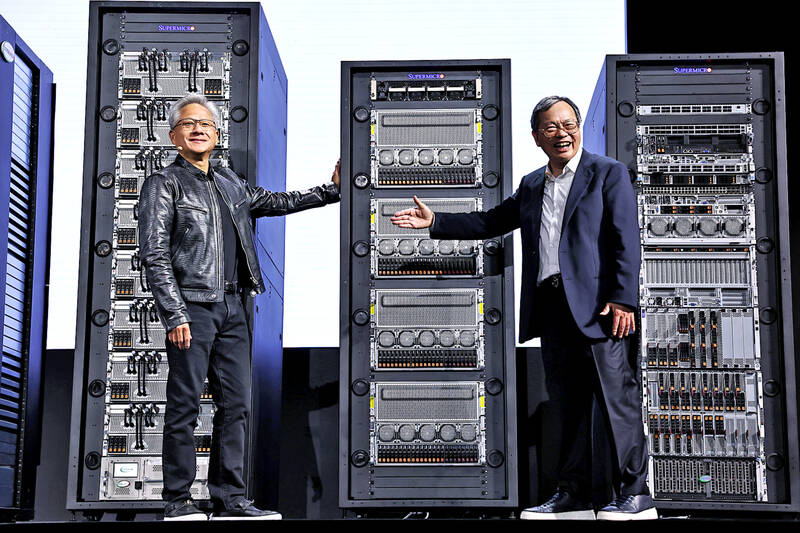

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) made an appearance during a speech by Super Micro Computer Inc CEO Charles Liang (梁見後) at Computex Taipei yesterday to champion the benefits of direct liquid cooling for artificial intelligence (AI) data centers.

US-based Super Micro manufactures server solutions and provides information technology infrastructure under the trade name of Supermicro.

Describing himself as Liang’s long-time partner and Supermicro’s “best sales guy,” Huang said that with the widespread transition to generative AI capable of generating text, images and video, data centers would need to upgrade to greener, more efficient systems.

Photo: CNA

Huang added that the estimated US$3 trillion poured into new data centers by 2030 would see demand for Supermicro’s solutions soar, “and Charles and the Supermicro team are ready to take your order.”

Data processing has been increasing exponentially in the AI era and graphics processing unit (GPU) servers will need to be assisted by solutions such as Supermicro’s direct liquid cooling (DLC) system, introduced by Liang yesterday, to accelerate computing.

During his keynote, Taiwan-born and raised Liang stressed the company’s liquid cooling solutions helped AI data centers save energy and money better than traditional air conditioning.

“We were the first company to bring optimized GPU servers to the market with Nvidia back in 2014, and since then we have been one of the main providers of AI assistance of optimized solutions to many leading AI factories in the world,” Liang said.

Counting Intel Corp, Advanced Micro Devices Inc and also Nvidia as its partners, Liang said Supermicro along with these partners is “on a mission to build more sustainable data center infrastructures that address the rising need for more computing and storage in today’s world, especially when it comes to generative AI training and inferencing.”

Supporting the latest AI development can be challenging through the traditional air cooling method, as it is more expensive and environmentally taxing than DLC, which Liang said had been around for more than 30 years.

“DLC can use room temperature water to provide optimal cooling for servers at much lower cost and with smaller environmental impact,” he said.

Liang added that the company’s goal is to make DLC quickly become a mainstream solution for any AI data center and factory that aims to improve efficiency and at the same time reduce operating expenses.

The company’s DLC solutions grew from zero percent to about less than 1 percent in market share in the last 30 years, but is already expecting 15 to 30 percent of market share in the next one to two years, he said.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing service provider, yesterday said it would boost equipment capital expenditure by up to 16 percent for this year to cope with strong customer demand for artificial intelligence (AI) applications. Aside from AI, a growing demand for semiconductors used in the automotive and industrial sectors is to drive ASE’s capacity next year, the Kaohsiung-based company said. “We do see the disparity between AI and other general sectors, and that pretty much aligns the scenario in the first half of this year,” ASE chief operating officer Tien Wu (吳田玉) told an