The IMF lifted its global inflation forecast for next year and called for central banks to keep policy tight until there is a durable easing in price pressures.

The IMF boosted its projection for the pace of consumer price increases across the world to 5.8 percent for next year in its World Economic Outlook released yesterday, up from its forecast of 5.2 percent three months ago.

The call for vigilance on inflation comes as it also trimmed the forecast for next year’s economic growth.

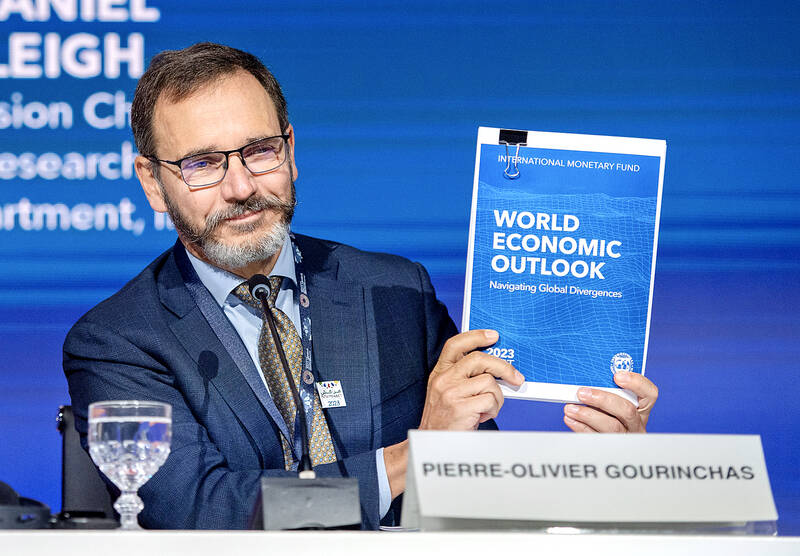

Photo: EPA-EFE

In most countries, the IMF foresees inflation remaining above central bank targets until 2025.

The forecasts are a much-anticipated event at annual IMF-World Bank meetings, which are taking place until Sunday in Marrakech, Morocco.

Central banks in major economies, including the US and the EU, have raised interest rates aggressively for more than a year to curb inflation, which reached 8.7 percent globally last year, the highest level since the mid-1990s.

“Monetary policy needs to remain tight in most places until inflation is durably coming down towards targets,” IMF chief economist Pierre-Olivier Gourinchas said in a briefing with reporters. “We’re not quite there.”

The surge was spurred by factors including COVID-19 pandemic supply chain disruptions; fiscal stimulus in response to the global lockdown; subsequent strong demand and a tight US labor market; and food and energy disruptions from Russia’s invasion of Ukraine, which had a particular effect in Europe and the UK.

The fund sees global growth of 2.9 percent for next year, down 0.1 percentage point from its outlook in July, and below the 3.8 percent average of the two decades before the pandemic. Its forecast for this year is unchanged at 3 percent.

While the global growth outlook is low, it is relatively stable and the IMF sees better odds that central banks can tame inflation without sending the world into recession.

Yet the steadiness in the IMF’s aggregate projection for growth masks some important changes in the individual country forecasts that underpin it. It raised its growth estimate for the US for this year to 2.1 percent from 1.8 percent and next year’s estimate to 1.5 percent from 1 percent, based on stronger business investment in the second quarter and resilient consumption growth.

On the other hand, the growth forecast for China was cut to 5 percent from 5.2 percent for this year and to 4.2 percent from 4.5 percent for next year.

The IMF also lowered its growth estimate for Taiwan by 1.3 percentage points to 0.8 percent this year, but forecast growth of 3 percent next year.

The growth estimate for the eurozone was cut to 0.7 percent this year from 0.9 percent, and to 1.2 percent next year from a 1.5 percent projection earlier. Japan’s growth forecast was raised to 2 percent this year from a previous projection of 1.4 percent.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

United Microelectronics Corp (UMC, 聯電) forecast that its wafer shipments this quarter would grow up to 7 percent sequentially and the factory utilization rate would rise to 75 percent, indicating that customers did not alter their ordering behavior due to the US President Donald Trump’s capricious US tariff policies. However, the uncertainty about US tariffs has weighed on the chipmaker’s business visibility for the second half of this year, UMC chief financial officer Liu Chi-tung (劉啟東) said at an online earnings conference yesterday. “Although the escalating trade tensions and global tariff policies have increased uncertainty in the semiconductor industry, we have not

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new