The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply with new US and UK sanctions imposed for Russia’s invasion of Ukraine.

The sanctions aim to restrict revenues for Russia from the export of metal produced by companies such as Rusal and Nornickel that help to fund its military operations in Ukraine.

The US Department of the Treasury and the British government on Friday prohibited the 147-year-old LME and the Chicago Mercantile Exchange from accepting new Russian production of aluminum, copper and nickel.

Photo: Reuters

If an owner of Russian metal can provide evidence that it was produced before Saturday, it can still be put on LME warrant — a title document conferring ownership, the LME said.

“Russian metal warrants issued on or after 13 April 2024 for metal produced before 13 April 2024 are still subject to restrictions that prevent UK LME members and clients from canceling or withdrawing the corresponding metal unless they are doing so for the account of a non-UK client,” the exchange said in a statement.

On Friday, a UK official said that London expected any market disruption to be short-lived and that the government had consulted with colleagues in the US, the LME, the Bank of England and the British Financial Conduct Authority to minimize any impact.

One industry source, speaking on condition of anonymity, predicted that price reaction would be muted when trading resumes in Asian time today, while another said that a repeat of the kind of aluminum price jump spurred by US sanctions on Rusal in April 2018 was possible.

Both said that any EU sanctions would be almost certain to trigger a price surge. The bloc last year imported about 500,000 tonnes of aluminum for use in transportation, construction and packaging.

The action does not block bilateral contracts between two companies, rather than via the LME, British officials said on Friday, speaking on condition of anonymity.

The officials said continued trading of Russian metals on the exchanges is expected to be at a discount and that it does not restrict supply.

The share of available aluminum stocks of Russian origin in warehouses approved by the LME was 91 percent last month, while the proportion of copper stocks rose to 62 percent from 52 percent in February. Russian nickel in LME warehouses amounted to 36 percent of the total.

The high share of Russian-origin metal in LME inventories has been a concern for some producers, who compete with Russia’s Rusal, and some Western consumers who have avoided Russian metal since Moscow’s invasion of Ukraine in 2022.

The UK banned the import of base metals from Russia in December last year and said it would extend the prohibition to ancillary services when it could be done in concert with international partners.

The LME, the world’s largest and oldest forum for trading metals, is owned by Hong Kong Exchanges and Clearing Ltd.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

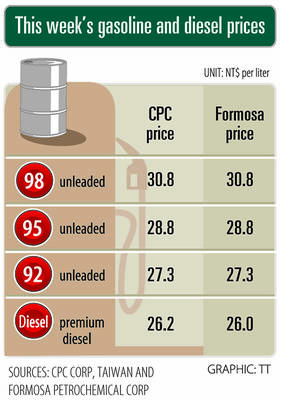

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the