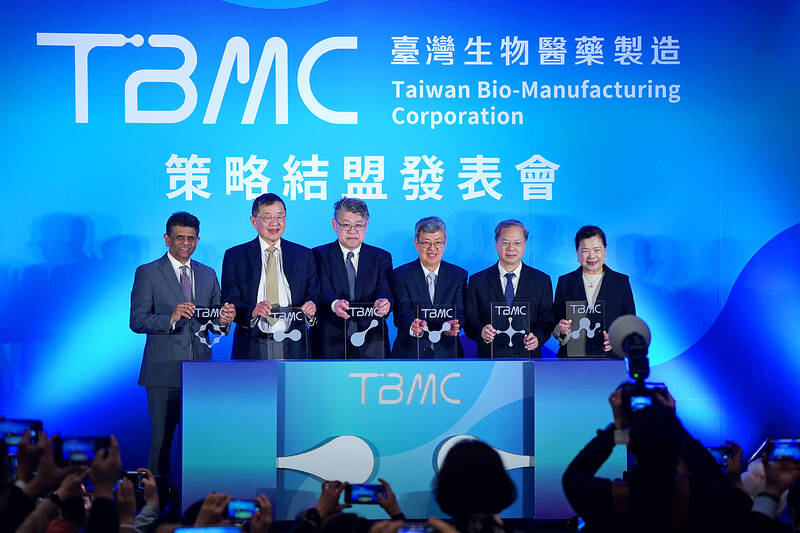

Taiwan Bio-Manufacturing Corp (TBMC, 臺灣生物醫藥製造), a government-initiated biotech company, on Friday staged its first public event in Taipei, during which it outlined its business model as being similar to that of contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and highlighted its strategic alliance with a US technology-focused biomanufacturing company.

The company, co-established by the Industrial Technology Research Institute (ITRI) and the Development Center for Biotechnology (DCB) last year, on Friday announced a strategic alliance with National Resilience Inc from the US, which it said would give it access to the latter’s expertise in biologics, vaccines, nucleic acids, cell therapy and gene therapy.

TBMC was started following the government’s realization during COVID-19 that Taiwan needed to have its own pharmaceutical manufacturing capabilities, Minister of National Development Kung Ming-hsin (龔明鑫) told a news conference in Taipei.

Photo courtesy of Taiwan Bio-Manufacturing Corp

“It is both a health issue and a national security issue,” he said.

The pandemic put Taiwan’s inability to mass produce mRNA vaccines under the spotlight, TBMC chairman and acting CEO Michel Chu (瞿志豪) said.

“Then-vice president Chen Chien-jen (陳建仁) and then-vice premier Shen Jong-chin (沈榮津) initiated a plan to start a company that specializes in the contract manufacturing of biologics, but can also manufacture vaccines during a pandemic,” Chu said in a video played at the news conference that introduced the company.

Chu also told the audience that the company plans to make the most of Taiwan’s advantages — abundant biotech talent and an outstanding smart manufacturing industry — to catapult the country into becoming a global market for contract development and manufacturing organizations (CDMOs).

CDMOs are companies that provide pharmaceutical companies with outsourcing options for drug development and manufacturing to lower risks and capital investment in advanced manufacturing processes.

TBMC is thus not only similar to TSMC in name, but also in its strategy of specializing in advanced contract manufacturing, Chu said.

The establishment of TBMC is based on the “successful experience” of TSMC, he added.

TBMC, like TSMC in 1986, was partly funded by the government, first employed talent from the ITRI — and also the DCB in the case of TBMC — and used foreign technologies and innovations “to secure the trust of future clients,” Chu said.

TSMC’s foreign partner back then was Royal Philips Electronics NV — which transferred some of its semiconductor patents to TSMC — while TBMC works with National Resilience.

“There are very few CDMOs in the world that out-license,” Chu said. “Many companies around the world would love for TSMC to authorize its advanced manufacturing technologies to them, but TSMC would definitely not be willing to do so.”

The reason TBMC was able to strike a deal with National Resilience was not just its special Taiwan connection — Resilience vice chairman Patrick Yang (楊育民) is Taiwanese American — but also because Taiwan has the exceptional automated and smart manufacturing capabilities that large-molecule drugs increasingly require, Chu said.

Large-molecule drugs, also known as biologics, are made from living organisms, while small-molecule drugs, which make up most of the pharmaceutical drugs on the market, are chemically synthesized.

Minister of Economic Affairs Wang Mei-hua (王美花) added that Taiwan has an edge when comes to talent, its medical system and protection of intellectual property, but “as the pharmaceutical industry is a field where big companies gain the most by remaining large, international collaboration is crucial for Taiwan’s biotech industry.”

CDMO shows great potential for biologics in Asia, Wang said, adding that TBMC has established a lab in the Taipei Bioinnovation Park and that it aims to have a Good Manufacturing Practices-grade factory in the Hsinchu Biomedical Science Park within two years.

“We’re hoping TBMC will become another ‘sacred mountain that protects the nation’ [as TSMC is referred to among Taiwanese] in the decades to come,” the minister said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the