Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported revenue of NT$508.63 billion (US$16.7 billion) for last quarter, falling short of its estimate after sluggish demand for 7-nanometer chips used in smartphones and computers drove down last month’s revenue to the weakest level in about 17 months.

Revenue last month contracted 15.4 percent year-on-year and 10.9 percent month-on-month to NT$145.41 billion, the company said in a statement.

Based on TSMC’s foreign exchange rate assumption of NT$30.7 per US dollar, last quarter’s revenue amounted to US$16.56 billion, lower than its estimated range of US$16.7 billion to US$17.5 billion.

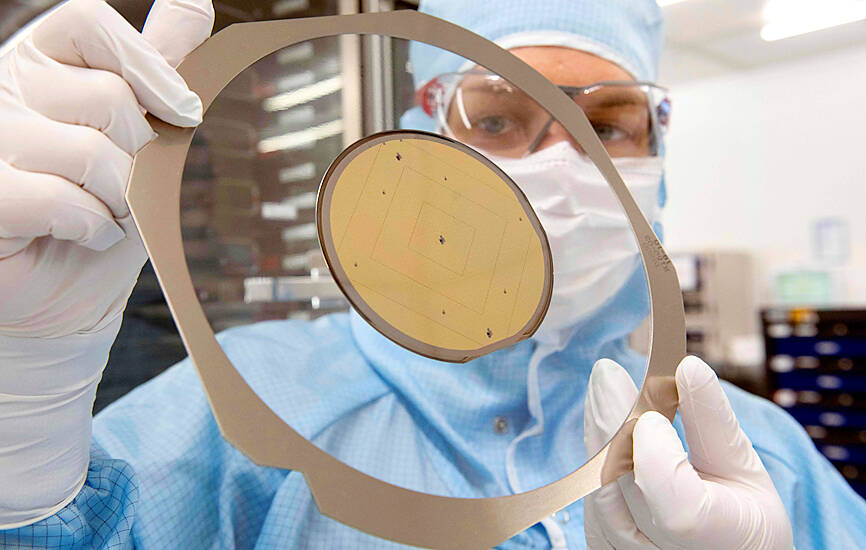

Photo: AFP

The world’s biggest contract chipmaker in January said the utilization rates of its 7-nanometer and 6-nanometer technologies would be greater than it had estimated a quarter earlier, due to end-market weakness in smartphones and PCs, as well as a delay in a customer’s scheduled product launch.

TSMC is expected to present detailed financial figures and its business outlook during a quarterly investors’ conference on Thursday next week. Company executives would also answer investors’ questions, which could include queries regarding the company’s investments in Arizona.

TSMC chairman Mark Liu (劉德音) has said that some clauses in application guidelines for chip investment subsidies under the US’ CHIPS and Science Act are unacceptable.

He said the company would discuss the matter with US authorities.

TSMC has pledged to invest US$40 billion on building advanced fabs in the US.

Minister of Economic Affairs Wang Mei-hua (王美花) yesterday said the ministry is closely watching the issue.

The ministry hopes that the US’ demands will not affect the cost of chip capacity buildup in the US, or industrial cooperation between Taiwan and US.

Separately, United Microelectronics Corp (UMC, 聯電), the world’s No. 3 contract chipmaker, yesterday posted revenue of NT$17.69 billion for last month, down 20.11 percent annually, but up 4.49 percent monthly.

During the first quarter, revenue dropped about 20 percent sequentially to NT$54.21 billion.

UMC had expected its revenue to shrink by about 18 to 19 percent, due mostly to declines in wafer shipments, as customer demand dwindled amid inventory corrections. Three months ago, the company told investors that average selling prices would remain flat.

UMC has expressed the hope that the first quarter will be a trough in terms of revenue and factory utilization.

MediaTek Inc (聯發科), the world’s largest 5G chip designer and one of TSMC’s customers, said revenue last quarter fell about 33 percent annually and 11.6 percent quarterly to NT$95.65 billion.

The figure matches MediaTek’s forecast of revenue of between NT$93 billion and NT$101.7 billion, as customers were conservative about their business outlook and have been managing inventory cautiously.

Revenue last month shrank 27.41 percent annually to NT$42.96 billion, but rose 41.73 percent from February’s NT$30.31 billion.

MediaTek said the first quarter would be the trough for this year, as inventory levels at its customers and channels are expected to fall substantially.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”