Early signs of a strong outcome in this year’s annual wage talks have heightened the chances that the Bank of Japan (BOJ) would end its negative interest rate policy next week, three sources familiar with its thinking said.

The central bank is likely to scrutinize a preliminary survey on the wage talks’ outcome, to be released by the Japanese Trade Union Confederation tomorrow, before deciding whether conditions to phase out stimulus have fallen into place, the sources said.

This year’s annual wage talks started yesterday, with Toyota Motor Corp agreeing to give factory workers their biggest pay increase in 25 years, heightening expectations that other companies would follow suit with bumper wage increases.

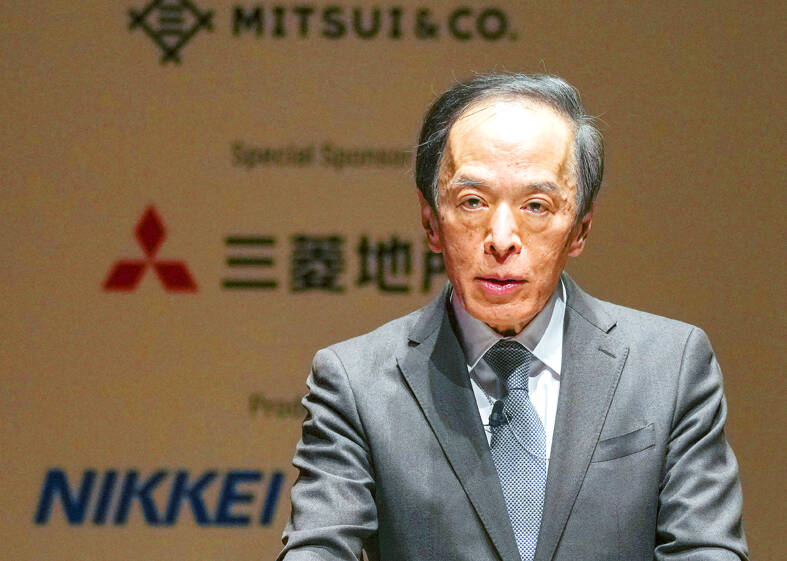

Photo: EPA-EFE

“There seem to be enough factors that justify a March policy shift,” one of the sources said.

“In the end, it will be a judgement call by the nine board members,” the source said, speaking on condition of anonymity due to the sensitivity of the matter.

BOJ Governor Kazuo Ueda signaled the bank’s readiness to phase out its massive stimulus as soon as next week, pointing to “fairly high pay demands” made by labor unions.

“The outcome of this year’s annual wage negotiation is critical” in deciding the timing of an exit from massive stimulus, Ueda told parliament yesterday.

“We’re seeing many companies make offers, including today. We hope to reach an appropriate decision looking comprehensively at these results,” as well as other data, he added.

Many market players expect the BOJ to end negative rates either at its two-day meeting concluding on Tuesday next week, or a subsequent meeting next month.

An end to negative interest rates, which have been in place since 2016, would mark a landmark shift away from the BOJ’s massive stimulus program and Japan’s first interest rate hike since 2007.

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Huawei Technologies Co’s (華為) latest smartphones carry a version of the advanced made-in-China processor it revealed last year, results from an independent analysis showed. This underscored the Chinese company’s ability to sustain production of the controversial chip. The Pura 70 series unveiled last week sports the Kirin 9010 processor, research firm TechInsights found during a teardown of the device. This is a newer version of the Kirin 9000s, made by Semiconductor Manufacturing International Corp (SMIC, 中芯) for the Mate 60 Pro, which had alarmed officials in Washington who thought a 7-nanometer chip was beyond China’s capabilities. Huawei has enjoyed a resurgence since