Nvidia Corp is building a new business unit focused on designing bespoke chips for cloud computing firms and others, including advanced artificial intelligence (AI) processors, nine sources familiar with its plans told Reuters.

The dominant global designer and supplier of AI chips aims to capture a portion of an exploding market for custom AI chips and shield itself from the growing number of companies pursuing alternatives to its products.

The Santa Clara, California-based company controls about 80 percent of the high-end AI chip market, a position that has sent its stock market value up 40 percent so far this year to US$1.73 trillion after it more than tripled last year.

Photo: Reuters

Nvidia’s customers, which include ChatGPT creator OpenAI, Microsoft Corp, Alphabet Inc and Meta Platforms Inc, have raced to snap up the dwindling supply of its chips to compete in the fast-emerging generative AI sector.

The firm’s H100 and A100 chips serve as a generalized, all-purpose AI processor for many of those major customers, but the tech companies have started to develop their own internal chips for specific needs. Doing so helps reduce energy consumption, and can potentially shrink the cost and time to design.

Nvidia is now attempting to play a role in helping these companies develop custom AI chips that have flowed to rival firms such as Broadcom Inc and Marvell Technology Group Inc, the sources said.

“If you’re really trying to optimize on things like power, or optimize on cost for your application, you can’t afford to go drop an H100 or A100 in there,” Eclipse Ventures LLC general partner Greg Reichow said in an interview. “You want to have the exact right mixture of compute and just the kind of compute that you need.”

Nvidia does not disclose H100 prices, which are higher than for the prior-generation A100, but each chip can sell for US$16,000 to US$100,000 depending on volume and other factors. Meta plans to bring its total stock to 350,000 H100s this year.

Nvidia officials have met with representatives from Amazon.com, Meta, Microsoft, Google and OpenAI to discuss making custom chips for them, two sources familiar with the meetings said. Beyond data center chips, Nvidia has pursued telecom, automotive and video game customers.

Dina McKinney, a former Advanced Micro Devices Inc and Marvell executive, heads Nvidia’s custom unit and her team’s goal is to make its technology available for customers in cloud, 5G wireless, video games and automotives, a LinkedIn profile said. Those mentions were scrubbed and her title changed after Reuters sought comment from Nvidia.

According to estimates from research firm 650 Group’s Alan Weckel, the data center custom chip market will grow to as much as US$10 billion this year, and double that next year.

The broader custom chip market was worth roughly US$30 billion last year, which amounts to roughly 5 percent of annual global chip sales, according to Needham & Co analyst Charles Shi.

Currently, custom silicon design for data centers is dominated by Broadcom and Marvell.

In a typical arrangement, a design partner such as Nvidia would offer intellectual property and technology, but leave the chip fabrication, packaging and additional steps to Taiwan Semiconductor Manufacturing Co (台積電) or another contract chip manufacturer.

Nvidia moving into this territory has the potential to eat into Broadcom and Marvell sales.

“With Broadcom’s custom silicon business touching US$10 billion, and Marvell’s around US$2 billion, this is a real threat,” SemiAnalysis founder Dylan Patel said. “It’s a real big negative — there’s more competition entering the fray.”

Nvidia is in talks with telecom infrastructure builder Ericsson AB for a wireless chip that includes the chip designer's graphics processing unit technology, two sources familiar with the discussions said.

Weckle expects the telecom custom chip market to remain flat at roughly US$4 billion to US$5 billion a year.

Nvidia also plans to target the automotive and video game markets, according to sources and public social media postings.

Weckel expects the custom auto market to grow consistently from its current US$6 billion to US$8 billion range at 20 percent a year, and the US$7 billion to US$8 billion video game custom chip market could increase with the next-generation consoles from Microsoft and Sony Group Corp.

Nintendo Co's current Switch handheld console already includes Nvidia's Tegra X1 chip. A new version of the Switch console expected this year is likely to include a Nvidia custom design, one source said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

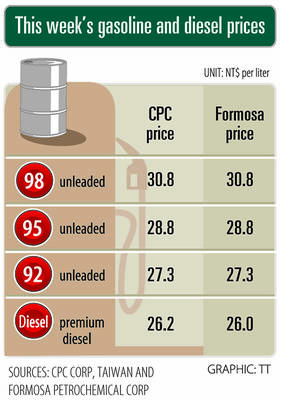

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the