Google yesterday said that Taiwan is set to accumulate about US$103 billion of economic benefits stemming from artificial intelligence (AI) development by 2030 and called on the government to work to strengthen AI infrastructure and universalize its use.

At its policy white paper announcement event in Taipei, Google said that McKinsey Global Institute predicted AI could add up to US$13 trillion to the global economy by 2030. The company added that in Taiwan, total gains were estimated to hit US$103 billion, citing a report by Access Partnership.

“The manufacturing industry is set to net the most, about NT$1.5 trillion (US$45.79 billion) or nearly 50 percent of all gains,” Google Taiwan managing director of sales and operations Tina Lin (林雅芳) said.

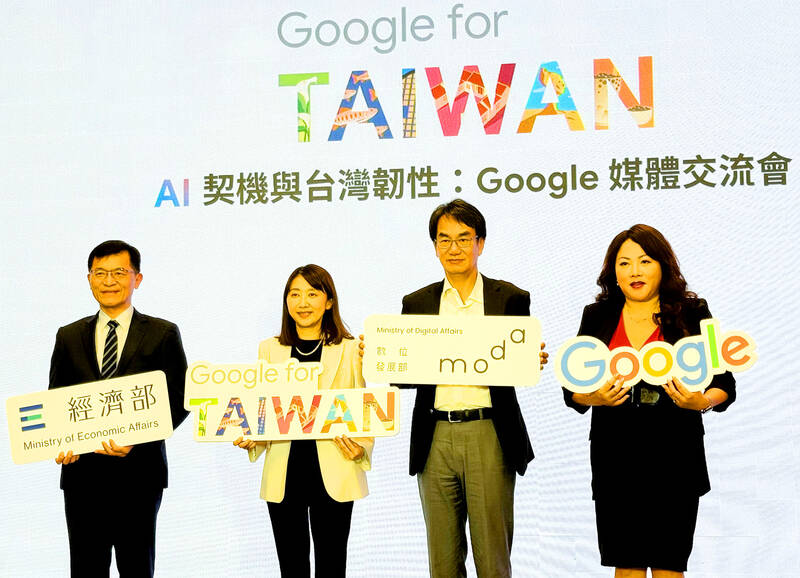

Photo: CNA

AI-driven cybersecurity tools could also help Taiwanese companies save up to NT$957.5 billion in economic losses from cybercrime by 2030, Lin said, citing the Access Partnership report.

Google has been playing its part by contributing to economic benefits and digital resilience through its investment in local research and development, data centers, and submarine cables, she said.

The company has also been working with the government and civil society to strengthen cybersecurity and combat disinformation, she added.

Lin highlighted the significant potential of AI in enhancing medical applications. Google, in collaboration with local hospitals and the National Health Insurance Administration, has been developing AI tools to aid in early breast cancer detection, assist with diagnosing illnesses, and predict medical conditions, she said.

Google Taiwan’s government affairs and public policy head Anita Chen (陳幼臻) said the government should invest in AI infrastructure, ensure the education system effectively cultivates talent and promote the use of the technology.

“Taiwan has key advantages in developing AI such as outstanding semiconductor and ICT [information and communications technology] industries, tech talent and a population willing to embrace new technology,” Chen said.

“But in the competitive world of AI, every decision could impact Taiwan’s ability to retain its competitive edge,” she added.

Chen said that the draft AI basic law was a good start and that Google recommended the legislation was “risk scenario-directed,” rather than placing restrictions on AI tools.

“The law should also determine ‘reasonable regulations’ concerning copyright so AI models can interact with a wide range of data,” she said.

Other policy suggestions include building an “AI talent-cultivating education system,” which should focus on training AI professionals and “equipping the general labor force with the ability to use AI applications,” Chen said.

The government should also promote the universalization of AI technologies, she said.

“The government can lead the way by using AI in public services to help universalize the technology and familiarize society with it,” she added.

Taiwan’s small and medium-sized enterprises and traditional sectors such as manufacturing and retail industries will need the government’s support in terms of funding and access to perform digital upgrades, Chen said.

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.

MediaTek Inc (聯發科) shares yesterday notched their best two-day rally on record, as investors flock to the Taiwanese chip designer on excitement over its tie-up with Google. The Taipei-listed stock jumped 8.59 percent, capping a two-session surge of 19 percent and closing at a fresh all-time high of NT$1,770. That extended a two-month rally on growing awareness of MediaTek’s work on Google’s tensor processing units (TPUs), which are chips used in artificial intelligence (AI) applications. It also highlights how fund managers faced with single-stock limits on their holding of market titan Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are diversifying into other AI-related firms.