US consumer prices increased more than expected last month amid rises in the costs of gasoline and shelter, casting further doubt on whether the Federal Reserve will start cutting interest rates in June.

The consumer price index (CPI) rose 0.4 percent last month after advancing by the same margin in February, the US Department of Labor’s Bureau of Labor Statistics (BLS) said yesterday.

Gasoline and shelter costs, which include rents, accounted for more than half of the increase in the CPI.

Photo: EPA-EFE

In the 12 months through last month, the CPI increased 3.5 percent also as last year’s low reading dropped out of the calculation. That followed a 3.2 percent rise in February.

The US central bank has a 2 percent inflation target. The measures it tracks for monetary policy are running considerably below the CPI rate.

Economists polled by Reuters had forecast the CPI gaining 0.3 percent on the month and advancing 3.4 percent on a year-on-year basis.

Though the annual increase in consumer prices has declined from a peak of 9.1 percent in June 2022, the disinflationary trend has slowed in recent months.

Following last week’s stronger-than-expected job growth last month as well as a drop in the unemployment rate to 3.8 percent from 3.9 percent in February, some economists have pushed back rate cut expectations to July. Others still believe the Fed will move in June. A minority see the window for rate cuts closing.

Fed Chair Jerome Powell has repeatedly said that the US central bank is in no rush to start lowering borrowing costs.

Financial markets saw a roughly 56 percent probability of the Fed cutting rates at its June 11-12 policy meeting, according to CME’s FedWatch Tool. The Fed has kept its policy rate in the 5.25-5.50 percent range since July last year. It has raised the benchmark overnight interest rate by 525 basis points since March, 2022.

Excluding the volatile food and energy components, the core CPI gained 0.4 percent last month after a similar rise in February and January. In the 12 months through last month, the core CPI rose 3.8 percent, matching February’s increase.

“Data was hotter than expected, both on the top line and the core number, and that’s driven futures down because it’s indicative of sticky inflation and the potential for the Fed to either cut fewer times or not at all in 2024,” Dakota Wealth Management LLC senior portfolio manager Robert Pavlik said.

“I don’t think it speaks to the need for a rate hike, but stocks have to be re-priced for a different environment which is presenting itself with this inflationary data.”

Yields across US government bonds spiked after the consumer price data was released, with the yield on the 10-year note last at 4.4927 percent.

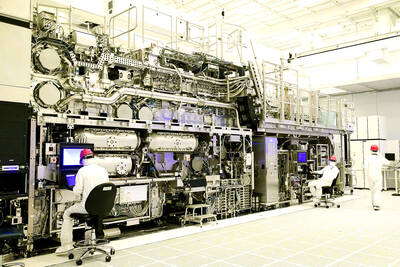

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

Quanta Computer Inc (廣達), which makes servers and laptop computers on a contract basis, yesterday said it expects artificial intelligence (AI) devices to bring explosive growth to Taiwan’s electronics industry, as AI applications are starting to run on edge devices such as AI PCs. Taiwanese electronics manufacturers such as chipmakers, component suppliers and hardware assemblers are likely to benefit from a rapid uptake of AI applications, Mike Yang (楊麒令), president of Quanta Cloud Technology Inc (雲達科技), a server manufacturing arm of Quanta, told reporters on the sidelines of a technology forum in Taipei yesterday. “I believe the growth potential is promising once

RETALIATION: Beijing is investigating Taiwan, the EU, the US and Japan for dumping, following probes of its market, as well as tariff hikes on its imports The Chinese Ministry of Commerce yesterday said it had launched a dumping investigation into imports of an important engineering chemical from Taiwan, the EU, the US and Japan. It would probe imports of polyoxymethylene copolymer, a thermoplastic used in many precision parts used in phones, auto parts and medical equipment, the Chinese commerce ministry said. The ministry is reviewing materials provided by six Chinese companies that applied for assistance on behalf of the industry on April 22, it said. The probe will target polyformaldehyde copolymer imported from suppliers in the EU, the US, Taiwan and Japan last year, and will assess any damage