MediaTek Inc (聯發科) yesterday said that its flagship mobile processors would generate more than US$1 billion in revenue this year, as the world’s biggest smartphone chip supplier aims to bring its chips to edge devices and cloud-based machines with generative artificial intelligence (AI) capabilities.

That means about 7 percent of the chip supplier’s revenue this year, estimated at US$14 billion, would come from advanced 5G mobile processors.

The Hsinchu-based chip designer has added its first AI processing unit (APU) to its latest flagship mobile processor, the Dimensity 9300. MediaTek sarted building its APU technology about four to five years ago.

Photo courtesy of MediaTek Inc

The new advanced processor is optimized to run large language models for generative AI, the company said.

MediaTek expects smartphones powered by Dimensity 9300 — the third-generation of its flagship mobile chip — to hit the market by the end of this year. Next year, the company plans to increase the availability of AI-enabled 5G processors to a variety of smartphones.

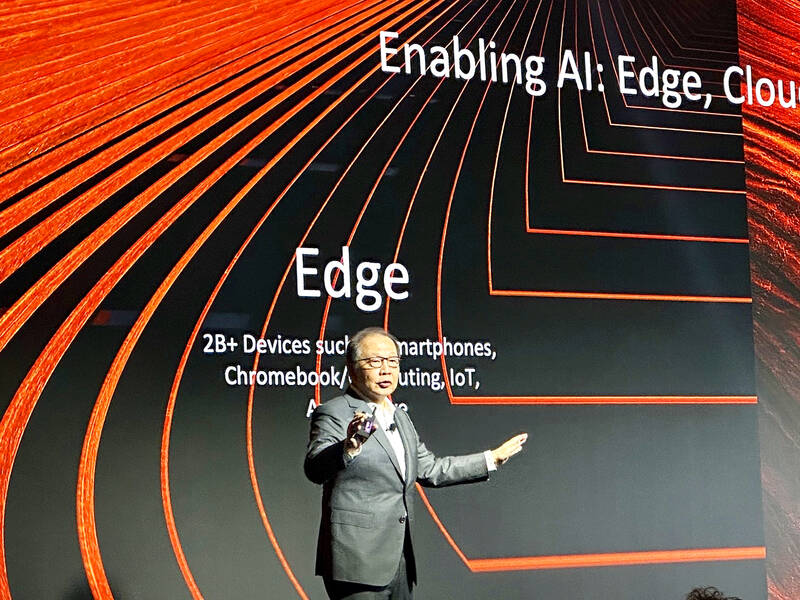

The introduction of the Dimensity 9300 chip has boosted MediaTek’s confidence that its flagship mobile processors would “bring in more than US$1 billion in revenue for us,” company CEO Rick Tsai (蔡力行) said in his speech during the MediaTek Executive Summit 2023 in the US yesterday.

“In the next five years, I want Mediatek to enable AI either on all [devices] on edge, cloud or [anything] in between,” Tsai said.

MediaTek said the US market would play a critical role in fueling its revenue growth in the next five years, as it is diversifying its product portfolio from mobile chips and broadening its footprint beyond China.

MediaTek made a great stride yesterday by adding Meta to its US client portfolio. The company is to collaborate with Meta to develop chips for the technology giant’s new augmented reality (AR) glasses. Meta’s Reality Labs vice president Jean Boufarhat joined Tsai onstage to make the announcement.

The partnership ignited speculation that MediaTek might replace Qualcomm Inc and become the sole chip supplier for Meta’s new AR glasses.

Mediatek said that building an ecosystem is crucial for the firm to grow its revenue in the future.

The chip designer partners with Taiwan Semiconductor Manufacturing Co (台積電) to utilize its leading-edge technology, including 3-nanometer processing and advanced chip packaging technologies from chip on wafer on substrate, or CoWoS, to chiplets to manufacture its processors, Tsai said.

The company also collaborates with ARM Holdings and Nvidia Corp to broaden its business to computing and automotive areas, he said.

“We want to work with them [those partners] to optimize, to maximize capabilities, so people can enjoy edge AI,” Tsai said. “We cannot do Deep Mind things. We cannot do [what] OpenAI [does]. But, we will provide technology, chips and services to enable them to do that.”

Mediatek said it has built up its technology leadership by investing heavily in research and development. Since 2018, the company has spent about US$18 billion on research and development, it said.

During the same period, its revenue is estimated to have surged 77 percent to an estimated US$14 billion this year from US$7.9 billion, it said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

UNCERTAINTY: A final ruling against the president’s tariffs would upend his trade deals and force the government to content with billions of dollars in refunds The legal fight over US President Donald Trump’s global tariffs is deepening after a federal appeals court ruled the levies were issued illegally under an emergency law, extending the chaos in global trade. A 7-4 decision by a panel of judges on Friday was a major setback for Trump, even as it gives both sides something to boast about. The majority upheld a May ruling by the Court of International Trade that the tariffs were illegal. However, the judges left the levies intact while the case proceeds, as Trump had requested, and suggested that any injunction could potentially be narrowed to apply