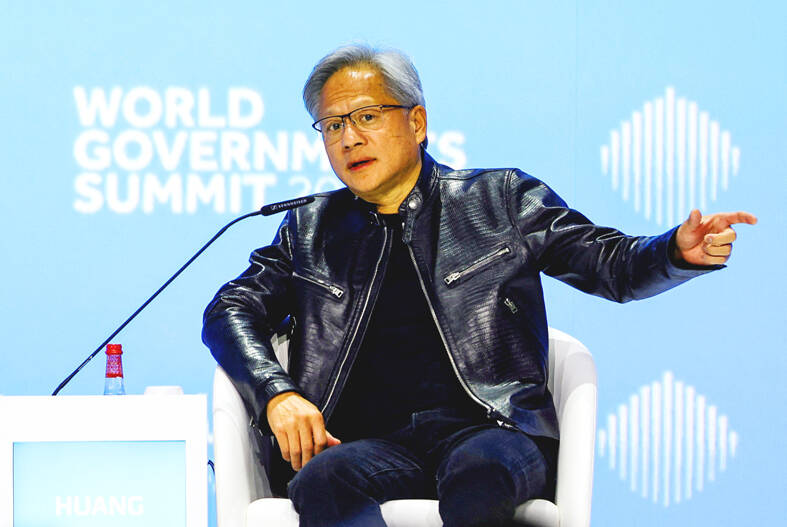

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) said yesterday that every country needs to have its own artificial intelligence (AI) infrastructure to take advantage of the economic potential while protecting its own culture.

“You cannot allow that to be done by other people,” Huang said at the World Government Summit in Dubai.

Huang, whose firm has catapulted to a US$1.73 trillion stock market value due to its dominance of the market for high-end AI chips, said his company is “democratizing” access to AI due to swift efficiency gains in AI computing.

Photo: Reuters

“The rest of it is really up to you to take initiative, activate your industry, build the infrastructure, as fast as you can,” he said.

He said that fears about the dangers of AI are overblown, adding that other new technologies and industries such as cars and aviation have been successfully regulated.

“There are some interests to scare people about this new technology, to mystify this technology, to encourage other people to not do anything about that technology and rely on them to do it. And I think that’s a mistake,” Huang said.

Huang anticipates advances in computing over the next few years will keep the cost of developing AI well below the US$7 trillion that Sam Altman is said to be fundraising.

“You can’t assume just that you will buy more computers. You have to also assume that the computers are going to become faster and therefore the total amount that you need is not as much,” Huang told the summit.

The 60-year-old’s company makes the most sought-after AI accelerators and he’s confident the chip industry will drive down the cost of AI, as those parts are made “faster and faster and faster.”

Huang was responding to a report in the Wall Street Journal that OpenAI CEO Sam Altman is seeking to raise US$7 trillion from investors in the Middle East, including the United Arab Emirates, for a semiconductor initiative to power AI projects that would rival Nvidia.

Altman and other AI developers are seeking ways to diversify their hardware options, including by exploring chipmaking ventures of their own. For Altman to have a realistic chance of making a dent in their lead, he would need to spend lavishly on research, development, facilities and expert personnel, but Huang’s view would suggest that better, more cost-efficient chips will make that unnecessary.

Still, the Nvidia CEO doesn’t see an end to the increase in AI spending anytime soon. In his remarks, Huang estimated that the global cost of data centers powering AI will double in the next five years.

“We’re at the beginning of this new era. There’s about a trillion dollars’ worth of installed base of data centers. Over the course of the next four or five years, we’ll have US$2 trillion worth of data centers that will be powering software around the world,” he said.

Separately, Australia is lagging international peers on the adoption of AI and other advanced technologies, according to the Productivity Commission.

We are “pretty much toward the bottom of the pack of OECD nations,” Danielle Wood, chair of the commission, said at the AFR Workforce Summit yesterday, referring to Australia’s rich-world counterparts in the Organisation for Economic Co-operation and Development.

“So there is a really important question, not just how does the government get the policy settings right and there’s a huge amount to be done there, but how do we shift closer to that frontier when it comes to technological adoption?” Wood said.

A government report last year predicted that Australia’s productivity growth would be 1.2 percent annually in the long term, down from 1.5 percent in the same report two years earlier. The 0.3 percentage point drop in productivity would cut estimated real GDP over the next 40 years by almost 10 percent.

Wood said she was optimistic about the overall impact on productivity from AI adoption in fields such as healthcare, education and retail and “less concerned about some of the negative workforce fallouts.”

“On the jobs piece, we have been through these kind of waves of technological changes before,” Wood said. “It may be that this time is different to history, but certainly what history, at least to date has shown is every time we get one of these waves of change, net job creation is greater than job destruction.”

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be