MediaTek Inc (聯發科), the world’s biggest supplier of 5G smartphone chips, yesterday reported its worst quarterly net income in about two years, due to customer inventory digestion and lackluster consumer spending in China.

Net income plummeted 40.4 percent sequentially and 38.6 percent annually to NT$18.51 billion (US$622.8 million) in the final quarter of last year, the Hsinchu-based chipmaker said. Last quarter’s earnings were the weakest since the fourth quarter of 2020.

For the full year, net income expanded 6 percent annually to NT$118.63 billion.

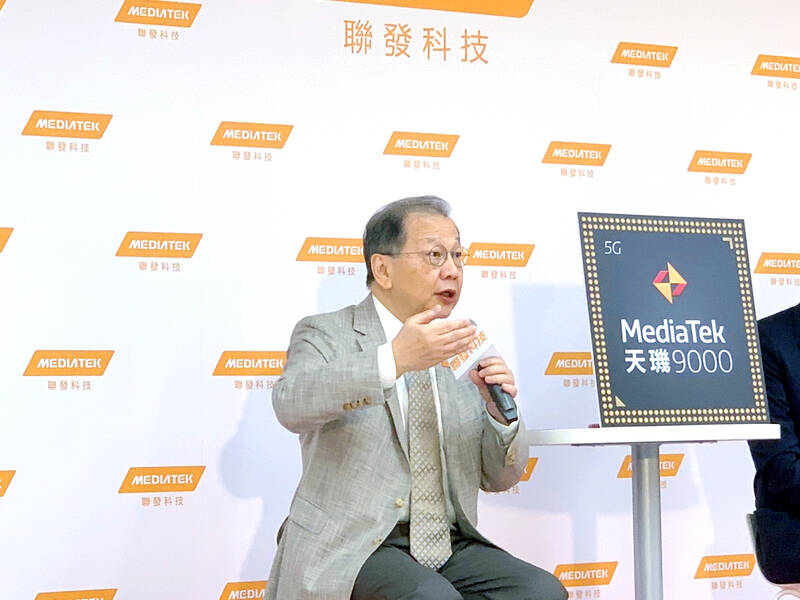

Photo: Vanessa Cho, Taipei Times

Demand has shown signs of stabilizing and business should pick up gradually from next quarter, MediaTek said.

Most of its customers have been cautiously managing inventories, which are approaching normal levels, it said, adding that some customers reported better-than-expected sales in China during the Lunar New Year holiday.

With the external environment improving, including China’s reopening after dropping strict COVID-19 restrictions, and a relatively stable global economy, “we believe demand visibility will gradually improve in the next few months and our business would start recovering from the second quarter of this year,” MediaTek CEO Rick Tsai (蔡力行) told a virtual investor conference yesterday.

“TV and Wi-Fi, for example, are seeing a mild demand pickup in the first quarter of 2023. Thus, the first quarter of 2023 is likely a low point for MediaTek,” he said.

To secure the company’s profitability, Tsai said MediaTek would continue to exercise “pricing discipline,” implying that the company would not engage in a price competition to spur demand for its chips.

Gross margin is forecast to fall to between 46 and 49 percent this quarter, versus 48.3 percent in the previous quarter, Tsai said, adding that it expects the ratio to remain at this level throughout the year.

Revenue this quarter is projected to shrink by 6 to 14 percent sequentially to between NT$93 billion and NT$101.7 billion, Tsai said.

That would be the first time MediaTek’s revenue falls below the NT$100 billion mark since the fourth quarter of 2020.

Smartphone chips, the biggest contributor to MediaTek’s revenue, fell 29 percent sequentially last quarter as customers scaled back orders due to inventory digestion.

Mobile phone chips accounted for 52 percent of the company’s total revenue last quarter.

MediaTek did not give a full-year forecast for revenue, saying it is still monitoring how soon and to what extent the global economy would recover over the next few months.

However, the chipmaker said it would continue to tap the world’s most cutting-edge production technologies, such as Taiwan Semiconductor Manufacturing Co’s (台積電) 3-nanometer process for its chips.

MediaTek expects global smartphone shipments to shrink slightly this year, but 5G smartphone penetration is forecast to climb to about 55 percent from 45 percent last year, bolstered by fast-growing demand from emerging markets like India.

Asked about the impact of Oppo Mobile Telecommunications Corp’s efforts to develop its own chips, Tsai said the company does not comment on customers’ activities, but it has “very strong relationships with our customers.”

After re-entering the flagship smartphone chip market, MediaTek last year captured more than 20 percent of China’s Android flagship market, from almost zero in 2021, it said.

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC) Chairman C.C. Wei (魏哲家) and the company’s former chairman, Mark Liu (劉德音), both received the Robert N. Noyce Award -- the semiconductor industry’s highest honor -- in San Jose, California, on Thursday (local time). Speaking at the award event, Liu, who retired last year, expressed gratitude to his wife, his dissertation advisor at the University of California, Berkeley, his supervisors at AT&T Bell Laboratories -- where he worked on optical fiber communication systems before joining TSMC, TSMC partners, and industry colleagues. Liu said that working alongside TSMC

TECHNOLOGY DAY: The Taiwanese firm is also setting up a joint venture with Alphabet Inc on robots and plans to establish a firm in Japan to produce Model A EVs Manufacturing giant Hon Hai Precision Industry Co (鴻海精密) yesterday announced a collaboration with ChatGPT developer OpenAI to build next-generation artificial intelligence (AI) infrastructure and strengthen its local supply chain in the US to accelerate the deployment of advanced AI systems. Building such an infrastructure in the US is crucial for strengthening local supply chains and supporting the US in maintaining its leading position in the AI domain, Hon Hai said in a statement. Through the collaboration, OpenAI would share its insights into emerging hardware needs in the AI industry with Hon Hai to support the company’s design and development work, as well