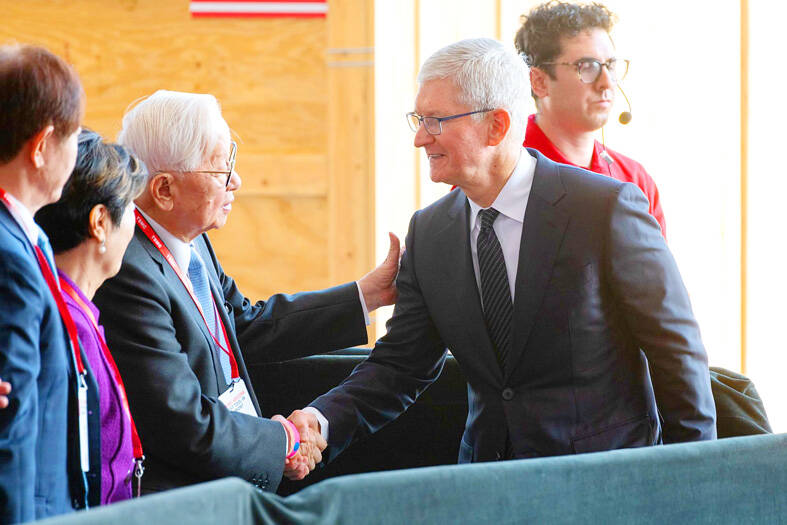

Apple Inc is to be the biggest customer of Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new Arizona factories, Apple CEO Tim Cook wrote on Twitter yesterday.

“Apple silicon unlocks a new level of performance for our users. And soon, many of these chips can be stamped ‘Made in America.’ The opening of TSMC’s plant in Arizona marks a new era of advanced manufacturing in the US — and we are proud to become the site’s largest customer,” he wrote.

Cook’s tweet came as TSMC held a “tool-in” ceremony for its US$12 billion wafer fab in Arizona on Tuesday, which marked the beginning of equipment installation at the facility near Phoenix. The fab is expected to start production in 2024, using the chipmaker’s advanced 4-nanometer process.

Photo: Bloomberg

Prior to the ceremony, TSMC announced it would increase its investment in Arizona to US$40 billion and build a second fab that would use the more advanced 3-nanometer process, with production scheduled to start in 2026.

Apple is the biggest customer of TSMC, accounting for about 26 percent of the chipmaker’s revenue last year. TSMC is the sole supplier of chips used in iPhones.

Advanced Micro Devices Inc (AMD) and Qualcomm Inc are also to source chips from the new Arizona factories.

Photo: Bloomberg

AMD CEO Lisa Su (蘇姿丰) said TSMC’s presence in Arizona is “extremely” critical to the global semiconductor industry, as well as AMD’s expanded ecosystem of partners and clients.

“TSMC enables us to focus on what we do best: designing innovative chips that change the world,” Su said at the ceremony. “AMD expects to be a significant user of the TSMC Arizona fabs and we look forward to building our highest performance chips in the United States.”

Qualcomm said that TSMC bringing its advanced technologies to the country would benefit the US semiconductor industry and the overall economy.

Photo: CNA

“As a longtime customer of TSMC, we are pleased to start leveraging the Arizona facility to manufacture our leading-edge products when production begins in 2024,” Qualcomm senior vice president and chief supply chain and operations officer Roawen Chen (陳若文) said.

TSMC’s most advanced processes are usually first adopted by suppliers of smartphone chips and high-performance computing chips.

Intel Corp CEO Pat Gelsinger, who visited Taiwan yesterday, wrote on Twitter that “Arizona is a great place to make semiconductors, with excellent engineering talent. Intel has led the building of the local ecosystem and talent base since we started manufacturing here in 1980.”

“As Intel and TSMC and others continue to invest here, Arizonans are a critical part of the future of the industry,” he wrote.

Gelsinger visited Taiwanese partners and attended Intel’s first Sustainability Taiwan Day in Taipei, which featured speeches, discussions and other high-tech related activities.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth