Gudeng Precision Industrial Co (家登精密) expects revenue to expand at an annual pace of more than 10 percent this year to NT$5 billion (US$164.18 million) as Chinese chipmakers turn to the company for supplies of wafer pods in the wake of the US-China technology war.

Longer term, the company sees revenue growing to NT$10 billion within three years.

Gudeng is a beneficiary of Washington’s tightening export controls on advanced semiconductor technologies and equipment to China to slow Beijing’s progress.

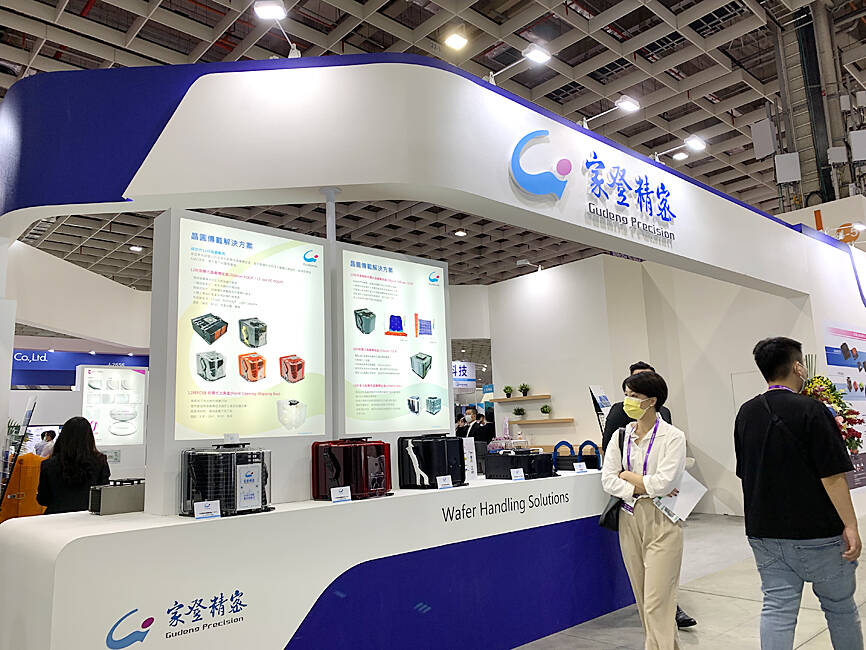

Photo: Grace Hung, Taipei Times

The US curbs have limited Chinese companies’ access to key components, Gudeng said yesterday.

“Since late last year, many Chinese companies have replaced US and European suppliers with Gudeng. That has been reflected in the company’s revenue growth,” Gudeng chairman Bill Chiu (邱銘乾) told reporters at the company’s headquarters in New Taipei City’s Tucheng District (土城).

“We have seen a constant flow of orders from China because of geopolitical factors,” Chiu said. “We are struggling to keep up with the demand.”

Revenue skyrocketed 54 percent annually last month to NT$426.53 million. That brought the company’s revenue in the first two months to NT$740.05 million, growing 20.54 percent from NT$614 million during the same period last year.

Last year, Gudeng’s revenue soared 44 percent year-on-year to NT$4.5 billion.

The new Chinese orders are mostly for Gudeng’s wafer pods, which are box-like front-opening unified pods (FOUP) used to ship, transport and store wafers. Wafers are unloaded from the FOUP within processing equipment to keep the wafers sterile.

Chinese clients — including Semiconductor Manufacturing International Corp (SMIC, 中芯) and ChangXin Memory Technologies Inc (長鑫) — contributed about 19 percent to Gudeng’s revenue last year.

To cope with the growing demand from China, Gudeng has inked a letter of intent to acquire Golden Dragon Global Ltd for 107.5 million yuan (US$15.64 million) to facilitate its expansion in China.

Taiwan is the biggest revenue source for Gudeng, accounting for 70 percent last year. Gudeng is the world’s largest extreme ultraviolet (EUV) pod supplier, with a market share of 80 percent.

EUV pods are used to carry reticles when EUV tools are utilized to produce chips. The company is Taiwan Semiconductor Manufacturing Co’s (台積電) sole supplier of EUV pods.

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be