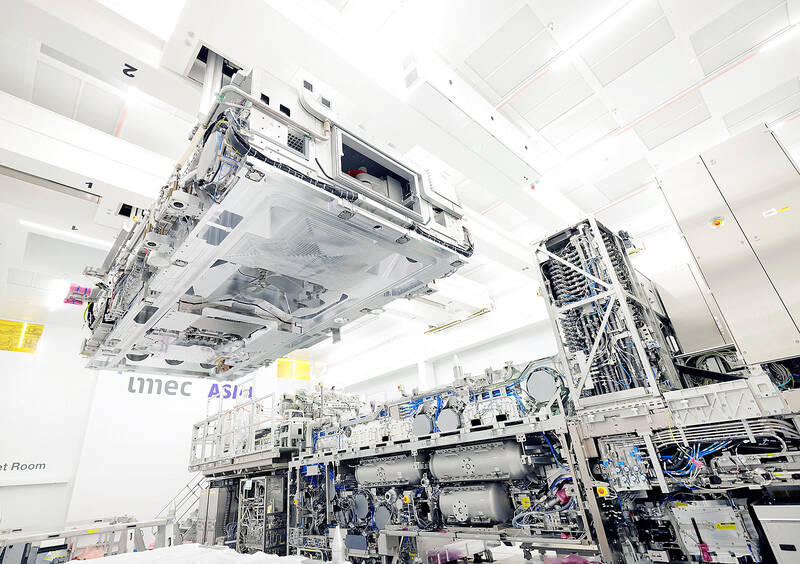

ASML Holding NV is showing off its latest chipmaking machine, a 350 million euro (US$380 million) piece of equipment that weighs as much as two Airbus A320s.

Media outlets were given a tour on Friday of the system known as High-NA extreme ultraviolet. Intel Corp has already placed orders for the machine and got the first one shipped to a factory in Oregon in late December. The company plans to start making chips with it late next year.

The machine can print lines on semiconductors 8 nanometers thick, 1.7 times smaller than the previous generation. The thinner the lines, the more transistors you can fit on a chip. And the more transistors you can fit on a chip, the higher the processing speeds and memory.

Photo: Reuters

That is why, ASML executives said, the system will prove essential for artificial intelligence (AI), a technology that is notorious for the intensity of the processing it requires.

AI will need “massive amounts of computing power and data storage. I think without ASML, without our technology, that’s not going to happen,” company chief executive officer Peter Wennink said in an interview with Bloomberg last month. “It’s going to be a big driver for our business.”

ASML is the only company that produces equipment needed to make the most sophisticated semiconductors, and demand for its products is a bellwether for the industry’s health.

The Dutch company last quarter received record orders for its top-of-the-line extreme ultraviolet (EUV) lithography machines, showing optimism among the biggest customers for the technology, including Intel, Samsung Electronics Co and Taiwan Semiconductor Manufacturing Co (台積電).

Installation of the first 150,000-kilogram system required 250 crates, 250 engineers and six months to complete, ASML spokesperson Monique Mols said during the press tour of the company headquarters in Veldhoven.

The rise of generative AI over the past year, catalyzed by OpenAI’s ChatGPT launch late 2022, has boosted expectations for semiconductor companies across the board. The so-called low-NA EUV machines, which ASML has been selling since 2018, have a price tag of 170 million euros.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.