Chinese technology giants including Huawei Technologies Co (華為) and Baidu Inc (百度) as well as start-ups are stockpiling high bandwidth memory (HBM) semiconductors from Samsung Electronics Co in anticipation of US curbs on exports of the chips to China, three sources said.

The companies have ramped up their buying of the artificial intelligence (AI) capable semiconductors since early this year, helping China account for about 30 percent of Samsung’s HBM chip revenue in the first half of this year, one of the sources said.

US authorities are planning to unveil an export-control package this month that would impose new restrictions on shipments for China’s semiconductor industry, reports from last week said, citing sources.

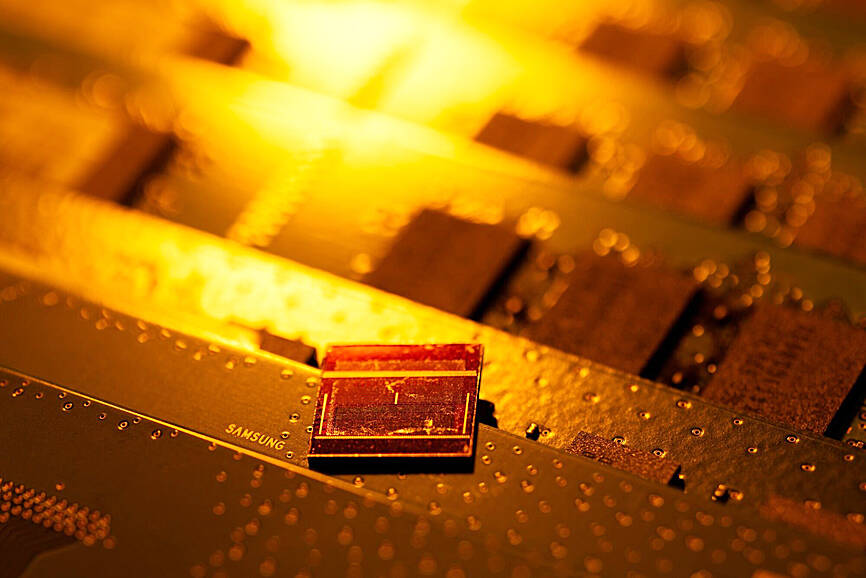

Photo: Bloomberg

Those sources also said the package is expected to lay out parameters for restricting HBM chip access.

HBM chips are crucial components in developing advanced processors such as Nvidia Corp’s graphics processing units that can be used for generative AI work.

There are only three major chipmakers producing HBM chips — SK Hynix Inc and Samsung from South Korea, and US-based Micron Technology Inc.

Chinese chip demand has been largely focused on the HBM2E model, which is two generations behind the most advanced version HBM3E, the sources said.

The global AI boom has led to a tightness in supply of the advanced model.

“Given that its domestic technology development is not yet fully mature, China’s demand for Samsung’s HBM has become exceptionally high, as other manufacturers’ capacities are already fully booked by American AI companies,” White Oak Capital Partners Pte Ltd investment director Nori Chiou said in Singapore.

Although it is hard to estimate the volume or value of the stockpiled HBM chips in China, businesses ranging from satellite manufacturers to tech firms such as Tencent Holdings Ltd (騰訊) have been buying them, the sources said.

One of the sources said that chip designing start-up Beijing Haawking Technology Co (北京中科昊芯) recently ordered HBM chips from Samsung.

Meanwhile, Huawei has been using Samsung HBM2E semiconductors to make its advanced Ascend AI chip, one of the sources said.

Chinese firms have made some headway in producing HBM, with Huawei and memory chipmaker Changxin Xinqiao Memory Technologies Inc (長鑫存儲) focusing on developing HBM2 chips, which are three generations behind the HBM3E model, earlier reports said.

Those efforts could be affected by the new US rule.

Restrictions on HBM sales to China could have a bigger effect on Samsung than its key rivals, which rely less on the Chinese market, said the sources who were briefed on the sales.

Micron has refrained from selling its HBM products to China since last year, while SK Hynix, whose major HBM customers include Nvidia, focuses more on advanced HBM chip production, they said.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01