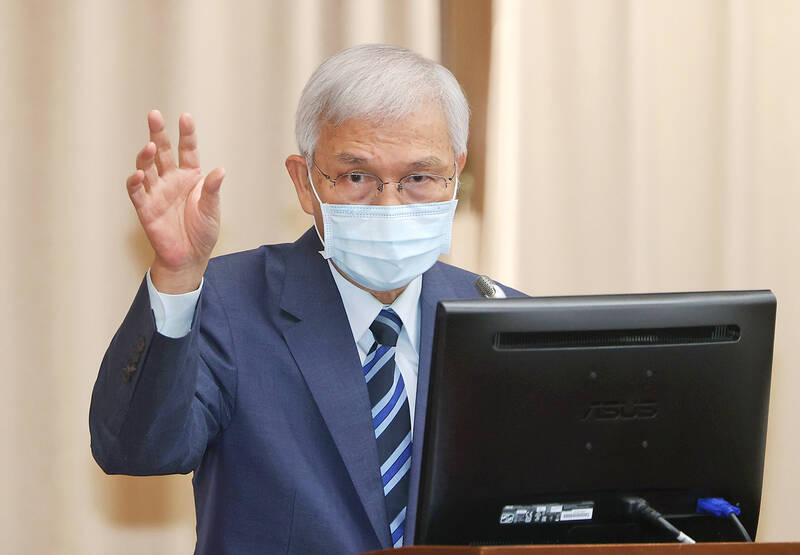

Central bank Governor Yang Chin-long (楊金龍) yesterday reiterated that the bank would intervene in the foreign exchange market to maintain currency stability if necessary, but denied there is a so-called “Yang’s defense line.”

Yang made the statement at a meeting of the legislature’s Finance Committee where lawmakers from across party lines voiced concern over the New Taiwan dollar’s gradual, but steady decline against the US dollar.

“The central bank will step in when it spots abnormal fund movements that might threaten the currency market’s stability,” Yang told lawmakers.

Photo: CNA

The governor attributed the NT dollar’s performance to global fund outflows from Asian markets to take shelter in the greenback, after the US Federal Reserve last month said that it would keep interest rates up and for longer.

The NT dollar has fallen 5.01 percent against the greenback so far this year, a relatively stable showing compared with the yen’s 11.8 percent slump, the won’s 6.99 percent drop and the yuan’s 5.04 percent decline, Yang said.

Asian currencies saw greater corrections — from 7.67 to 25.66 percent — from 2017 to 2018 at the beginning of the US-China trade dispute when he had just assumed the governorship, Yang said.

The market has the final say regarding the local currency’s value, the governor said, adding that there is no so-called “Yang’s defense line,” although the market suspects that NT$32.4 is the level the central bank wants to maintain against the US dollar.

The NT dollar yesterday rose NT$0.003 from a day earlier to close at NT$32.325 against the greenback in Taipei trading, although it weakened to a seven-year low of NT$32.435 intersession, data from the central bank’s Web site showed.

Yang dismissed concerns that the US would put Taiwan on its watch list for unfair foreign exchange practices for supporting the local currency.

“The US Department of the Treasury frowns on interventions to thwart currency appreciation, but does not mind efforts to support the currency,” Yang said, adding that the US understands the importance of currency stability, and the central bank maintains good communication with the US.

Although Taiwan’s exports are taking a hit from a global slowdown, the nation has accumulated a trade surplus of more than US$20 billion, one of three criteria used by the US to weigh currency manipulation, Yang said.

Disappointing exports would weigh on Taiwan’s GDP and stock market, and foreign funds would move to realize capital gains whenever they see fit, Yang said.

Capital outflows have amounted to US$15.71 billion thus far, accounting for the rout on the TAIEX, he said.

The governor said fighting inflation remains the central bank’s top priority, but he is not overly worried about the second wave of inflation that is approaching.

It is unlikely that US consumer prices would reach new highs, even if international oil prices rise to US$100 a barrel, Yang said.

Rather, it would only slow the pace at which consumer prices return to the 2 percent target, he added.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,