The climate monitor for the nation’s manufacturing sector in December last year was “blue” for the second consecutive month, as global inflation and interest rate hikes lowered demand and prices for most products, the Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) said yesterday.

The TIER business composite index shed 0.24 points to 9.48, indicating a recessionary state, after the sub-indices on demand and selling prices weakened, but the readings for operating conditions, costs and raw material prices improved marginally, the Taipei-based think tank said.

Major customers continued to adjust inventory to cope with soft end-market demand amid a global economic slowdown and monetary tightening, the institute said, adding that Taiwan’s latest exports and export orders declined by double-digit percentage points for two months in a row.

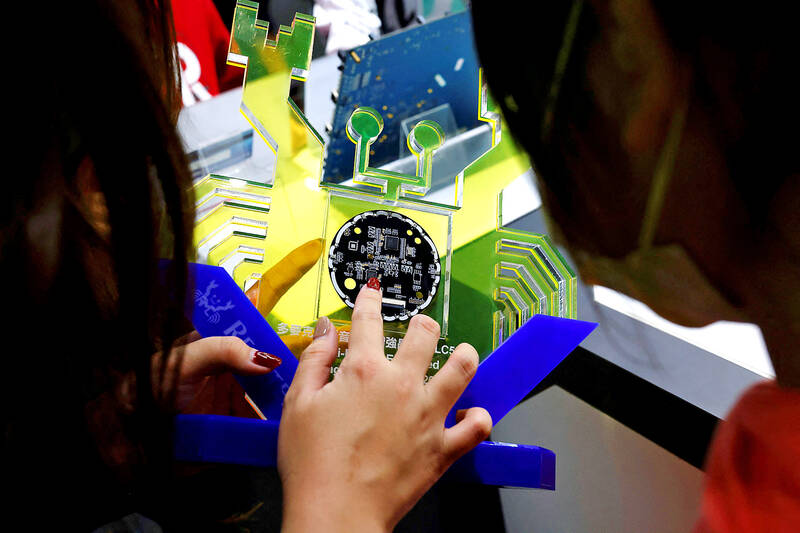

Photo: Ann Wang, REUTERS

China’s recent scrapping of COVID-19 restrictions increased infections in the country, disrupting supply chains, but fueling hopes for a fast recovery, it said.

TIER uses a five-color spectrum to capture the industry’s movements, with “red” indicating a boom, “green” suggesting a steady state and “blue” signifying a downturn. Dual colors indicate a transition to a better or worse condition.

The number of firms in business decline jumped from 59.04 percent in November last year to 73.63 percent in December, and none reported a boom, TIER said.

Demand for electronics used in high-performance computing and electric vehicles remained solid, but sales of smartphones and notebook computers stalled, as global consumers cut back spending on technology gadgets, it said, adding that it caused the business climate for the sector, which is the main export driver, to signal “blue.”

The climate monitor for petrochemical and plastic sectors was also “blue,” as labor shortages in China deteriorated due to spiking virus infections, the institute said.

Firms generally reported a retreat in business, and grew conservative in input and inventory management, it said.

Suppliers of necessity goods such as paper and textile products fell from the “yellow-blue” to “blue” state, as firms wrote off inventory losses to reflect poor demand and selling prices, TIER said.

Makers of metal products continued to struggle with sluggish demand even after major global players cut capacity to ease the imbalance between supply and demand, it said.

Machine equipment vendors held particularly gloomy views, as soft global economic outlook prompted customers to be frugal about buying capital equipment, it said.

Auto parts suppliers said they also took a hit from an overall decline in purchases of durable goods.

The number of new vehicle plates increased by 3.84 percent to 41,900, as consumers sought to avoid price hikes by major vehicle brands this year, rather than a recovery in the business, they said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.