US President Joe Biden’s administration is considering blacklisting a number of Chinese semiconductor firms linked to Huawei Technologies Co (華為) after the telecom giant notched a significant technological breakthrough last year, people familiar with the matter said.

Such a move would mark another escalation in a US campaign to ring-fence and curtail Beijing’s artificial intelligence (AI) and semiconductor ambitions. It would ratchet up the pressure on a Chinese national champion that has made advances despite existing sanctions, including producing a smartphone processor last year that many in Washington thought beyond its capabilities.

Most of the Chinese entities that could be affected were previously identified as chipmaking facilities acquired or being built by Huawei in a presentation by the Washington-based trade group Semiconductor Industry Association, people familiar with the matter said.

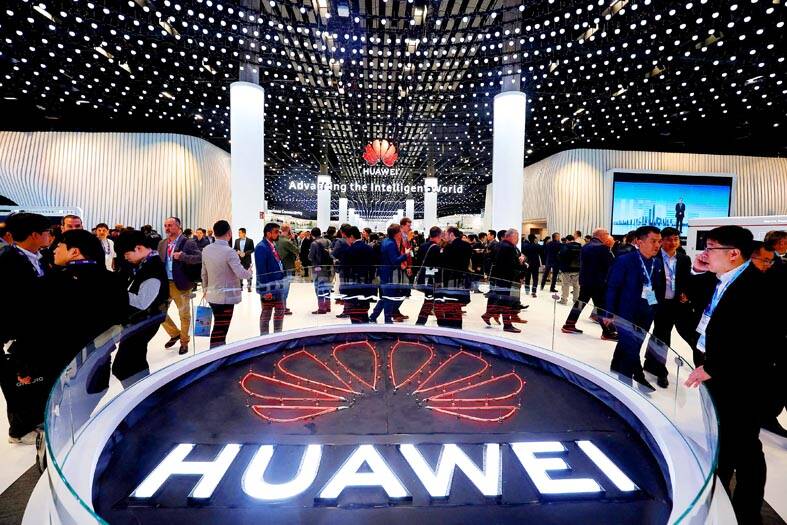

Photo: Reuters

No final decisions have been made, the people said.

The companies that could be blacklisted include chipmakers SiEn Integrated Circuits Co (芯恩), SwaySure Technology Co (昇維旭) and Pensun Technology Co (鵬新旭), the people said.

US officials are also weighing sanctions on China’s leading memorychip maker Changxin Xinqiao Memory Technologies Inc (CXMT, 長鑫存儲).

“Adding more Chinese companies to the US Entity List is a highly likely event,” Jefferies analyst Edison Lee (李裕生) wrote after CXMT was identified as a potential target. “It is easy to implement and justify, and it will further block certain key Chinese companies from being able to exploit current loopholes in export restrictions.”

Beyond companies that actually produce chips, US officials might also sanction Shenzhen Pengjin High-Tech Co (鵬進) and SiCarrier Technologies Co (新凱來), the people said.

The concern is that those two companies, which make semiconductor manufacturing gear, are acting as proxies to help Huawei obtain restricted equipment, the person said.

It is not clear whether the US Department of Commerce, which administers the so-called entity list, has additional evidence linking the companies to Huawei, the people said.

The US has the authority to sanction businesses that are at risk of harming its national security and officials do not necessarily need to prove past harmful or illegal activity.

The Chinese Ministry of Foreign Affairs reiterated that it “resolutely opposes” US actions that disrupt market order and harms Chinese enterprises, but did not comment specifically on the potential US moves under deliberation.

It is uncertain when US officials would make a final decision, the people said, adding that timing is likely to depend on the status of relations between Washington and Beijing — which both sides have worked to improve in recent months.

US Secretary of the Treasury Janet Yellen is expected to visit China again this year, and top officials have discussed a phone call between Biden and Chinese President Xi Jinping (習近平) this spring.

There are also other policy considerations, such as when the White House would announce a long-awaited adjustment of sweeping China tariffs first imposed under former US president Donald Trump.

Officials are also considering raising duties on older-generation chips from China, according to people familiar with the matter who said those conversations have picked up in the past few weeks.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

UNCERTAINTY: A final ruling against the president’s tariffs would upend his trade deals and force the government to content with billions of dollars in refunds The legal fight over US President Donald Trump’s global tariffs is deepening after a federal appeals court ruled the levies were issued illegally under an emergency law, extending the chaos in global trade. A 7-4 decision by a panel of judges on Friday was a major setback for Trump, even as it gives both sides something to boast about. The majority upheld a May ruling by the Court of International Trade that the tariffs were illegal. However, the judges left the levies intact while the case proceeds, as Trump had requested, and suggested that any injunction could potentially be narrowed to apply