate of US$28 billion to US$32 billion.

The production value of semiconductor manufacturing equipment and components returned to positive growth at 6.9 percent in the first five months, after posting an annual decrease of 5.7 percent last year, accounting for 78.5 percent of the overall sales of semiconductor equipment, the ministry said.

Semiconductor inspection equipment and components contributed 21.5 percent to the sector’s total sales in the five-month period, with production value edging up 0.7 percent from a year earlier, the ministry added.

As Taiwanese semiconductor equipment suppliers intensified efforts to explore business opportunities abroad over the past few years, their exports exceeded 50 percent of total shipments for the first time last year, the ministry said.

Exports of semiconductor equipment reached US$1.48 billion in the first half of this year, an 8.2 percent increase from the same period last year, customs data from the Ministry of Finance showed.

China, including Hong Kong, remained the largest destination for Taiwanese equipment exports, accounting for 35.7 percent of the total in the first six months, while Singapore became the second-largest market with 21.2 percent share of Taiwanese exports as the city-state strongly promoted semiconductor investment there, the data showed.

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass