Hon Hai Precision Industry Co (鴻海精密) yesterday announced that it plans to team up with Nvidia Corp to build an advanced computing center at the Kaohsiung Software Park (高雄軟體園區), with the US chip giant’s GB200 flagship chips at its core.

The computing center is to house artificial intelligence (AI) servers based on Nvidia’s latest AI chip — consisting of a total of 64 racks and 4,608 graphics processing units (GPUs), Hon Hai said.

Construction of the center is slated for completion by 2026, it added.

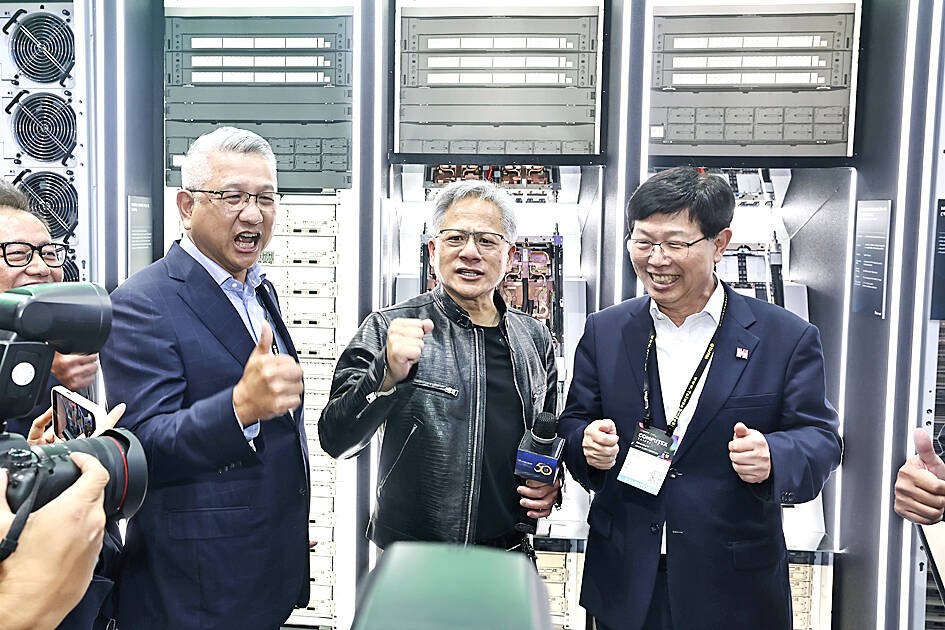

Photo: Fang Wei-chieh, Taipei Times

Through the latest collaboration, Hon Hai is banking on Nvidia’s AI technology to drive the development of its three smart platforms — smart manufacturing, smart electric vehicles (EV) and smart cities, Hon Hai said in a statement.

“Both companies will continue to deepen cooperation in AI, electric vehicles, smart factories, robots, smart cities and other fields, and demonstrate the strong competitiveness brought by AI through Foxconn’s huge manufacturing scale,” said the firm, which is Apple Inc’s largest contract manufacturer and is known as Foxconn Technology Group (富士康科技集團) internationally.

Hon Hai did not elaborate on how much it plans to invest in the center.

The company’s announcement came as Nvidia CEO Jensen Huang (黃仁勳) and Hon Hai chairman Young Liu (劉揚偉) met yesterday at a booth at Computex Taipei.

The booth belongs to Ingrasys Technology Inc (鴻佰科技), a Hon Hai subsidiary that makes Nvidia’s GB200 NVL72, a next-generation AI liquid-cooled rack solution and other Nvidia server products.

By leveraging Nvidia’s Omniverse and Isaac robotics platforms, coupled with Hon Hai’s image recognition technology and autonomous mobile robots, the company hopes to optimize its capacity utilization of AI server and EV production lines in Kaohsiung, it said.

In addition, Foxtron Vehicle Technologies Co’s (鴻華先進) new automotive manufacturing facilities in Kaohsiung’s Ciaotou District (橋頭) would become one of the group’s benchmark AI factories, it added.

Foxtron is an EV joint venture between Hon Hai and Yulon Motor Co (裕隆汽車). The new Ciaotou plant, which is under construction, is to use digital twin technology to achieve greater collaboration between virtual and physical production lines, as Foxtron is seeing electric bus orders outpace its current capacity, it said.

Upon the completion of the advanced computing center, the two companies will work with partners in the ecosystem to make generative AI applications a reality and help turn Kaohsiung into a smart city that would feature not just smart public transportation management, but also next-generation digital governance and medical health infused with generative AI technology, Hon Hai said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,