A walkout by more than 12,000 autoworkers yesterday could slow an outperforming US economy should it drag on — even risking the first monthly net drop in payroll employment in nearly three years — but is unlikely on its own to trigger a recession.

Economists see the most immediate risk to activity concentrated in the auto sector itself, which only this year got back on its feet after two years when COVID-19 pandemic-related supply chain bottlenecks hampered vehicle output. With dealer inventories restrained, sales of new cars and trucks slumped even as consumer demand remained strong.

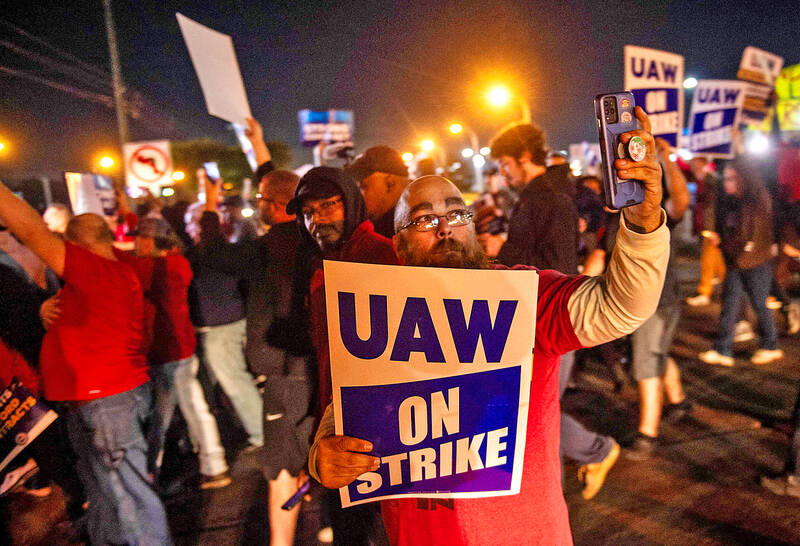

After failing to reach a deal on a new contract with Detroit’s “Big Three” automakers, General Motors, Ford and Stellantis, the United Auto Workers (UAW) union yesterday went on strike at three plants in three states. The stoppage for now affects about 12,700 hourly employees.

Photo: AFP

Should it widen in the weeks ahead to include all 146,000 UAW members at the three companies, it could become the largest automotive industry strike in a quarter century — since more than 150,000 GM workers went off the job for nearly two months in 1998.

That would put “at risk half a billion dollars per day in an economy that generates more than US$26.7 trillion in goods and services each year, or more than US$73 billion per day,” RSM chief US economist Joe Brusuelas estimated this week.

RSM estimated the US economy would suffer a modest 0.2 percent drag to annualized growth of GDP this quarter should the strike action last for a month, Brusuelas said.

“While that amount is large in nominal dollar terms, it would not be large enough to tip the economy into recession. In the end, the impact of a such a strike would be modest compared to previous generations,” Brusuelas said.

Other economists offered comparable estimates of the potential drag from a prolonged strike by the Big Three’s full union membership.

The US economy this year has dodged what was a consensus expectation for falling into recession in the face of aggressive interest rate hikes by the US Federal Reserve to rein in the highest inflation in four decades.

In fact, growth in GDP motored along at an above-trend rate of just above 2 percent annualized through the first six months of the year, and indicators of activity so far in the third quarter suggest it has accelerated further.

That said, activity in some sectors — manufacturing in particular — has recently slowed or even stalled, and a historically hot job market has cooled over the summer.

A full-blown strike “could push US payroll growth temporarily negative,” Michael Pearce, lead US economist at Oxford Economics, wrote on Wednesday.

While this was the survey week for the US Department of Labor’s monthly nonfarm payrolls report for this month, the fact that union members were on the job for most of the week ahead of the walkout means they would be counted as employed for this month’s report, Pearce said.

That means any recorded knock to employment would likely not occur until next month, should the strike last that long, and that would not be reported until early November.

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest

EXPANSION: While Gigabyte Technology is optimistic about market demand this year, uncertainty remains due to the impact of potential US tariffs and currency fluctuations Motherboard and graphics card maker Gigabyte Technology Co (技嘉) yesterday said that it plans to launch an artificial intelligence (AI) server assembly line in the US in the second half of this year. The company’s core motherboard and graphics card businesses in the US remain stable, but sales of its higher-priced AI servers still hinge on the development of tariff policies, Gigabyte chairman Dandy Yeh (葉培城) told reporters following the company’s annual shareholders’ meeting in Taipei. Yeh was referring to the “reciprocal” tariffs announced by US President Donald Trump on April 2, which were later postponed for 90 days. While Gigabyte