Qisda Group (佳世達集團) on Thursday said it would invest NT$320 million (US$10.44 million) in Rapidtek Technologies Inc (鐳洋科技) as the companies aim to explore global business opportunities for low Earth orbit (LEO) satellites.

The group, led by electronics maker Qisda Corp (佳世達), has been developing its network communications business over the past few years, with a bullish outlook on the LEO satellite market in particular.

“Satellite signal coverage is not restricted by terrain constraints and represents a key battlefield for next-generation network communications,” the group said in a statement.

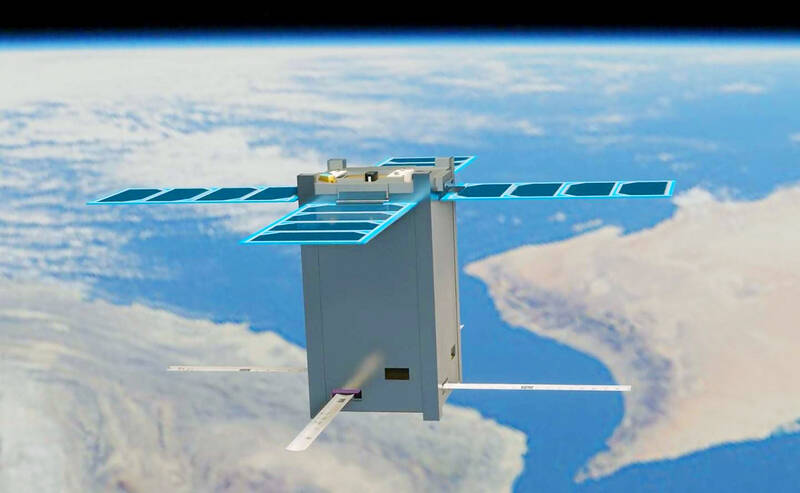

Photo courtesy of the National Applied Research Laboratories

Rapidtek, a New Taipei City-based company established in 2015, is mainly focused on antenna design and radio frequency testing.

“As Rapidtek is specialized in the design and research of key components of LEO satellites, Qisda Group’s investment in the company is expected to create strong synergy in product development and channel layout, as well as accelerate the mass production of satellite-related products and jointly develop the market,” the statement said.

LEO satellites operate at an altitude of 200km to 2,000km above the Earth’s surface.

According to Yuanta Securities Investment Consulting Co (元大投顧), the global market value of LEO satellites is expected to grow at a compound annual growth rate of 24 percent to US$11.3 billion by 2026, from US$3.11 billion in 2020, with ground-based equipment making up the lion’s share of the market at 50 percent, followed by satellite services at 44 percent.

Rapidtek said it is honored to have such a strong partner on board, and is looking forward to leveraging the strengths of both parties to explore global business opportunities in the LEO market.

The company in February launched a space industry research-and-development center in Taoyuan’s Cingpu District (青埔) in cooperation with National Central University. It was selected last year by the Taiwan Space Agency to implement several satellite and space components projects.

Meanwhile, Qisda Corp on Friday released its financial results for the first quarter, with operating margin hitting 15.8 percent, the highest in 10 years, the company said in a separate statement.

First-quarter revenue decreased 17.15 percent year-on-year to NT$50.45 billion and net profit dropped 39.4 percent to NT$324.04 million, due to non-operating expenses of NT$120.7 million, compared with non-operating gains of NT$241.49 million the previous year, it said.

Earnings per share were NT$0.16 in the January-to-March period, down from NT$0.27 a year earlier, Qisda said.

Qisda is scheduled to hold an online earnings conference today to further elaborate on the financial results of the first quarter and shed light on the outlook for the second quarter. The company is to hold its annual general meeting on May 29 and shareholders are to vote on the company's proposal of distributing a cash dividend of NT$2 per share this year.

In addition to Qisda Corp, which is focused on the information technology business, the Qisda Group also runs some value-added businesses in the medical, business solutions, and networking and communication sectors through its subsidiaries including BenQ Medical Technology Corp (明基三豐醫療器材), Metaage Corp (邁達特數位), DFI Inc (友通資訊), Aewin Technologies Co (其陽科技), Ace Pillar Co (羅昇企業) and Alpha Networks Inc (明泰科技).

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the