S&P Global Ratings yesterday affirmed its “AA+” long-term and “A-1+” short-term credit ratings for Taiwan.

“The stable outlook reflects our expectation that over the next 24 months, risks to the ratings remain fairly balanced,” S&P said in a statement on its Web site.

Structural demand for Taiwanese semiconductor exports is likely to offset headwinds associated with long-standing geopolitical tensions, the ratings agency said.

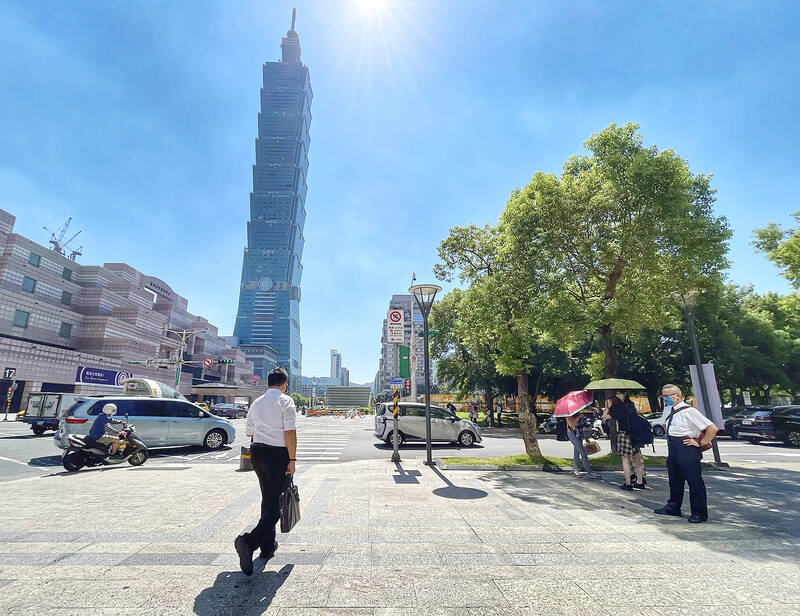

Photo: CNA

The ratings are anchored on Taiwan’s robust external position and strong economic support, although an ongoing semiconductor downturn would curb Taiwan’s growth in the short term, it said.

Softening global demand for technology products has weighed on key export sectors in Taiwan, with its semiconductor sector particularly exposed to the slowdown, it said.

Weakening global demand would also hit non-tech sectors, particularly suppliers of commodities and consumer products, the agency said.

“We expect Taiwan’s economic growth to slow this year,” S&P said.

However, Taiwan’s electronics manufacturing sector remains dynamic, highly competitive and well-placed to benefit from long-term developments in technology-intensive integrated circuit chips, the agency said.

Although workers around the world have returned to their offices, reducing the need for remote-working equipment, demand for chips would likely remain robust due to a boom in artificial intelligence, 5G network deployment, big data processing and analytics, and electric vehicles, S&P said.

Taiwan’s growth prospects would be brighter than its peers at a similar income level, it said.

Effective policymaking has contributed to the government’s fiscal health, evidenced by robust domestic liquidity and low debt-servicing costs, it said.

“We expect Taiwan to maintain healthy fiscal metrics over the next three to five years,” S&P said.

However, cross-strait tensions continue to constrain Taiwan’s ratings, as a sharp deterioration in risk sentiment could hurt its export-reliant economy and fiscal position, it said.

The ratings agency said cross-strait relations would not deteriorate toward a major military conflict, adding that close economic and trade links between Taiwan and China support this assessment.

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,