Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday promoted Y.J. Mii (米玉傑) and Y.P. Chyn (秦永沛) as co-chief operating officers (COO) of the world’s biggest contract chipmaker, signaling the formation of a succession team.

The latest executive reshuffle comes after TSMC chairman Mark Liu (劉德音) in December last year announced that he is to retire this year. CEO C.C. Wei (魏哲家) has been recommended as his successor while continuing to serve in his current position.

Mii and Chyn, as well as the company’s human resources, finance, legal and corporate planning units, are to report directly to Wei, a company statement released after the board of directors approved the appointment during a special board meeting yesterday said.

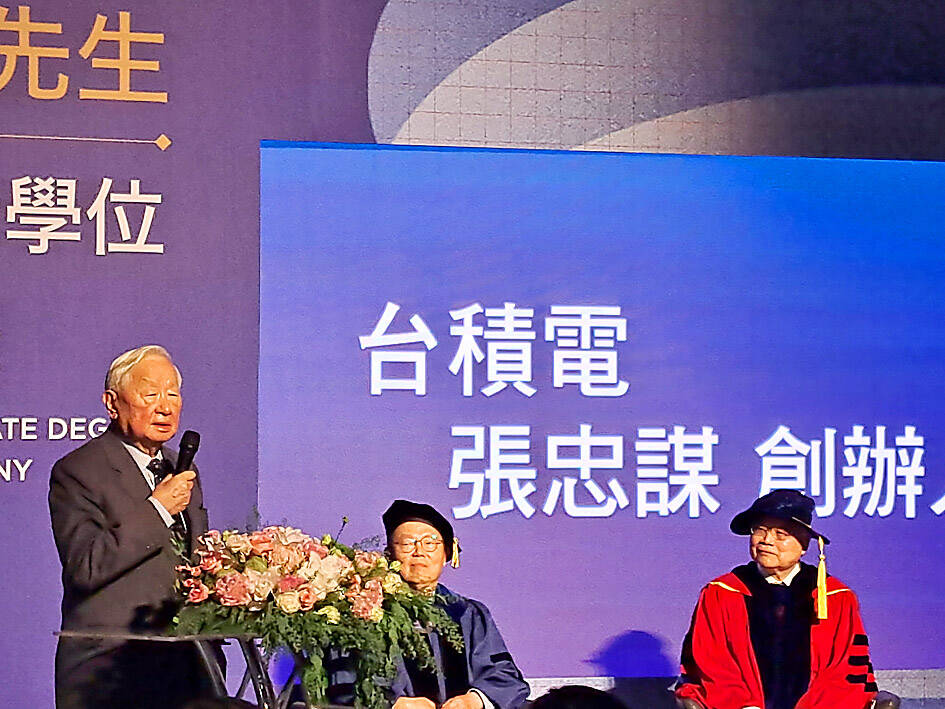

Photo: Grace Hung, Taipei Times

All other organizations are to report to the co-COOs. The new personnel adjustments and organizational structure take effect today, it said.

TSMC did not disclose details about the new COOs’ job responsibilities.

The company appointed Cliff Hou (侯永清), senior vice president of Europe and Asia sales and corporate research, as Chyn’s deputy, while Kevin Zhang (張曉強), senior vice president of TSMC’s business development, is to be Mii’s deputy.

Chyn is currently responsible for the operation and management of all fabs in Taiwan and overseas. He also co-leads TSMC’s Overseas Operations Office, which is responsible for supporting the company’s global expansion and accelerating the organizational effectiveness of overseas operations, information on the company’s Web site says.

Mii is in charge of the company’s research and development (R&D). He joined TSMC in 1994 as a manager at Fab 3 and then joined the R&D unit in 2001. In 2011, Mii was appointed vice president of R&D and in November 2016, he was promoted to senior vice president.

This is not the first time TSMC has adopted a co-COO management model. In 2012, the chipmaker’s board appointed three executives — Chiang Shang-yi (蔣尚義), Liu and Wei — to share the responsibilities of COO.

The three took turns taking charge of the company’s three major divisions: R&D, operations or manufacturing and business development.

In 2018, Liu was tapped as company chairman after founding chairman Morris Chang (張忠謀) retired from his post. Wei became company CEO.

“C.C. has been on the job of CEO for six years. In fact, he is the most well-prepared CEO,” Chang said during his speech at a ceremony in which Wei was awarded an honorary doctorate by National Yang Ming Chiao Tung University in Hsinchu yesterday.

Wei is a CEO with comprehensive experiences in the company’s three key divisions, in addition to sales and marketing, Chang said.

He was appointed head of the chipmaker’s first business development division in charge of sales and marketing in 2019, Chang said.

Prior to that, Wei was responsible for managing the company’s 6-inch and 8-inch fabs. He also worked at the R&D divisions of TSMC and Texas Instruments, Chang said.

In his speech, Wei said he has learned a lot from Chang, including how to be a trusted partner of customers.

The first step in building trust with customers is not to compete with them, Wei said, adding that this is the “essence of running a foundry model.”

Moreover, it is something that TSMC’s major rivals, one from South Korea and the other from California, can never catch up with, he said.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth