German Chancellor Olaf Scholz on Saturday urged a swift conclusion to talks on a free trade deal between the EU and the Mercosur South American trade bloc during a stop in Buenos Aires on his inaugural tour of the region.

Seeking to reduce Germany’s economic reliance on China and diversify trade with democracies worldwide, Scholz is visiting Argentina, Chile and Brazil, all led by fellow leftists who came to power in the region’s new “pink tide.”

Berlin wants to lower its dependence on China for minerals key to its energy transition, making resource-rich Latin America an important partner. The region’s potential for renewable energy output is another attraction.

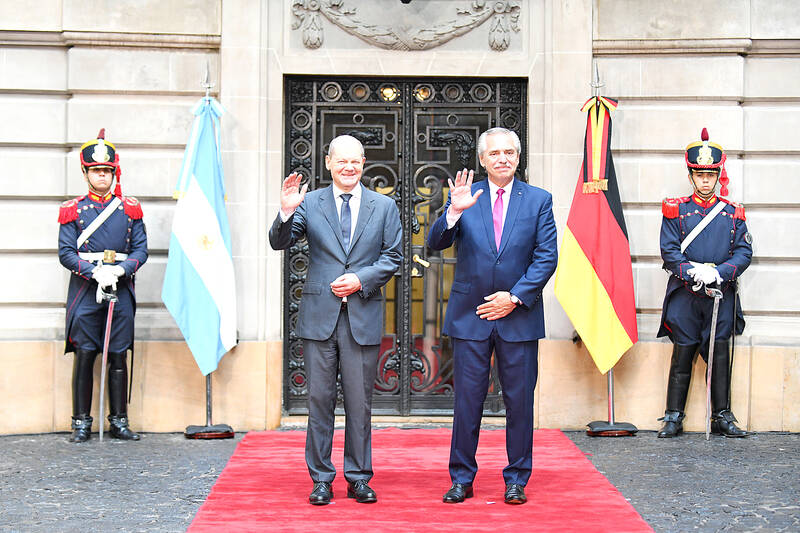

Photo: EPA-EFE

“There is great potential to further deepen our trade relations, and the possibilities that could come from the EU-Mercosur deal are obviously particularly significant,” Scholz told a news conference alongside Argentine President Alberto Fernandez.

Fernandez has blamed European protectionism for delaying the deal, agreed to in principle in 2019, but not ratified by national parliaments.

EU ambassadors have said Brazil must take concrete steps to stop soaring destruction of the Amazon rainforest.

Berlin hopes that the concern can be put aside with the election of Brazilian President Luiz Inacio Lula da Silva, who has promised to overhaul the country’s climate policy. Scholz is to meet him today at the end of his three-day tour.

Russia’s invasion of Ukraine, which sparked an energy crisis in Germany due to its heavy reliance on Russian gas, increased awareness of the need to reduce economic reliance on authoritarian states.

For Germany to reduce its reliance on China for minerals, it must embrace sectors it has shied away from, a German government official said on Friday.

“For example, lithium mining — that’s a challenging task, especially regarding the environment and social standards,” the official, traveling with Scholz, told reporters.

Argentina and Chile sit atop South America’s “lithium triangle,” which holds the world’s largest trove of the ultra-light battery metal.

Several business executives — including the heads of Aurubis AG, Europe’s largest copper producer, and energy company Wintershall Dea AG — are accompanying the chancellor.

Fernandez said he and Scholz discussed the possibility of attracting German investment to the country’s vast shale gas reserve, lithium deposits and green hydrogen production.

Wintershall Dea, for example, is part of a consortium that in September last year announced it was investing about US$700 million to develop a gas project off the coast of Argentina’s southernmost tip, Tierra del Fuego.

“Argentina has the potential to supply Europe with energy in the long term,” Wintershall CEO Mario Mehren said in a statement.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.