Minister of Economic Affairs Wang Mei-hua (王美花) and US National Institute of Standards and Technology (NIST) Director Laurie Locascio on Tuesday agreed to increase cybersecurity collaboration between the two countries, a Ministry of Economic Affairs official who is familiar with the matter said.

Wang and Locascio agreed at a meeting in Taipei to build up a joint cybersecurity supply chain under the US-Taiwan Technology Trade and Investment Collaboration (TTIC) framework, the official said.

The TTIC, established in December 2021, is a bilateral cooperation framework that aims to facilitate the development of joint commercial programs and bolster critical technology supply chains.

Photo: CNA

Initial areas of focus include semiconductors, 5G, electric vehicles, sustainable energy and cybersecurity.

The official said that many US information technology companies use Taiwan-produced hardware, and that the US hopes the nation would be able to manufacture advanced servers and 5G mobile networks to enhance cybersecurity.

Both countries could enjoy economic benefits from further cybersecurity cooperation, the official said.

Also on Tuesday, Locascio said at the opening ceremony of a US Business Day forum that the US was drafting a new version of the NIST Cybersecurity Framework, which it hoped to launch next year.

She said she hopes to discuss collaboration opportunities with Taiwan, for example to protect customer data privacy.

Many US start-ups are on the hunt for partners with expertise in cybersecurity, she said.

Locascio led a cybersecurity business development mission in Taiwan from Monday to yesterday, which introduced 13 US firms to some of Taiwan’s leading information and communication technology security, and critical infrastructure protection markets.

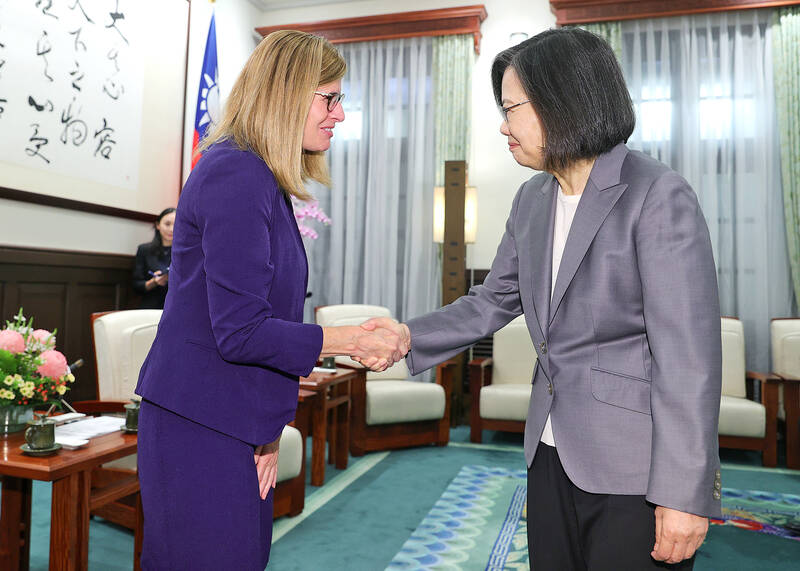

The delegation met with President Tsai Ing-wen (蔡英文), and visited the National Science and Technology Council and the Ministry of Digital Affairs to exchange ideas relating to cybersecurity and semiconductors, the NIST said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

FORTUNES REVERSED: The new 15 percent levies left countries with a 10 percent tariff worse off and stripped away the advantage of those with a 15 percent rate In a swift reversal of fortunes, countries that had been hardest hit by US President Donald Trump’s tariffs have emerged as the biggest winners from the US Supreme Court’s decision to strike down his emergency levies. China, India and Brazil are among those now seeing lower tariff rates for shipments to the US after the court ruled Trump’s use of the International Emergency Economic Powers Act to impose duties was illegal. While Trump subsequently announced plans for a 15 percent global rate, Bloomberg Economics said that would mean an average effective tariff rate of about 12 percent — the lowest since

Standard Chartered Bank Taiwan’s newly appointed chief executive officer, Anthony Yu (游天立), yesterday unveiled an ambitious growth strategy for the bank’s wealth management division, reflecting a bullish outlook on Taiwan’s high-net-worth market. Yu, the first local executive to lead Standard Chartered Bank’s Taiwan operations, emphasized rising client demand and detailed plans to expand the bank’s digital capabilities, as well as its physical presence across the country. Standard Chartered Taiwan saw a remarkable surge in new wealth management clients last month, with the number of clients holding assets equivalent to US$1 million more than doubling compared with the same month last year, he