CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) are to lower domestic diesel prices this week, but leave gasoline prices unchanged.

In separate statements yesterday, state-run CPC and privately owned Formosa said that they would lower diesel prices by NT$0.1 per liter, effective today, after keeping prices unchanged the previous week.

Based on its floating oil price formula, the cost of crude oil last week had declined by 0.91 percent from a week earlier, CPC said.

Formosa said international crude oil prices fluctuated last week, as a Black Sea storm reduced oil production in Kazakhstan and the market was concerned about OPEC+ oil producers’ ability to implement voluntary production cuts early next year.

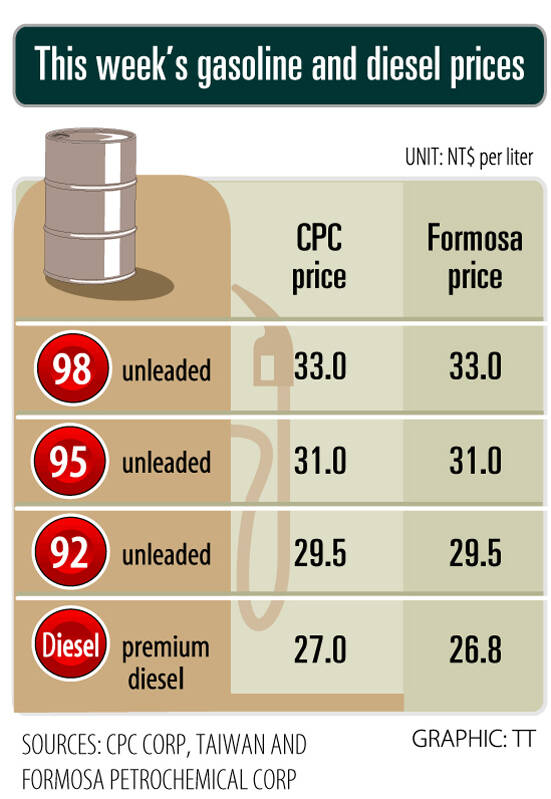

Effective today, gasoline prices at CPC and Formosa stations are to stay at NT$29.5, NT$31.0 and NT$33.0 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said.

Premium diesel is to cost NT$27.0 per liter at CPC stations and NT$26.8 at Formosa pumps, they said.

Meanwhile, CPC said despite an increase in international prices for liquefied petroleum gas (LPG), it would keep domestic prices unchanged this month for products including household and automotive LPG, propane and butane, as well as propane and butane mixes.

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Huawei Technologies Co’s (華為) latest smartphones carry a version of the advanced made-in-China processor it revealed last year, results from an independent analysis showed. This underscored the Chinese company’s ability to sustain production of the controversial chip. The Pura 70 series unveiled last week sports the Kirin 9010 processor, research firm TechInsights found during a teardown of the device. This is a newer version of the Kirin 9000s, made by Semiconductor Manufacturing International Corp (SMIC, 中芯) for the Mate 60 Pro, which had alarmed officials in Washington who thought a 7-nanometer chip was beyond China’s capabilities. Huawei has enjoyed a resurgence since

purpose: Tesla’s CEO sought to meet senior Chinese officials to discuss the rollout of its ‘full self-driving’ software in China and approval to transfer data they had collected Tesla Inc CEO Elon Musk arrived in Beijing yesterday on an unannounced visit, where he is expected to meet senior officials to discuss the rollout of "full self-driving" (FSD) software and permission to transfer data overseas, according to a person with knowledge of the matter. Chinese state media reported that he met Premier Li Qiang (李強) in Beijing, during which Li told Musk that Tesla's development in China could be regarded as a successful example of US-China economic and trade cooperation. Musk confirmed his meeting with the premier yesterday with a post on social media platform X. "Honored to meet with Premier Li