Japan yesterday approved as much as ¥590 billion (US$3.9 billion) in subsidies to chip venture Rapidus Corp, committing more money to its ambition to catch up in semiconductor manufacturing.

The additional funding will help Rapidus buy chipmaking equipment and also develop advanced back-end chipmaking processes, Japanese Minister of Economy, Trade and Industry Ken Saito told a news conference in Tokyo.

The amount is on top of ¥330 billion of public money the 19-month-old start-up has already received in its bid to mass produce chips in Japan’s Hokkaido Prefecture and compete with industry leaders Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co.

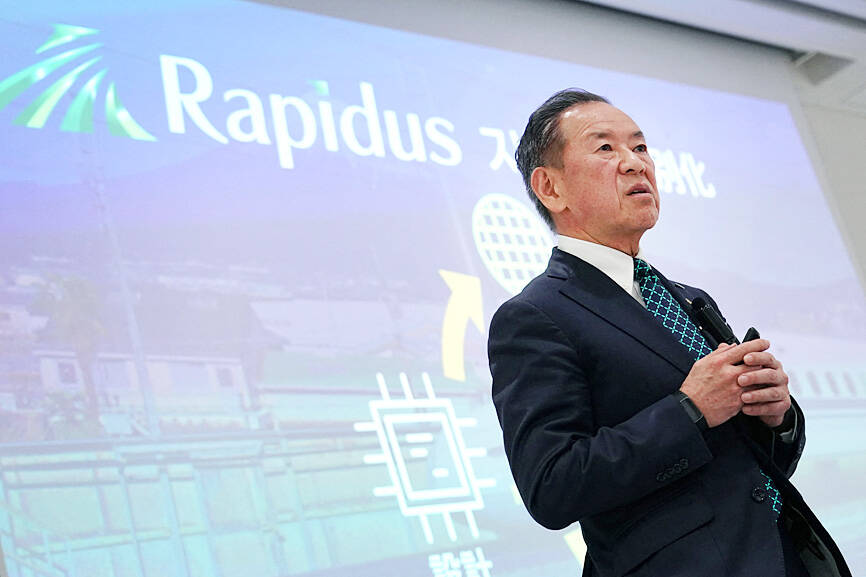

Photo: AFP

“The next-generation semiconductors Rapidus is working on are the most important technology that will dictate the future of Japanese industry and economic growth,” Saito said. “This fiscal year is extremely important for Rapidus.”

The sum is part of about ¥4 trillion Japan has earmarked over the past three years to regain some of its former chipmaking prowess, with Japanese Prime Minister Fumio Kishida targeting ¥10 trillion in financial support to chipmakers, along with the private sector.

Japan has committed billions of dollars into TSMC’s first factory in Kumamoto Prefecture, as well as to Micron Technology Inc’s expansion at its Hiroshima plant to make advanced DRAM.

Geopolitical tensions are spurring governments around the world to broaden domestic capabilities to make semiconductors, which are crucial for running vehicles, power plants and weapons systems, as well as consumer electronics.

The US has also pledged billions of dollars to chipmakers, but delays in licensing and subsidy allocations have held back factory construction plans.

Rapidus is teaming up with the country’s researchers in nanotechnology and materials to close the gap with TSMC in cutting-edge fabrication technology.

TSMC holds the biggest share of the world’s outsourced advanced chip production, with closest rival Samsung struggling for years to catch up.

As much as ¥536.5 billion of the newly approved subsidies will be used to install equipment for the pilot line at Rapidus’ Chitose plant, enlist researchers from IBM Corp, shorten turnaround times and build a production control system, the Japanese Ministry of Economy, Trade and Industry said.

The remaining ¥53.5 billion will be used to develop advanced packaging technologies to help combine multiple chips to generate more capabilities, it said.

Packaging is an area that is grabbing more attention as squeezing more transistors onto a single sliver of silicon gets increasingly costly.

Japan’s three decades of economic stagnation and loss of international competitiveness were caused in part by lack of understanding about the importance of semiconductors for digitalization, decarbonization and economic security, Saito said.

“It’s no exaggeration to say that chips are the foundation for this country’s industries and those of the world,” he said.

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

H200 CHIPS: A source said that Nvidia has asked the Taiwanese company to begin production of additional chips and work is expected to start in the second quarter Nvidia Corp is scrambling to meet demand for its H200 artificial intelligence (AI) chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for this year, while Nvidia holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said that Nvidia has asked TSMC to begin production of the additional chips and work is expected to start in the second

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”