China Evergrande Group’s (恆大集團) alleged US$78 billion revenue overstatement escalates the legal peril of founder Hui Ka Yan (許家印), who now stands at the center of one of the biggest financial fraud cases in history.

The nation’s top securities regulator said the developer’s onshore unit inflated revenue by recognizing sales in advance in the two years through 2020 that led up to its default. It imposed a 4.18 billion yuan (US$581 million) fine against the unit.

Evergrande’s alleged fraud dwarfs that of Luckin Coffee Inc (瑞幸咖啡) and Enron Corp, dealing a blow to the reputation of its former auditor PricewaterhouseCoopers LLP and the country’s financial oversight. It fuels concern about how widespread such accounting issues are, just as the new China Securities Regulatory Commission (CSRC) chairman is trying to tighten oversight.

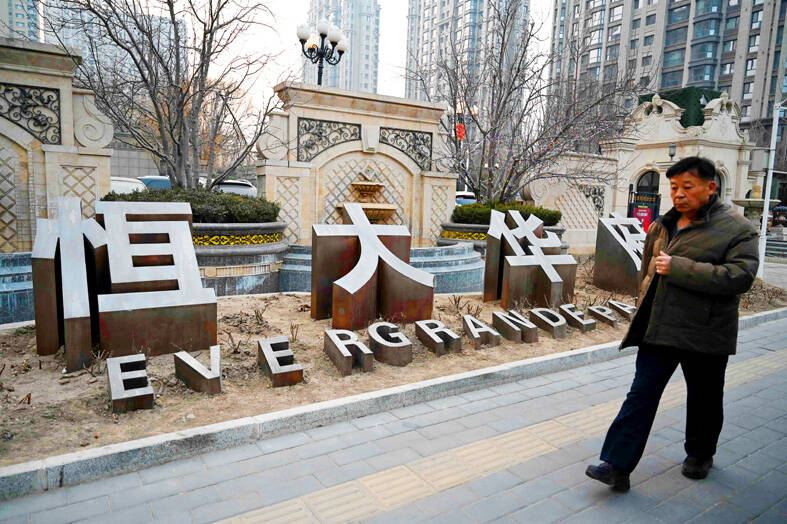

Photo: AFP

The fine also means Evergrande, with about US$332 billion in liabilities, will have even less money to pay off global creditors, despite a Hong Kong court ordering the company to be liquidated in late January.

“The alleged fraud is shocking in its scale,” said Brock Silvers, managing director at private equity firm Kaiyuan Capital. “Hui became an expected civil and criminal target as soon as Evergrande was ordered into liquidation.”

The allegations mark the latest blow for Hui, once among Asia’s richest tycoons, who oversaw a sprawling empire that spanned real estate to electric vehicles. Evergrande was one of China’s biggest developers, taking on massive debt to expand across the country as condo sales boomed.

The CSRC’s action may pave the way for more serious charges against Hui, who was detained by police last year due to “suspicion of illegal crimes.” No criminal charges against Hui have been made public and his whereabouts aren’t known. The levies are administrative penalties.

Regulators allege Hui instructed other personnel to “falsely inflate” annual results. The onshore unit Hengda Real Estate Group (恆大地產集團) boosted its 2019 revenue by about 214 billion yuan, and another 350 billion yuan in 2020, the regulator said. The inflated figures accounted for half of Hengda’s total revenue in 2019, and 79 percent in 2020.

As the supervisor in charge, Hui used particularly “egregious” means, the regulator said. Hengda also used these inflated figures in marketing to issue a combined 20.8 billion yuan in bonds, the regulator said.

Evergrande used to recognize revenue from apartments including those that were presold but yet to be delivered. The developer said last year that it changed its approach in 2021 to book revenue after the units were completed or occupied by their owners.

Hengda’s auditor in 2019 and 2020 was PricewaterhouseCoopers Zhong Tian LLP (普華永道中天會計師事務所), a mainland entity affiliated with PwC’s network. PwC resigned as Evergrande’s auditor in January last year due to audit disagreements.

PwC has also resigned as auditor for other Chinese developers including Sunac China Holdings Ltd (融創中國控股) and Shimao Group Holdings Ltd (世茂集團) In Hong Kong, the city’s Financial Reporting Council said in 2022 that it was looking into Evergrande’s financial statements for 2020 and expanding an investigation of an audit carried out by PwC.

“The more alarming question is — given than many other real estate developers have faced financial distress — who else relied on accounting gimmickry to buy them time,” said Joel A. Gallo, an adjunct professor at New York University in Shanghai. “Regulators should pose tough questions to the industry and their auditors.”

“To improve investor confidence in a sector that has weighed down the market, transparency, which has been murky so far, needs to be demonstrated,” Gallo added.

The CSRC’s fine against Hengda, while among the largest ever in China, trails that of the 7.1 billion yuan slapped on fintech giant Ant Group Co (螞蟻集團) for policy violations.

Hui was fined 47 million yuan for the falsified results and other alleged violations, and banned for life from capital markets activities. Other former executives Xia Haijun (夏海鈞) and Pan Darong (潘大榮) were also among people punished with fines and market bans.

Once Asia’s second-richest man, worth US$42 billion at his peak in 2017, Hui has seen his wealth plummet to about US$1 billion after the developer defaulted in 2021. Evergrande’s stock has tumbled and was eventually suspended from trading.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth