The arranged marriage of UBS Group AG and Credit Suisse Group AG would create the biggest bank Switzerland has ever seen, with some wondering if the superbank might be too big for its own good.

The deal struck late on Sunday prevented the collapse of the country’s second-biggest lender by folding it into the largest.

Even before last week’s dramatic events, the two firms were already among the 30 around the world deemed of strategic importance to the global banking system and therefore too big to fail.

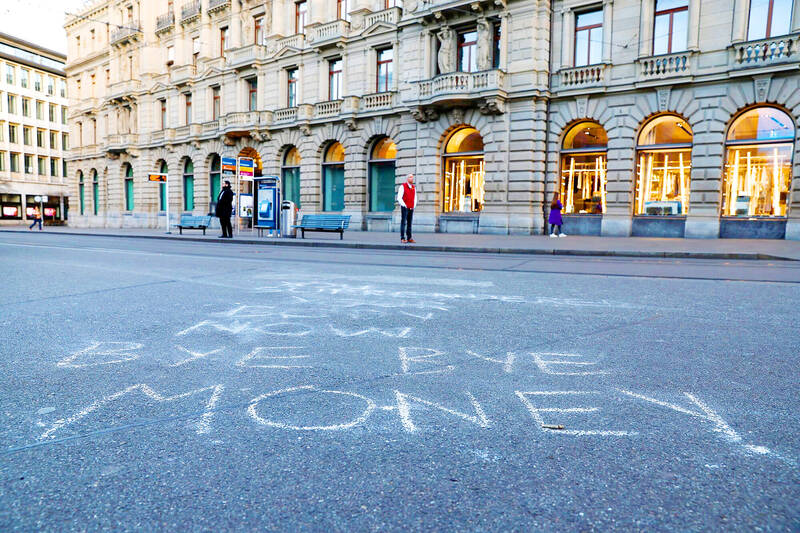

Photo: Bloomberg

Some in business, industry and politics are not convinced that one even bigger bank would turn out for the better.

“Credit Suisse was really the bank of the economy and industry,” said Philippe Cordonier, managing director of Swissmem, the Swiss national association representing the engineering industry.

For exporting companies, Credit Suisse offered a range of services essential for international transactions, “payments abroad, credits, leasing or currency hedging,” he said.

“This is where the question arises of what skills will be kept,” Cordonier said, adding that the profiles of the two banks, although close, are not identical.

So far, many questions remain unanswered.

Such a takeover would normally need months of negotiations, but UBS only had a couple of days, under some serious arm-twisting by Swiss authorities.

UBS chief executive officer Ralph Hamers told an analysts’ conference that he did not yet have all the details of the takeover.

Cordonier said the alternative could be to turn from the national banks to Switzerland’s 26 cantonal banks.

However, many do not have the skills to help companies export to far-off markets such as Asia, and would have to develop them.

The other option is to turn to foreign banks, although they would not possess “in-depth knowledge” of the Swiss market, Cordonier said.

“If there is only one major bank that has the capacity to work abroad, this will restrict the choice of solutions for companies,” he said, adding that he is also concerned about the repercussions on costs “if there is less competition.”

Founded in 1856 by Alfred Escher, a central figure in developing Switzerland’s railways, Credit Suisse was closely linked to the country’s economic development.

The bank financed the expansion of the rail network, the construction of the Gotthard Tunnel beneath the main ridge of the Alps, and the start-up of Swiss companies that went on to become leaders in their sector.

“Twenty-five years ago, there were four big Swiss banks,” said the Swiss Federation of Companies, which represents small and medium-sized enterprises (SMEs).

The banking sector has already seen major convergence in 1998 when Swiss Bank Corp merged with the Union Bank of Switzerland to form the modern UBS.

“The concentration into a smaller number of banks reduces competition and makes it more difficult to obtain good financing conditions for SMEs,” the federation said in a statement.

The orchestrated takeover has also triggered virulent criticism among Swiss political circles, of all stripes.

Politicians have called for the further tightening of regulations — which are already strict in Switzerland — in the face of this new giant, which would dominate the nation’s banking sector.

A partial nationalization could “at least” have been considered, the Berner Zeitung daily quoted University of Zurich economic history professor Tobias Straumann as saying.

Carlo Lombardini, a lawyer and professor of banking law at the University of Lausanne, said the UBS takeover “was surely the only swift and feasible solution.”

However, he would have preferred another outcome, such as a takeover “by a foreign bank,” he said. “But a large foreign group doesn’t do acquisitions in a weekend.”

The other solution would have been to nationalize Credit Suisse “to enhance the good bank” and consolidate the poor assets into a “bad bank” to be liquidated, he said.

However, it is too late for such what-ifs, Lombardini said.

“It’s like wondering what would have happened if Napoleon had not lost at Waterloo,” he said, referring to the French emperor’s loss in the 1815 Battle of Waterloo in modern-day Belgium. “The real problem is we are going to have an even more too-big-to-fail bank.”

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest