German Chancellor Olaf Scholz on Saturday urged a swift conclusion to talks on a free trade deal between the EU and the Mercosur South American trade bloc during a stop in Buenos Aires on his inaugural tour of the region.

Seeking to reduce Germany’s economic reliance on China and diversify trade with democracies worldwide, Scholz is visiting Argentina, Chile and Brazil, all led by fellow leftists who came to power in the region’s new “pink tide.”

Berlin wants to lower its dependence on China for minerals key to its energy transition, making resource-rich Latin America an important partner. The region’s potential for renewable energy output is another attraction.

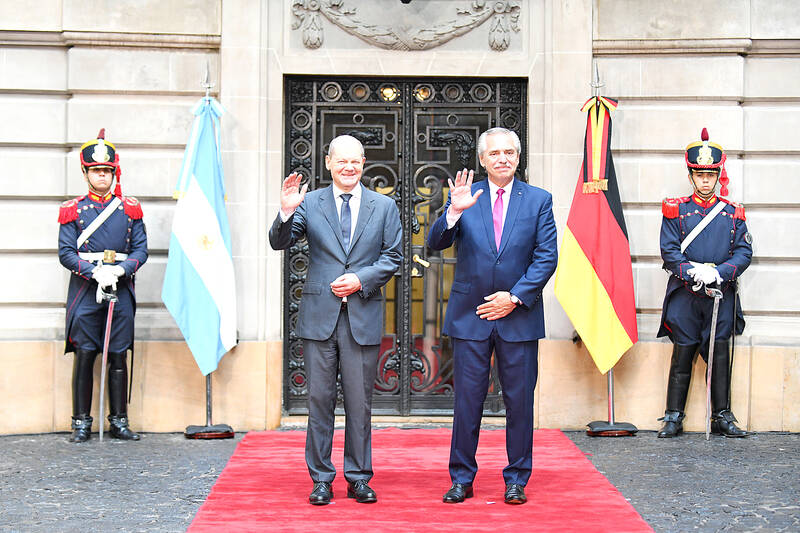

Photo: EPA-EFE

“There is great potential to further deepen our trade relations, and the possibilities that could come from the EU-Mercosur deal are obviously particularly significant,” Scholz told a news conference alongside Argentine President Alberto Fernandez.

Fernandez has blamed European protectionism for delaying the deal, agreed to in principle in 2019, but not ratified by national parliaments.

EU ambassadors have said Brazil must take concrete steps to stop soaring destruction of the Amazon rainforest.

Berlin hopes that the concern can be put aside with the election of Brazilian President Luiz Inacio Lula da Silva, who has promised to overhaul the country’s climate policy. Scholz is to meet him today at the end of his three-day tour.

Russia’s invasion of Ukraine, which sparked an energy crisis in Germany due to its heavy reliance on Russian gas, increased awareness of the need to reduce economic reliance on authoritarian states.

For Germany to reduce its reliance on China for minerals, it must embrace sectors it has shied away from, a German government official said on Friday.

“For example, lithium mining — that’s a challenging task, especially regarding the environment and social standards,” the official, traveling with Scholz, told reporters.

Argentina and Chile sit atop South America’s “lithium triangle,” which holds the world’s largest trove of the ultra-light battery metal.

Several business executives — including the heads of Aurubis AG, Europe’s largest copper producer, and energy company Wintershall Dea AG — are accompanying the chancellor.

Fernandez said he and Scholz discussed the possibility of attracting German investment to the country’s vast shale gas reserve, lithium deposits and green hydrogen production.

Wintershall Dea, for example, is part of a consortium that in September last year announced it was investing about US$700 million to develop a gas project off the coast of Argentina’s southernmost tip, Tierra del Fuego.

“Argentina has the potential to supply Europe with energy in the long term,” Wintershall CEO Mario Mehren said in a statement.

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

RATIONING: The proposal would give the Trump administration ample leverage to negotiate investments in the US as it decides how many chips to give each country US officials are debating a new regulatory framework for exporting artificial intelligence (AI) chips and are considering requiring foreign nations to invest in US AI data centers or security guarantees as a condition for granting exports of 200,000 chips or more, according to a document seen by Reuters. The rules are not yet final and could change. They would be the first attempt to regulate the flow of AI chips to US allies and partners since US President Donald Trump’s administration said it rescinded its predecessor’s so-called AI diffusion rules. Those rules sought to keep a significant amount of AI