You can check out, but you still have to pay! Norway is looking for ways to hang onto its ultra-rich, who are increasingly moving abroad to escape one of the rare European countries to impose a wealth tax.

Industrialist Kjell Inge Rokke, former cross-country ski legend Bjorn Daehlie, and the father of soccer star Erling Haaland are among the dozens of super-wealthy who have packed up and left over the past few years.

The reason? The center-left government in power since 2021 has hiked the wealth tax from 0.85 percent to 1 percent — and to 1.1 percent for the wealthiest — and raised the dividend tax.

Photo: AFP

Norway, Spain and Switzerland are the only European countries that have a tax on net wealth. In Norway it also applies to unrealized capital gains (gains not yet realized through the sale of shares, for example).

Owners of companies are among those hit hardest, often drawing a modest salary even though their company has a high value.

“If your salary is 1 million and you have to pay 3 million in [wealth] tax, it’s clear that it’s untenable,” said Tord Ueland Kolstad, a real-estate magnate who “grudgingly” moved to Lucerne, Switzerland, in 2022.

“The system is designed so that it confiscates more than what you can produce,” he said.

To pay a wealth tax, which can exceed their yearly income, entrepreneurs often need to take out dividends, hampering their company’s capacity to invest.

Those dividends are also subject to a tax rate of 37.84 percent.

“So basically you have two options: either leave Norway, or sell your company,” Kolstad said.

From 2021 to last year, more than 100 of Norway’s wealthiest people went into exile, with the large majority relocating to Switzerland.

Others transferred their wealth to heirs already residing abroad, as Norway does not have inheritance tax.

Norwegian Prime Minister Jonas Gahr Store has criticized the mini-exodus, stressing that taxes are what pay for Norway’s generous welfare system.

“When you’ve made your wealth in Norway, put your kids in school, benefited from the healthcare system, driven on the roads and reaped the rewards of its research, it’s a breach of the social contract,” he said in a speech in parliament.

The government is now working to tighten the country’s “exit tax.”

People who move abroad would have 12 years to pay the exit tax — also 37.84 percent of gains made in Norway from shares and other sources over many years — that has until now been easy to circumvent or defer.

“The aim is that gains made in Norway be taxed in Norway,” said Erlend Grimstad, a state secretary in the Norwegian Ministry of Finance.

“Our nurses and teachers have to hand over a large share of their earnings to society in the form of taxes,” he said. “If they see that the most well-off can simply avoid contributing their share by leaving the country, that undermines the legitimacy of the tax system.”

That does little to quell the anger of the ultra-rich.

Christer Dalsboe, who started his own company, made a buzz on social media recently singing a little ditty discouraging other entrepreneurs from starting businesses in the country.

“Don’t come to Norway, we will tax you till you’re poor. And when you have nothing left, we will tax you a little more,” he sang, sitting at a piano.

The liberal think tank Civita said the government’s plans to tighten the “exit tax” were in reality aimed at setting up roadblocks for millionaires and billionaires.

“Instead of attacking the reasons that push them into exile, meaning easing the tax burden on Norwegian shareholders, they seem to prefer to set up regulatory obstacles,” Civita economist Mathilde Fasting said.

In Lucerne, Tord Ueland Kolstad said he can receive “several calls a week” from other Norwegians considering moving to Switzerland.

“The flow has not stopped. Maybe it is just beginning,” Kolstad said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

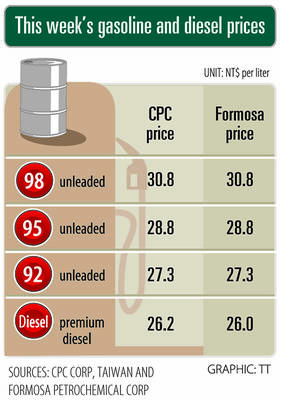

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the