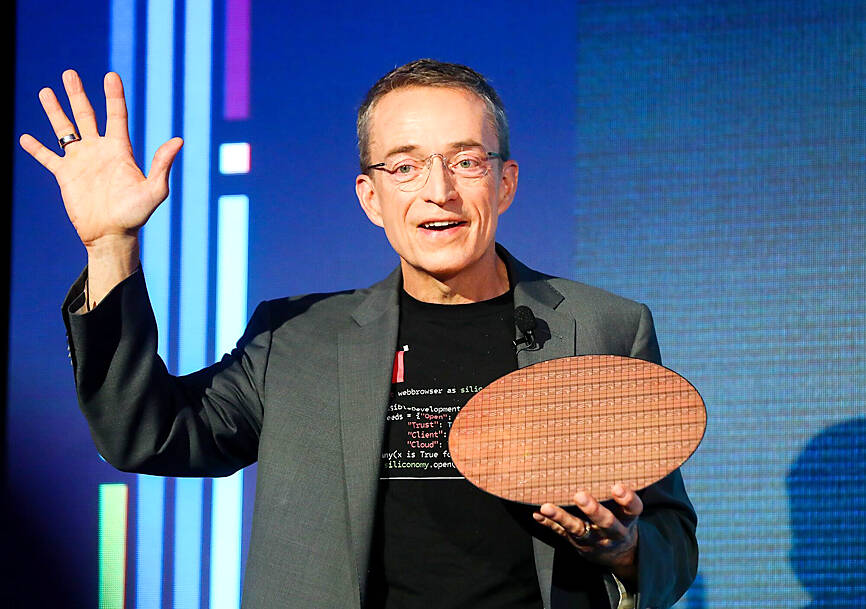

Intel Corp is expanding semiconductor capacity in the US, Europe and Asia as part of its efforts to satisfy the world’s need for a geographically balanced supply chain, while Taiwan has built itself into a foundry hub of Asia, CEO Pat Gelsinger told a media briefing in Taipei yesterday.

As a major part of its IDM2.0 (integrated device manufacturing) strategy, Intel aims to become a leading foundry service supplier to the world, Gelsinger said.

Taiwan has strong foundry companies, but Intel believes that “as the world wants a resilient geopolitical balanced supply chain, so our strategy is to align with that,” Gelsinger said. “Other than a strong Asian supply chain, with the hub built in Taiwan, there will be the need for a strong supply chain in America and Europe.”

Photo: Bloomberg

To address such needs, the US chipmaker is building a diverse manufacturing network around the world with multiple manufacturing operations in the US, Europe and Asia, he said.

In the US, Intel is building new fabs in Oregon, Arizona, New Mexico and Ohio, he said. The company also operates fabs in Israel and has unveiled major investment plans in Ireland, Poland and Germany to build leading-edge semiconductor factories, he said.

In Asia, Intel is expanding its footprint in Malaysia and Vietnam. The chipmaker is deploying wafer-level assembly and chip packaging manufacturing capabilities in Malaysia, Gelsinger said.

Intel’s investment in building geographically diversified fabs is well justified, as the global semiconductor market is expanding rapidly and is expected to reach an estimated US$1 trillion by the end of this decade from US$600 billion last year, he said.

To become a reliant foundry service provider, Gelsinger said Intel has to be “customer-obsessed,” as it has to become customers’ factories.

“No matter what, a good factory is making products that make their customers successful. Intel was never customer-oriented. We were a leadership technology provider,” Gelsinger said.

Commenting on growing competition from computers powered by ARM-based chips, Gelsinger said ARM has been unable to gain a sizeable share of the world’s PC market. At the same time, a growing number of companies are ushering into artificial-intelligence-enabled PCs, and Intel expects shipments of AI PCs to rise to 100 million units in 2025, he said.

Intel sees ARM-based chipmakers as potential customers of its foundry services, given that Intel’s OpenVINO, an open-source toolkit for optimizing and deploying AI inference, supports the ARM architecture, he said.

Gelsinger also told Intel’s local partners in Taipei that the company is confident about reaching its goal of delivering five advanced process nodes in four years. After successfully shipping the first node, the Intel 7 processor, Intel is on schedule to ramp up production of the Intel 18A, the last node of the plan, in the second half of next year.

Gelsinger took the reign of Intel in 2021.

Showing support for Intel, Asustek Computer Inc (華碩) chairman Jonney Shih (施崇棠) yesterday demonstrated the generative AI features on PCs.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)