Nvidia Corp on Wednesday overshot Wall Street estimates, as its profit skyrocketed bolstered by its dominance in chipmaking, which has made the company an icon of the artificial intelligence (AI) boom.

Its net income rose more than sevenfold from US$2.04 billion a year earlier to US$14.88 billion in its first quarter. Revenue more than tripled from US$7.19 billion the previous year to US$26.04 billion.

“The next industrial revolution has begun,” Nvidia CEO Jensen Huang (黃仁勳) said on a conference call with analysts.

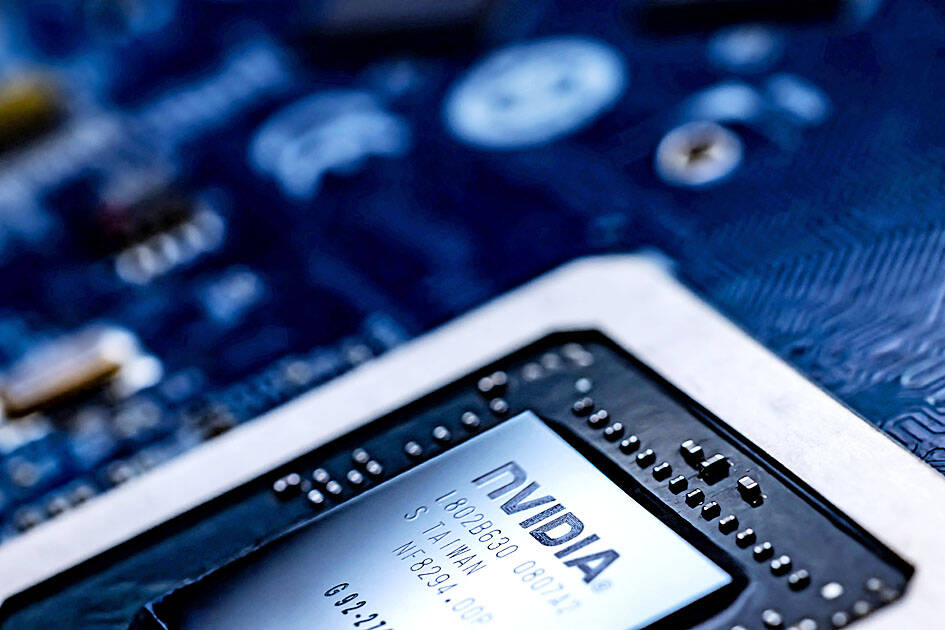

Photo by Joel Saget, AFP

Companies buying Nvidia chips would use them to build a new type of data center, designed to produce a new commodity: AI, Huang said, calling them “AI factories.”

Training AI models is becoming a faster process, as they learn to become “multimodal” — that is, capable of understanding text, speech, images, video and 3D data — and able to “reason and plan,” Huang added.

The company reported earnings per share — adjusted to exclude one-time items — of US$6.12, well above the US$5.60 that Wall Street analysts had expected, FactSet said.

Nvidia also announced a 10-for-1 stock split, a move that it said would make its shares more accessible to employees and investors.

The company increased its dividend from US$0.04 a share to US$0.10.

Nvidia shares rose 6 percent in after-hours trading to US$1,006.89 on Wednesday. The stock has risen more than 200 percent in the past year.

The company now boasts the third-highest market value on Wall Street, behind only Microsoft Corp and Apple Inc.

“Nvidia defies gravity again,” Emarketer analyst Jacob Bourne said of the quarterly report.

While many tech companies are eager to reduce their dependence on Nvidia, which has achieved a level of hardware dominance in AI rivaling that of earlier computing pioneers such as Intel Corp, “they’re not quite there yet,” Bourne said.

Demand for generative AI systems that can compose documents, make images and serve as increasingly lifelike personal assistants has fueled astronomical sales of Nvidia’s specialized AI chips over the past year.

Tech giants Amazon.com Inc, Google, Meta Platforms Inc and Microsoft Corp have signaled that they would need to spend more in coming months on the chips and data centers needed to train and operate their AI systems.

What happens after that could be another matter.

Some analysts believe that the breakneck race to build those huge data centers would eventually peak, potentially spelling trouble for Nvidia in the aftermath.

“The biggest question that remains is how long this runway is,” Third Bridge analyst Lucas Keh said.

AI workloads in the cloud would eventually shift from training to inference, or the more daily task of processing fresh data using already trained AI systems, Keh said.

Inference does not require the level of power provided by Nvidia’s expensive top-of-the-line chips, which would open up market opportunities for chipmakers offering less powerful, but also less costly, alternatives, Keh added.

When that happens, “Nvidia’s dominant market share position will be tested,” Keh said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the