AFP, COLORADO SPRINGS, Colorado

The US company Orbit Fab is aiming to produce the go-to “gas stations” in space, its CEO said, hoping its refueling technology will make the surging satellite industry more sustainable — and profitable.

The solar panels typically attached to satellites can generate energy for their onboard systems such as cameras and radios, but cannot help the orbiting objects adjust their positions, said Daniel Faber, who cofounded the company in 2018.

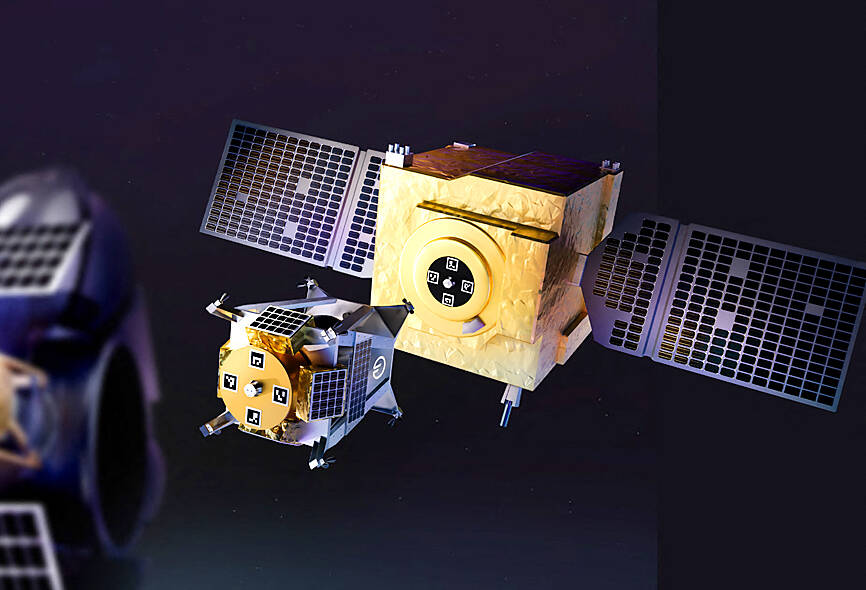

Photo: AFP / handout / Orbit Fab

“Everything always drifts, and so very quickly, you’re not where you needed to be — so you need to keep adjusting, which means you need to keep using up propellant,” he said at the space industry’s annual gathering in Colorado Springs, Colorado.

Satellites’ lives are therefore limited by how much fuel they can carry along with them — at least for now.

“If you can refuel satellites in orbit, you can stop them having to be thrown away,” which is “crazy” due to their high cost to manufacture and launch, Faber said.

His company envisions sending several large tanks into orbit, each containing up to several tons of fuel.

Then smaller, more easily maneuverable vessels would shuttle back and forth between the tanks and satellites — like robotic pump attendants.

Asked what the risks associated with operating such a system in orbit are, Faber responded candidly.

“Everything you might imagine,” he said.

However, with lots of testing on the ground, and in orbit, “it’s going to be safe,” he added.

Like cars, satellites hoping to receive additional propellant from Orbit Fab would have to have compatible fuel ports.

Faber said that between 200 and 250 satellites are already being designed to use his company’s system.

It is a market with room to grow, as about 24,500 satellites have been scheduled for launch between last year and 2031, space and satellite consultancy Euroconsult Group said.

Orbit Fab, which employs about 60 people and is looking to hire 25 more, has already launched one tank into orbit and plans to conduct fuel transfer tests.

In 2019, it proved the feasibility of the system with water-transfer tests at the International Space Station.

“Our first contract with the US government is to deliver them fuel in 2025” to Space Force satellites, Faber said.

He said they are planning to launch only a couple fuel shuttles to geostationary orbit, where satellites mostly lie in “a single plane around the equator” at a high altitude of about 36,000km.

Satellites in low Earth orbit have much different trajectories, and more fuel shuttles would be needed.

Another added benefit of refueling in orbit is the possibility of freeing up the key metric in rocket launches: weight.

Projects which were previously deemed infeasible for being too heavy might therefore see the light of day.

But above all, extending the life of satellites makes them more profitable in the long run.

Apart from refueling, companies are also looking at other ways of servicing satellites, with Faber saying that about 130 companies have recently popped up in the sector.

These include in-orbit “tow trucks” that can approach satellites in trouble and make repairs, such as helping deploy a solar panel or reorienting an antenna.

Orbit Fab, which recently announced it had raised US$28.5 million, has a “symbiotic” relationship with these start-ups, Faber said.

Their machines would need refueling and in return could “be doing things that we want, services we want, maybe repair our spacecraft, if there’s a problem,” he said.

They have already struck an agreement to refuel craft launched by Astroscale Holdings Inc, a Japanese company seeking to clear space debris, among other services.

Orbit Fab also aims to serve private space stations currently under development.

It is also looking toward a possible market on and around the moon, focusing not on extracting materials, but transforming them into propellant and delivering that to clients.

“At the moment, there’s nothing there” on the moon, Faber said. “In five, 10, 20 years’ time, we expect that will change dramatically.”

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

‘IMMENSE SWAY’: The top 50 companies, based on market cap, shape everything from technology to consumer trends, advisory firm Visual Capitalist said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) was ranked the 10th-most valuable company globally this year, market information advisory firm Visual Capitalist said. TSMC sat on a market cap of about US$915 billion as of Monday last week, making it the 10th-most valuable company in the world and No. 1 in Asia, the publisher said in its “50 Most Valuable Companies in the World” list. Visual Capitalist described TSMC as the world’s largest dedicated semiconductor foundry operator that rolls out chips for major tech names such as US consumer electronics brand Apple Inc, and artificial intelligence (AI) chip designers Nvidia Corp and Advanced

Pegatron Corp (和碩), an iPhone assembler for Apple Inc, is to spend NT$5.64 billion (US$186.82 million) to acquire HTC Corp’s (宏達電) factories in Taoyuan and invest NT$578.57 million in its India subsidiary to expand manufacturing capacity, after its board approved the plans on Wednesday. The Taoyuan factories would expand production of consumer electronics, and communication and computing devices, while the India investment would boost production of communications devices and possibly automotive electronics later, a Pegatron official told the Taipei Times by telephone yesterday. Pegatron expects to complete the Taoyuan factory transaction in the third quarter, said the official, who declined to be