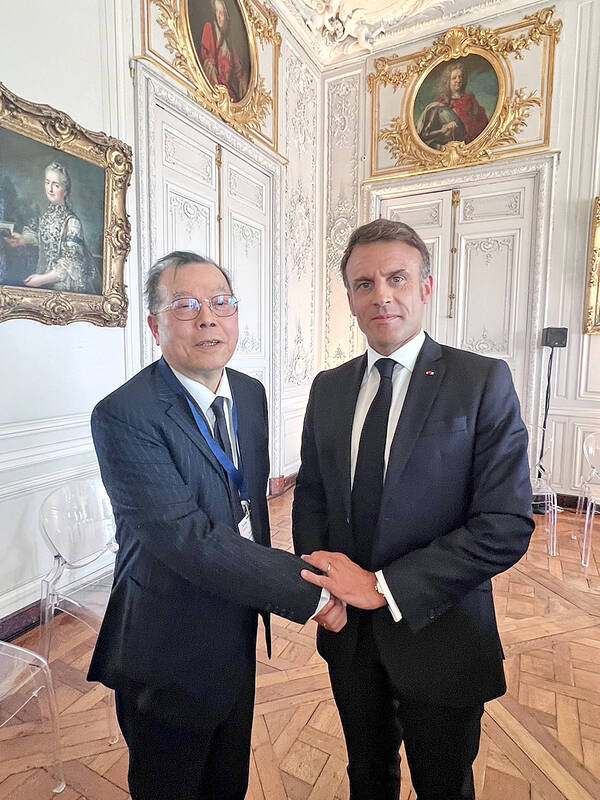

Powerchip Semiconductor Manufacturing Corp (力積電) chairman Frank Huang (黃崇仁) met with French President Emmanuel Macron on Monday and proposed cooperation in artificial intelligence (AI) development, the company said in a statement yesterday.

Huang was invited to attend a round table on AI and Quantum investment opportunities presided over by Macron in Paris to discuss technology development trends, Powerchip said.

Huang, the only entrepreneur from East Asia invited by France to the forum, said that many US companies have worked with their Taiwanese counterparts in tech development and taken advantage of Taiwan’s well-developed information technology (IT) platform to support their global operations.

Photo courtesy of Powerchip Semiconductor Manufacturing Corp via CNA

They include IT service provider IBM Corp, software developer Microsoft Corp, search engine provider Google, consumer electronics giant Apple Inc, and AI chip designers Advanced Micro Devices Inc and Nvidia Corp, Powerchip said.

For example, Nvidia CEO Jensen Huang (黃仁勳) has repeatedly approached Taiwan’s semiconductor industry for help in supplying high-end chips as his firm develops more advanced AI graphics processing units, Huang said.

If France learned from the US in making good use of Taiwan’s well-developed technology platform and its tech companies’ experience, France and Taiwan mutually benefit from technology upgrades, cost controls and service improvements, he said.

France has built a robust foundation in fundamental technologies, but its cooperative ties with Taiwan are not as close as those of the US, Huang said.

France could use Taiwan’s advantages in the tech sector to become more of a force in emerging technologies, such as AI applications, he added.

Powerchip said the round table was also attended by representatives from US and European companies such as IBM, Dutch semiconductor equipment supplier ASML Holding NV and e-commerce behemoth Amazon.com Inc.

Representatives of sovereign wealth funds from Saudi Arabia and the United Arab Emirates were also present, it said.

The forum was part of the Choose France summit held at the Chateau de Versailles to drum up foreign investment in France.

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

Popular vape brands such as Geek Bar might get more expensive in the US — if you can find them at all. Shipments of vapes from China to the US ground to a near halt last month from a year ago, official data showed, hit by US President Donald Trump’s tariffs and a crackdown on unauthorized e-cigarettes in the world’s biggest market for smoking alternatives. That includes Geek Bar, a brand of flavored vapes that is not authorized to sell in the US, but which had been widely available due to porous import controls. One retailer, who asked not to be named, because

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce

STILL LOADED: Last year’s richest person, Quanta Computer Inc chairman Barry Lam, dropped to second place despite an 8 percent increase in his wealth to US$12.6 billion Staff writer, with CNA Daniel Tsai (蔡明忠) and Richard Tsai (蔡明興), the brothers who run Fubon Group (富邦集團), topped the Forbes list of Taiwan’s 50 richest people this year, released on Wednesday in New York. The magazine said that a stronger New Taiwan dollar pushed the combined wealth of Taiwan’s 50 richest people up 13 percent, from US$174 billion to US$197 billion, with 36 of the people on the list seeing their wealth increase. That came as Taiwan’s economy grew 4.6 percent last year, its fastest pace in three years, driven by the strong performance of the semiconductor industry, the magazine said. The Tsai