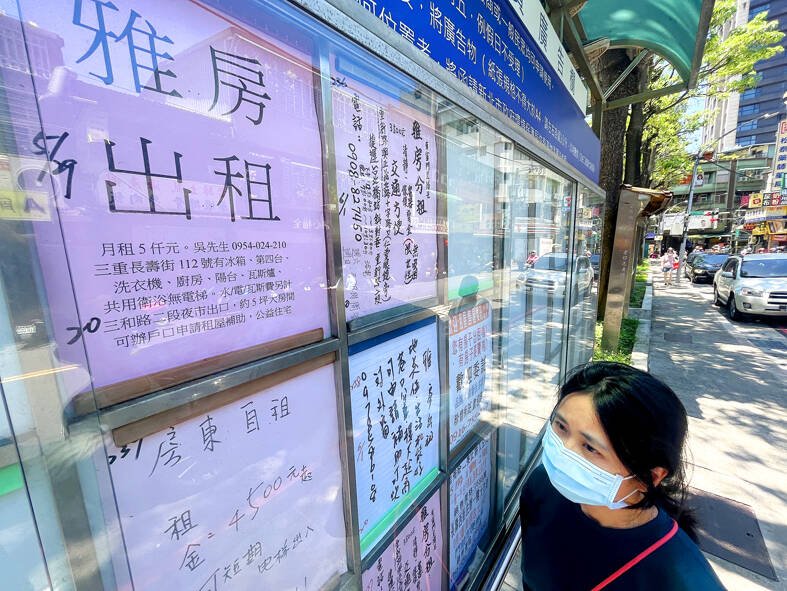

The nation’s rent index last month climbed another 1.98 percent to a record 103.66, as landlords passed on rising holding costs to tenants, Sinyi Realty Inc (信義房屋) said yesterday.

It was the first time in 12 months the pace of gains slowed below the 2 percent mark, but it remained a key factor in bolstering housing prices, Sinyi research manager Tseng Ching-der (曾進德) said.

The rent reading, tracked by the Directorate-General of Budget, Accounting and Statistics (DGBAS), has made noticeable advances for two years, as soaring house prices in the past few years prompted people to rent rather than buy their own home, the analyst said.

Photo: CNA

An ongoing economic weakness, interest rate hikes and unfavorable policy measures also curbed buying interest, Tseng said.

Nonethelesss, housing prices held firm, as developers refused to concede, buoyed by rising land, labor and building material prices, as well as the belief that real-estate properties are a proven bulwark against inflation.

Rent in central Taiwan reported the steepest gain of 2.59 percent, followed by rent in eastern Taiwan at 2.55 percent, southern Taiwan at 2.11 percent and northern Taiwan at 1.74 percent, Sinyi said, citing DGBAS figures.

Tseng said it was too early to tell whether the government’s plan to raise the cap on house taxes from 3.6 percent to 4.8 percent on multiple homes would spur another round of rent hikes.

The proposed tax adjustments still need to clear the legislature and would not affect landlords’ holding costs until they are implemented in July next year at the earliest, Tseng said, adding that a healthy job market has lent support to rental rates.

In related developments, new housing and presale projects in the first six months of the year surged 26.75 percent from a year earlier to NT$695.64 billion (US$22.52 billion) in northern Taiwan, as developers introduced more office buildings to meet robust demand, a report by property researcher My Housing Monthly said.

The value represented a new high since 2012, as developers sought to take advantage of the low vacancy rate for upscale offices in popular locations, the publication said.

Vacancy rates last quarter stood unchanged at 2.7 percent for Grade-A offices in Taipei, while rent inched up 1.3 percent, despite an economic slowdown, property consultancy Jones Lang LaSalle (JLL) Taiwan said.

That explained why presale and new housing projects in Taipei surged more than twofold to NT$323.02 billion in the first half of this year, but shrank in New Taipei City, Keelung and Taoyuan, My Housing Monthly said.

Urban renewal projects also made sizable contributions to new and presale house projects, as they are not subject to lending restrictions by the central bank to curb property speculation, it said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to