At a village hall near Loch Linnhe, a sliver of water sandwiched between the Hebrides and Glasgow, Scotland, Stewart Hawthorn laid out his plan to build the biggest salmon farm in the UK near this aging rural community. Once completed, it would create at least 16 jobs, the managing director of Long Loch Salmon said. It would feature eight enclosures holding up to 8,000 tonnes of fish, with a density double the industry standard. Most importantly, he claimed, it would help alleviate one of the biggest problems plaguing the business — excessive death rates.

Salmon is a hot commodity: Its aquaculture is the fastest-growing food production system in the world. Promoted as a healthy alternative to red meat and chicken — and a way to close the so-called “protein gap” for a growing global population — Atlantic salmon production has expanded more than sixfold since 1995. The fish is now the UK’s dominant food export, with much of the farming taking place in Scotland.

However, rising demand has come alongside record mortality numbers: About a quarter of Scottish salmon do not make it to harvest, and in the last five years, there have been 53 million excess fish deaths, exceeding even larger producers. This is partly due to warming waters, which bring micro jellyfish and plankton blooms, but industry practices are also to blame: Densely packed farms can give rise to sea lice outbreaks, and bacterial and viral infections. While lice outbreaks are not typically fatal, their treatments can be. In October last year, almost 5 percent of salmon on Scottish farms died. The death rate fell to 4 percent the following month, still far higher than the five-year average.

Photo: AP

What is happening in Scotland is a microcosm of broader challenges facing the global salmon industry, the bulk of which is concentrated in neighboring Norway. Despite pitching the red-fleshed fish as a more environmentally friendly alternative to beef, producers have not yet figured out how to scale sustainably. While the obvious solution — less-crowded pens — reduces the spread of disease, it also dents profitability.

This has left salmon farmers in an unfortunate holding pattern: Either they continue to expand at the risk of exacerbating death rates or they take punts on new systems. In Scotland, where local communities are increasingly mistrustful of a sector that they say fails to benefit them, salmon farmers have struggled to find places in which to experiment, casting further uncertainty over the future of the £600 million (US$762 million) industry.

Facing a trickle of mostly white, middle-aged couples concerned about how a super-sized salmon farm might impact their area, Hawthorn explained how his innovation — a giant polyvinylchloride (PVC) sack to protect fish from lice and micro jellyfish — could be the thing that finally allows the sector to expand.

“I’ve been accused by people of being a sort of evangelist, almost thinking I’m going to save the world,” the 56-year-old Scotsman said of his efforts to position farmed salmon as a lower carbon alternative to land-grown meat. “I don’t think that this project will save the world, but I think this project along with millions of other projects like it all around the world are exactly what’s needed.”

In Loch Linnhe, at least, it would take some work to win people over. While Hawthorn has promised that his net would capture up to 85 percent of the solid waste that thousands of fish would produce, such technology has only ever managed to catch less than half that. The system has never been successfully used at this scale, and locals fear that their beloved loch could become a laboratory for a start-up’s unproven technology.

“The developer’s claims are unrealistic,” said Jane Hartnell-Beavis, an interior designer turned community organizer, from a campaign stand outside the town hall. “Far from solving the welfare and environment issues, it will merely exacerbate them. There’s no right way to do the wrong thing.”

Similar standoffs are playing out across the country. A less ambitious version of Hawthorn’s plan, set in a national park, is under appeal after being rejected, and another farm in the West Highlands was only approved following an appeal. In a 2022 industry review, Russel Griggs, chair of the South of Scotland Enterprise development agency, described the mistrust and animosity between the salmon industry and other stakeholders as unlike anything he had ever seen.

Tensions have been heightened by red tape around licensing. New farms must go through a lengthy and complex application process. While Scotland’s government had wanted to double salmon production by 2030, it has scaled back these ambitions. Its goal now is an aquaculture sector that operates “within environmental limits.”

From 2013 to 2022, the number of active Scottish salmon farms dropped from 257 to 210.

Salmon farming can be a nasty business. Breeding involves removing eggs and sperm from anesthetized fish, and typically euthanizing males after extraction. Larger farms generate enough excess fish feces and urine to potentially destabilize fragile ecosystems. Overcrowding can result in ghoulish, lice-riddled fish — leading to images that anti-salmon farming campaigners have circulated online to persuade shoppers to stay out of the seafood section.

With these circumstances at least somewhat linked to mass fish death, corporate boardrooms are feeling the effects. Mowi, an Oslo-listed company that is the world’s largest salmon farmer, reported that die-offs resulted in third-quarter costs of at least 36 million euros (US$39.3 million) last year out of an operating profit of about 200 million euros. One Mowi farm in Colonsay, Scotland, reported 200,000 salmon deaths in a single week in October last year. Not even rising salmon prices have cushioned the blow.

There is no clear industry path toward sustainable growth. Nor is there scientific consensus on the environmental impacts or welfare implications of different farming systems. So, salmon producers are experimenting in limited ways on existing farms. Mowi is introducing digital tools that enable farmers to better detect problems and respond to changes in underwater environments. It has also tried semi-closed systems such as Hawthorn’s, but these have run into problems: One cage was destroyed in a storm and plagued with disease, according to media reports.

Familiar issues resurface when fish get too big, Mowi chief executive officer Ivan Vindheim said.

“You also end up with the salmon being squeezed. So, you have to take down density and then it becomes too expensive. The cost is just going through the roof and the mortality is too high,” Vindheim explained.

Clues to more sustainable farming might be found in Mowi’s Norwegian operations, which are more profitable than their Scottish counterparts. In Nordic farms, salmon live in deeper waters along longer coastlines. Regin Jacobsen, who has been CEO of the Faroe Islands-based Bakkafrost group since 1989, cited aquaculture analysis showing lower death rates in Norway, the Faroe Islands and Chile, where waters are colder and less prone to disease than shallow Scottish lochs. His company hopes it would soon be able to stem losses and increase salmon production in Scotland through a water recirculation system modeled on one already at use in the Faroe Islands.

These kinds of technological solutions require risk-taking, which is essential for salmon farming in places like Scotland. To figures such as Hawthorn, the next question is how experimental the government — and local stakeholders — are willing to get.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

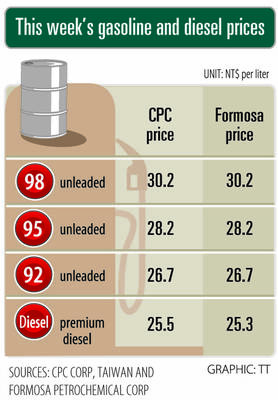

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01