The economy last quarter expanded 5.09 percent annually, missing the government’s May forecast by 0.09 percentage points, as exports did not fare as well as expected, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday.

Exports of goods and services grew 7.87 percent year-on-year in the second quarter, 3.35 percentage points less than the agency’s May estimate, DGBAS official Wang Tsui-hua (王翠華) said.

The data suggested that GDP growth for the whole of this year could be 3.91 percent, less than the 3.94 percent previously projected if other categories hold steady, she said.

Photo: CNA

The DGBAS is to provide an official update later this month.

On a positive note, outbound shipments grew 9.91 percent in US dollar terms, propelled by robust global demand for electronics used in high-performance computing, artificial intelligence (AI), smartphones, laptops, wearables and vehicles, the DGBAS said.

In all, net exports turned negative for the first time in a year and took out 0.39 percentage points from second-quarter GDP growth after factoring in a faster 10.62 percent gain in imports, Wang said.

Capital formation, the main drag on growth over the past few years, posted a robust 15.34 percent increase, beating the forecast by 10.49 percentage points and adding 3.87 percentage points to GDP, Wang said.

The impressive results came after imports of capital equipment rose 15.92 percent, the best performance in 11 quarters, as local firms bought machinery equipment to upgrade and expand their facilities to meet customer demand, Wang said, citing chipmaker Taiwan Semiconductor Manufacturing Co (台積電) and chip tester ASE Technology Holding Co (日月光投控) as examples.

Private consumption rose 2.71 percent due to wage hikes and rallies on the TAIEX, among other things, the DGBAS said.

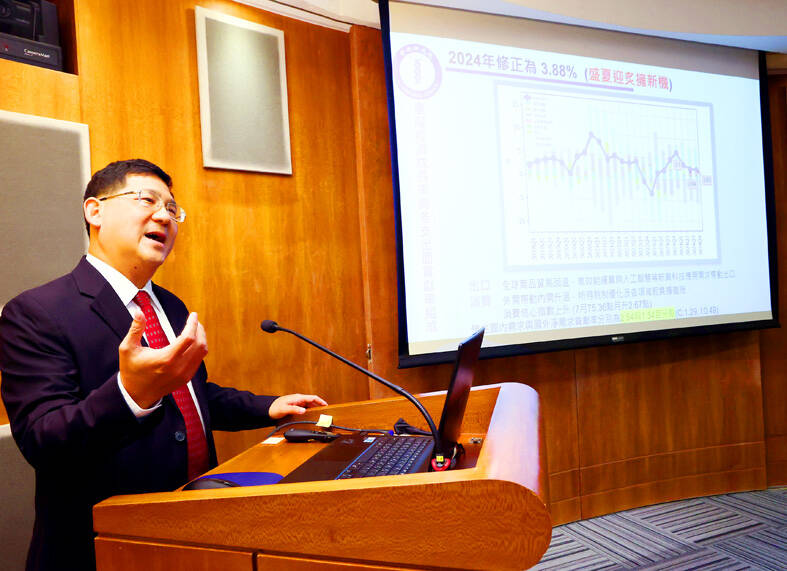

Separately, Academia Sinica projected GDP growth of 3.88 percent for this year, which was more conservative than the DGBAS’ estimate, but was up 0.86 percentage points from its previous forecast.

The upward revision was due to robust exports amid growing demand for advanced technologies such as high-performance computing and AI, said Lin Chang-ching (林長青), an adjunct research fellow with Academia Sinica’s Institute of Economics.

The institute projected a 2.62 percent increase in private consumption for this year based on a stable job market, active stock market trading, and robust cross-border and business travel.

However, typhoons, salary increases in the public sector, and rising electricity and housing costs could all contribute to inflationary pressures, leading the institute to predict a 2.21 percent increase in consumer prices for this year.

The institute called on the government to monitor inflationary pressures.

An internal survey conducted by Academia Sinica found that 64 percent of Taiwanese expect their cost of living to increase from last year.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known